SUMMARY UPDATE — In timber markets, prices for key products in the South varied across the quarter while prices in the Pacific Northwest softened across the same time period. Hardwood markets in the Northeast varied with white ash prices gaining traction. Lumber and panel prices saw positive movement throughout the quarter. Mortgage rates exceeded 7% across the last quarter; house starts ended 14.6% below last year’s levels while building permits remained consistent across the same period.

TIMBERLAND MARKETS — Total transactions through 2024 closed with more than $2 billion in US transaction volume, boosted by fourth quarter closings by Rayonier of nearly $500 million across two sales. This included Rayonier’s sale of 109,000 acres of timberland in northwest Washington to EFM and Campbell Global for a reported price of $359 million. The deal marked the largest transaction of 2024. Rayonier also sold 91,000 acres in Oklahoma to New Forests for a reported price of $136 million. The two transactions put Rayonier closer to its $1 billion sale target, with approximately $260 million remaining.

![]()

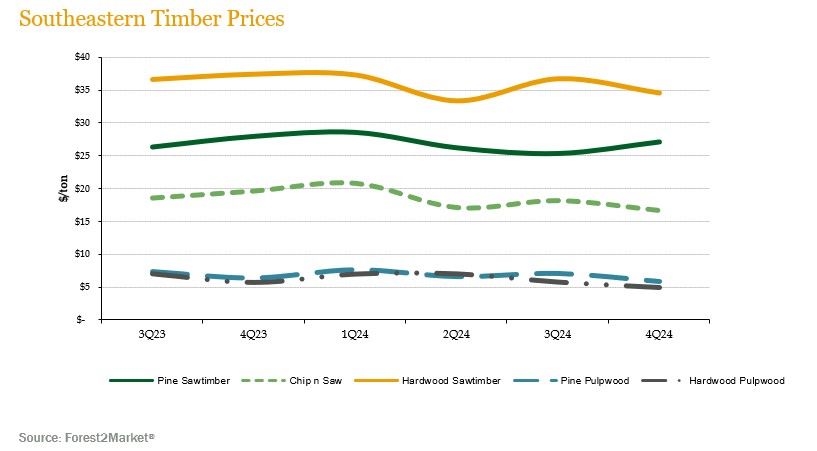

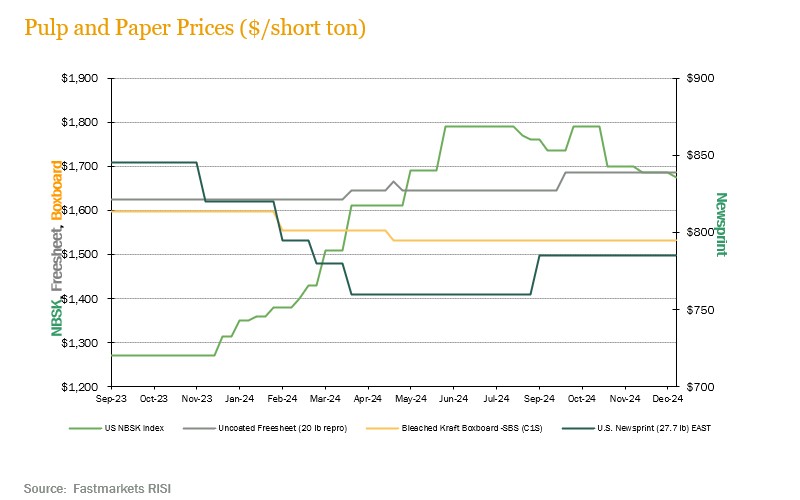

SOUTHEASTERN — Forest2Market reports that pricing for pine sawtimber prices rose in the US South during the last quarter while pulpwood and chip-n-saw softened across the same period. Pine sawtimber prices gained 7.1% across the quarter despite being down 3.1% year over year. Pine chip-n-saw prices are down 8.4% on the quarter while pine pulpwood is down 18.1% across the quarter and is down 8.9% year-over-year. Hardwood pulpwood decreased 13.8% during the quarter and ended 13.1% below last year’s level. Hardwood sawtimber fell 6.0% during the quarter and is down 7.7% for the year.

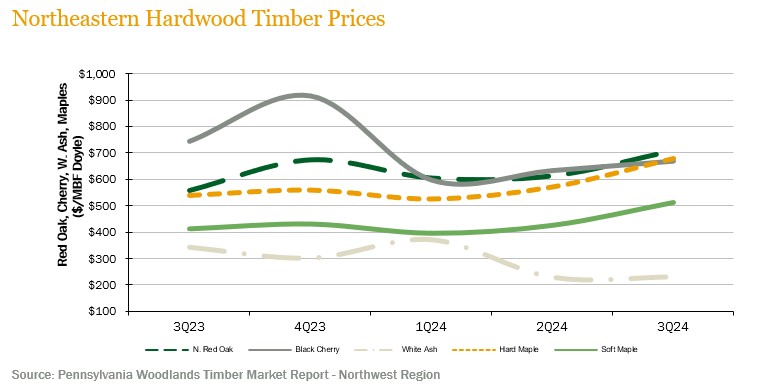

NORTHERN HARDWOODS — Demand increased across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, as of the end of September (the most recently available data), hard and soft maple rose 19.0% and 20.7% over the quarter, respectively. Red oak prices continued to rise; prices increased 15.8% during the third quarter and are up 27.4% year-over-year. Black cherry prices rose 5.6% over the quarter despite being down 10.0% year-over-year. White ash recovered slightly from a steep decline in the second quarter, recovering 0.7% over the quarter though prices are still down 32.7% year-over-year.

Hardwood lumber markets in the northeast weakened throughout the fourth quarter. Lumber/log demand in the US remained subdued due to weak home construction/remodeling expenditures and economic uncertainty both pre- and post-election. Export demand also remained lackluster due to struggling economies around the globe. Mills attempted to adjust production to this weakened demand to try and avoid building large lumber inventories. White oak continued to be the favored species. While demand for red oak and maple grade lumber was somewhat workable, most mills struggled to find a home for the lower grade lumber. Railroad cross ties provided some relief but could not absorb all the lower end production. Black cherry continued to be a species most mills tried to avoid. Pulpwood markets continued to be weak.

Hardwood markets in the Lake States remained depressed during the fourth quarter due to lower domestic lumber consumption and reduced exports. Veneer log markets were the high point during the quarter with hard maple, ash, and birch logs continuing to attract buyers. Bolt markets remained subdued due to anemic home construction/remodeling activity. Pulpwood markets also remained weak.

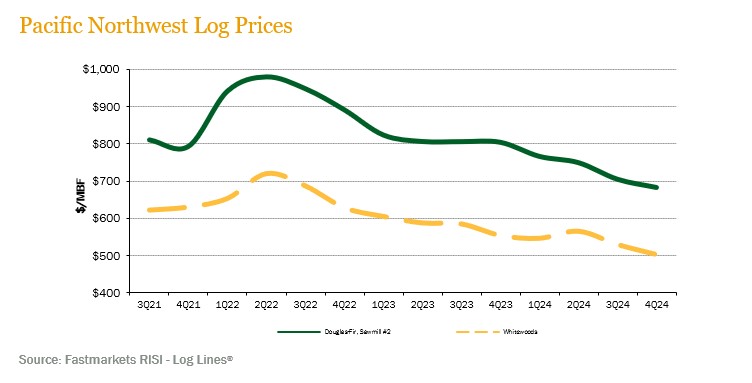

PACIFIC NORTHWEST — Pacific Northwest pricing continued to soften during the quarter. Log Lines® reported that average delivered prices for Douglas fir #2 logs decreased 3.1% quarter-over-quarter and 15.0% year-over-year. Whitewoods (i.e., true firs and hemlock) average delivered log prices fell 6.3% during the quarter and 9.3% year-over-year.

Log demand flattened out during the quarter with select markets offering premium pricing. Log prices remained relatively stable since last quarter with Douglas fir sawlogs averaging between $700 and $750/MBF. In select markets where buyers are paying to keep supply, namely in the Willamette Valley of Oregon, the market has seen estimated delivered values exceeding $850/MBF. These higher price areas are mainly where key domestic mills are looking to expand their capacity or are targeting specific lumber products. Chip-n-saw and pulp logs are still in low demand and have been difficult to market. Exports to China are now averaging $590/MBF for Douglas fir and $540 for whitewoods. Exports to Japan remain competitive as sawlog pricing is averaging around $800/MBF.

![]()

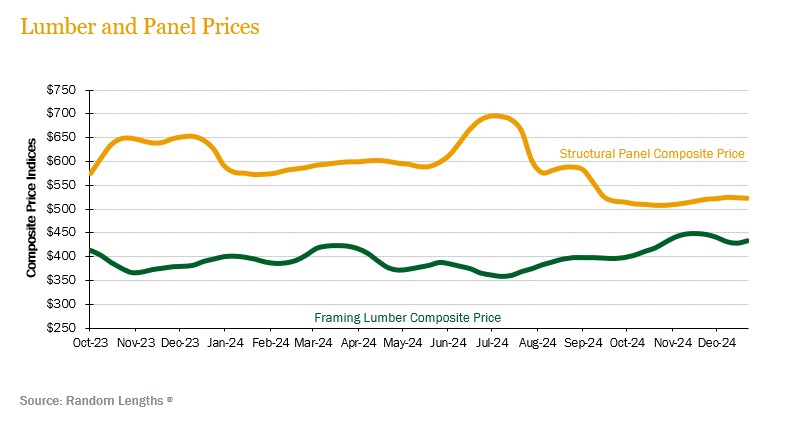

LUMBER AND PANELS — Lumber prices rose during the quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter up 9.3% and 4.0% above year-ago levels. Structural panel prices increased 9.6% during the quarter and finished 9.3% below December 2023 levels.

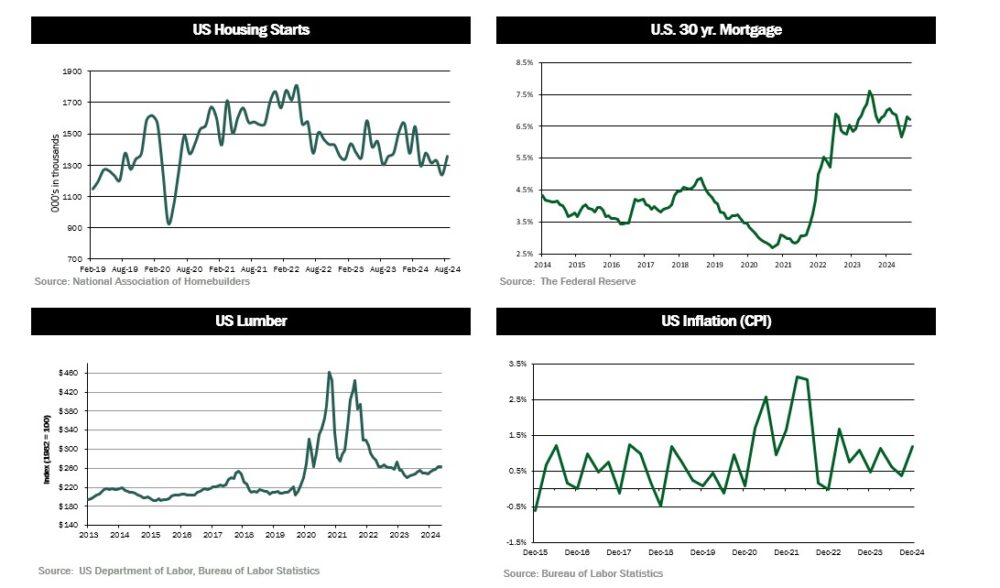

PULP AND PAPER — Demand for paper products remained relatively flat across the quarter though pulp demand softened during the same period. The benchmark NBSK (northern bleached softwood kraft) pulp price index fell 3.5% for the quarter and while finishing 27.4% above year-ago levels. US newsprint (27.7 lb.) prices stayed flat across but ended the quarter 4.3% below last September. Boxboard prices remained consistent quarter over quarter but are 3.7% above last year’s level.

![]()

TRANSACTIONS — As described above, the biggest news of the fourth quarter was Rayonier’s sale of 109,000 acres of timberland in northwest Washington. Additionally, Rayonier completed the sale of 91,000 acres in Oklahoma to New Forests for a reported price of $136 million. Other sales throughout the quarter were more modest. For example, the only other major closing in the fourth quarter was The Conservation Fund’s purchase of 41,400 acres in Maine from a private seller for $40 million.

Total timberland transaction volume for the year ended at more than $2 billion, but fell short of the the $2.2 billion observed in 2023.

TRANSACTIONS IN PROGRESS — Several other deals in the South and Pacific Northwest will trickle into the first quarter of 2025. Investors continue to monitor these pending transactions, while a handful of other offerings are taking bids in the first quarter.

TIMBERLAND AS A RESILIENT INVESTMENT — FIA was delighted to participate in IPE Real Assets’ Natural Capital magazine, published in January 2025. FIA’s article “Timberland — Resilience, opportunity amid economic uncertainty,” delves into the advantages of incorporating timberland into investment portfolios. The article inlcudes analysis on volatility, resilience, and value preservation, along with the optionality provided by natural capital. The article is available here.

![]()

The global economy showed signs of stabilization and moderate recovery throughout 2024, primarily driven by the expansion of the American economy as well as positive trends in global trade and commodity prices. Inflation rates cooled globally, aligning more closely with central bank targets, which contributed to the overall economic stability. However, several risks persist, including geopolitical tensions, extreme weather events, and the potential reactivation of inflationary pressures, which continue to create uncertainty in the short and medium term.

CHILE — Inflation in Chile showed a mixed trajectory during the year, with annual inflation moderating to 4.2% in November but core inflation rising to 4.0%, indicating persistent pressures in non-food goods and services. The Consumer Price Index recorded a monthly drop of -0.2% in December, leading to an annual inflation of 4.5%t. Despite the modest recovery, underlying inflationary pressures remain a concern for monetary authorities, with tariff adjustments and price indexing in key sectors like electricity continuing to exert pressure.

The exchange rate showed an appreciation of the US dollar against the Chilean peso, with the peso depreciating by approximately 6%, reflecting global economic uncertainty and the strengthening of the dollar. Economic activity saw a projected growth of 2.3% for 2024. Private consumption contracted, while investment and exports improved. The current account deficit is expected to decrease in 2025, reflecting better trade performance and import adjustments. Job creation was weak, and short-term interest rates reflect an expansive monetary policy.

Wood prices experienced a decline from mid-2022 to the end of 2024, with saw logs, pulpwood, sawn wood, and planed wood all showing sustained decreases. This adjustment is attributed to the economic slowdown, moderation in global demand, and contraction in sectors like construction. For 2025, moderate economic growth is projected, with an increase in exports, recovery in private consumption, and investment.

BRAZIL — Brazil’s GDP is expected to have ended 2024 with growth of 3.49%, with inflation rates expected to end at 4.83% for 2024 and projected for 4.96% during 2025, both above the Brazil Central Bank’s target. The external environment remains challenging due to uncertainties and volatility in the US economic cycle and synchronized monetary policies among major economies. Domestically, economic activity and the labor market have shown greater dynamism than expected. Financial conditions and the exchange rate have changed sharply, with a significant depreciation of the Brazilian real. The Brazilian export/import balance is expected to reach a $75 billion surplus for the year. The Central Bank raised the interest rate by 150 basis points to 12.25% during Q4 COPON meetings.

In Brazil’s forest sector, pulp price negotiations for November and December have mostly concluded, with hardwood prices stabilizing around USD 550/tonne in China, while some softwood producers are considering a slight price increase due to tighter supply-demand dynamics. Hardwood prices are expected to remain stable from November to January, indicating that prices have bottomed out in China and Europe, with better momentum for softwood and fluff products. A restocking movement following the 2025 Lunar New Year could support prices. Additionally, Suzano has managed to add volumes from Ribas with limited market impact.

![]()

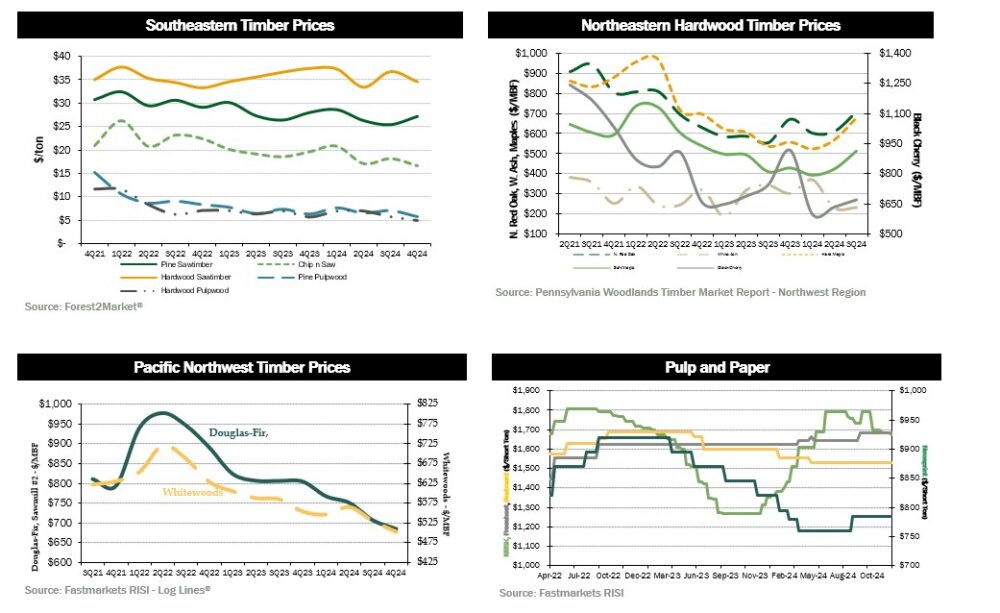

HOUSING — November housing starts came in at a seasonally adjusted annual rate of 1,289,000, 14.6% below levels a year prior. Building permits were at a seasonally adjusted annual rate of 1,505,000, roughly flat with a year prior.

MORTGAGE RATES — Mortgage rates climbed over the fourth quarter, and into the first quarter, with 30-year fixed rate mortgages eclipsing the 7% level.

JOBS — The December jobs report was strong at 256,000, with the unemployment rate falling to 4.1%.

CONSUMER CONFIDENCE — Consumer sentiment was essentially unchanged to start the new year with the Michigan Consumer Sentiment Index inching down 0.8 points (-1.1%) from December’s final reading to 74.

INFLATION — US producer prices rose less than expected, with the higher costs for goods partially offset by stable services prices. This suggests potential downward trend, following more recent inflation stalls.

TRADE DEFICIT — In November, the US trade deficit rose 6.2% to $78.2 billion. Imports increased 3.4% to $351.6 billion, which was reflective of increased shipments from a variety of sectors such as personal cars, semiconductors, and industrial supplies. US exports also rose by 2.7% to $273.4 billion in November, said the report.

INTEREST RATES — U.S. Treasury yields were strong the first few weeks of the new year, with rates on the 10-year note growing close to 4.8%.

OIL PRICES — Oil prices rose to a five-month high by mid January. Brent crude, the global benchmark was over $80 a barrel, its highest level since August.

U.S. DOLLAR — The US Dollar Index ended the year at a level around 108.

![]()

Disclaimer: Certain information contained in these materials has been obtained from third-party sources. While such information is believed to be reliable for the purposes used herein, FIA makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. This does not constitute an offering of any investment or an inducement to participate in any investment or investment advice. Past performance does not guarantee future performance. FIA is a Registered Investment Adviser with the Securities and Exchange Commission in the United States.