SUMMARY UPDATE — Log markets in the Pacific Northwest softened due to high inventory and favorable weather conditons. In the U.S. South, demand for pine sawtimber and chip-n-saw rose slightly while pulpwood softened substantially compared to last quarter. Hardwood markets in the Northeast softened for most species due to a decrease in domestic and export lumber demand. Lumber and panel prices fell initially but rebounded later in the quarter. Mortgage rates fell, dipping below 7% for a 30-year, fixed rate. Housing starts surged in response to falling rates.

TIMBERLAND MARKETS — The fourth quarter saw a flurry of timberland transactions to close out the year. The biggest news of the quarter was Weyerhaeuser’s announcement that they were buying and selling two separate packages with Forest Investment Associates (“FIA”). Weyerhaeuser purchased approximately 60,000 acres from FIA in Mississippi, North Carolina, and South Carolina for a reported price of $163 million. Meanwhile, Weyerhaeuser sold nearly 70,000 acres in South Carolina to FIA for $170 million. Elsewhere, Manulife completed its purchase of 55,000 acres in Oregon from Rayonier for a reported price of $242 million. Manulife also sold 11,000 acres in Oregon to Hampton Lumber for $56.4 million. While deal volume was down significantly in 2023 compared to 2022, we believe transaction prices remained strong. Investors continue to wait for news on several sales processes, and more offerings are coming to the market in 2024.

![]()

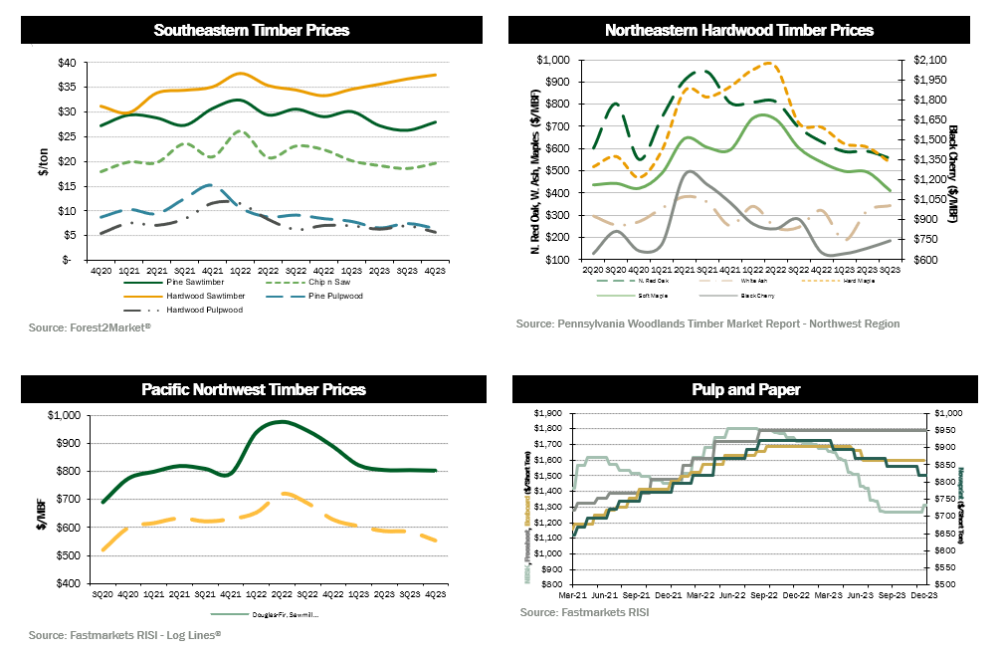

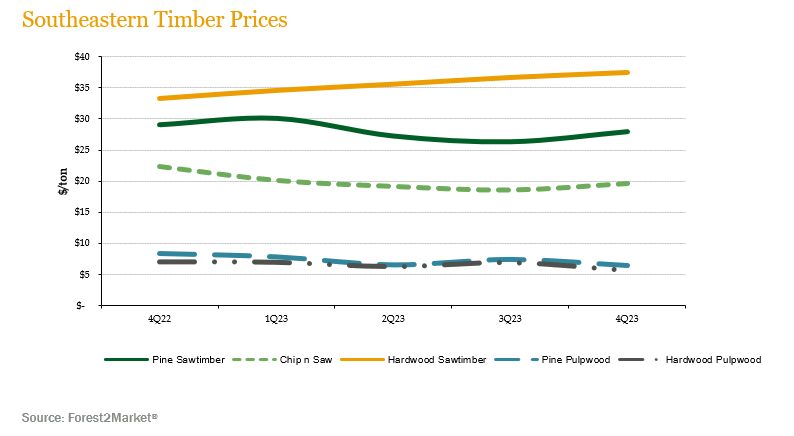

SOUTHEASTERN — Forest2Market reports that pricing for pine and hardwood sawtimber products in the U.S. South varied during the quarter depending on the product. Pine sawtimber rose 6.2% over the quarter but fell 3.8% year-over-year. Pine chip-n-saw prices rose 5.8% during the quarter but fell 12.5% compared to last year’s levels. Pine pulpwood prices saw a substantial decrease of 13.8% during the quarter and fell 24% year-over-year. Hardwood pulpwood fell about 18.2% during the quarter and finished 19.5% below last year’s level. Hardwood sawtimber experienced a modest increase of 2.2% during the quarter and a larger 12.7% increase for the year.

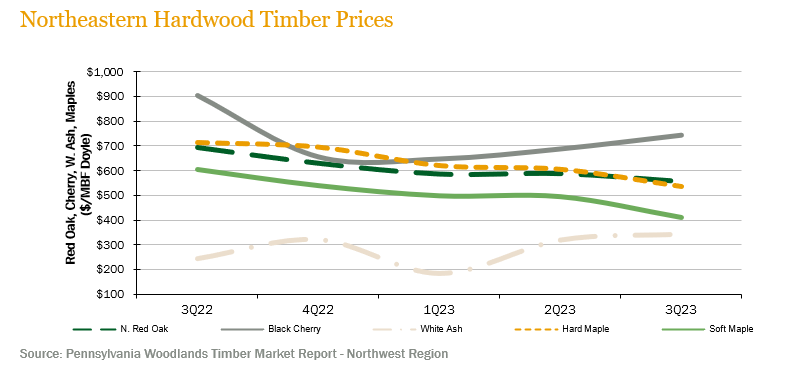

NORTHERN HARDWOODS — Demand varied across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices rose 7.4% during the third quarter (the most recent publicly reported pricing) and ended the quarter 40.3% above year-ago levels. Hard and soft maple fell in tandem at 11.5% and 16.8%, respectively for the quarter. Red oak also fell 5.5% during the quarter and 20.0% year-over-year. Lastly, black cherry prices increased 8.1% quarter-over-quarter and fell 17.8% year-over-year.

Hardwood markets, both domestic and export, experienced continued weakness throughout the fourth quarter. Domestic demand continues to be dragged down by high mortgage rates and the corresponding slowdown in new home construction. Economic uncertainty has also put a damper on remodeling projects in existing homes. Export lumber and log demand continued to be weak due to challenging economic conditions in China and other Asian countries as well as Canada, Mexico, and Europe. White oak, however, is still in high demand with red oak also showing promise. All other species, including hard and soft maple, remained out of favor. Throughout the later part of the quarter, wet weather conditions hampered logging conditions and kept sawmill log inventories manageable. Many mills took longer shutdowns during the holiday season this year. Pulpwood demand was also weak.

Hardwood markets in Wisconsin also remained subdued during the quarter due to lower domestic lumber consumption and lower exports. Hard maple, yellow birch, and basswood sawlog pricing remained depressed. Veneer demand and pricing were respectable while boltwood demand remained soft as lower home construction led to reduced flooring demand. Wet logging conditions in the latter part of the quarter did help keep log inventories in check.

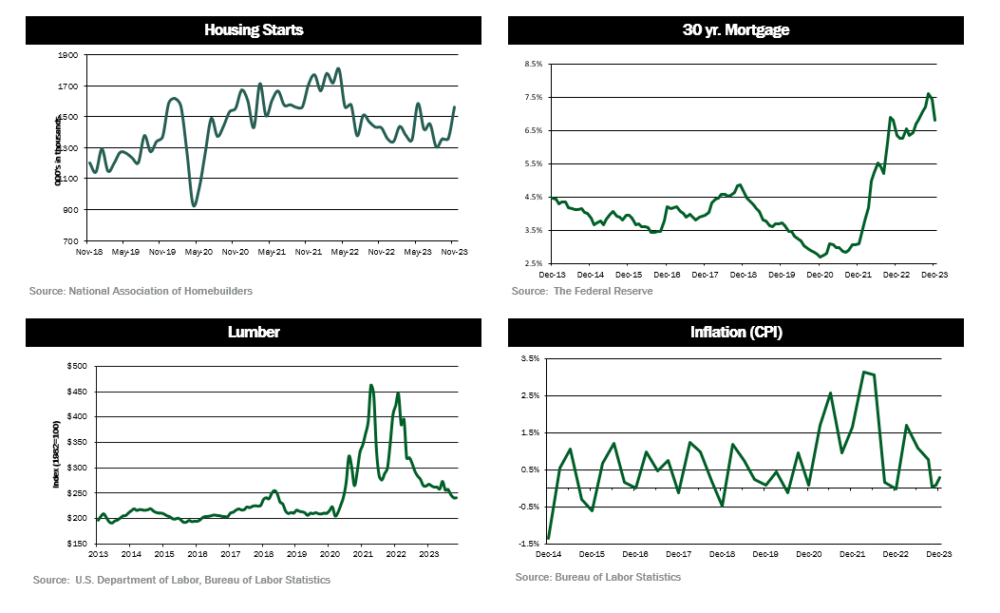

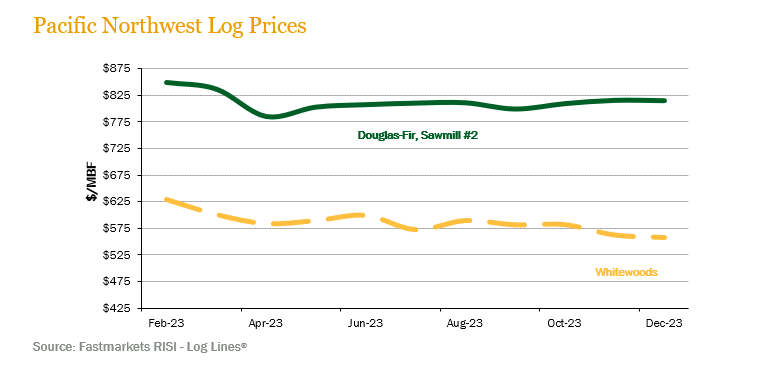

PACIFIC NORTHWEST — Pacific Northwest pricing continued to soften during the quarter. Log Lines® reported that average delivered prices for Douglas-fir #2 logs decreased 3.2% quarter-over-quarter and 11.3% year-over-year. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices fell 7.2% and 13.0% year-over-year.

Log markets and demand softened during the quarter. As seen throughout most of the year, log inventories remained high at most domestic sawmills, primarily due to favorable weather conditions. Prices were relatively flat and remain comparable to those seen last quarter. Domestic prices for Douglas-fir are holding around $800/MBF, with prices reaching over $850/MBF in select log markets. Export demand from China remains similar to previous quarters with pricing averaging around $600/MBF for Douglas-fir and about $500 for whitewoods. Exports to Japan have fallen but remain competitive at $900/MBF relative to domestic pricing.

![]()

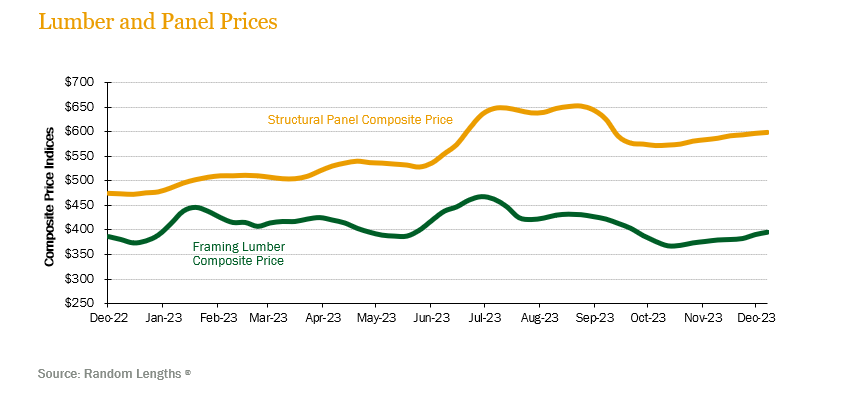

LUMBER AND PANELS — Lumber prices continued to soften during the first half of the quarter but regained traction later in the quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter down 6.4% but 2.3% higher than year-ago levels. Panel prices followed a similar trend during the quarter but had significant gains year-over-year. Structural panel prices fell 4.3% during the quarter but rose 26.4% above December 2023 levels.

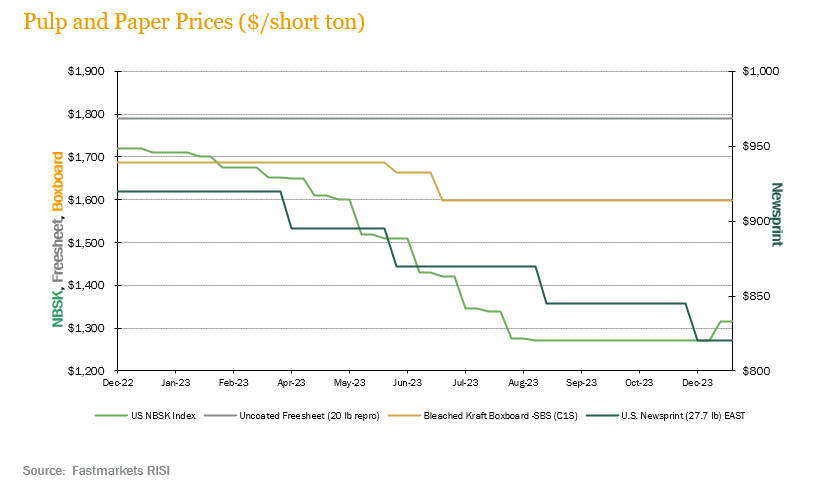

PULP AND PAPER — Demand for pulp and paper products remained generally flat. The benchmark NBSK (northern bleached softwood kraft) pulp price index increased 3.5% and ended the quarter 23.5% below year-ago levels. U.S. Newsprint (27.7 lb.) prices fell 3.0% over the quarter and 10.9% year-over-year. Freesheet and boxboard prices also remained flat during the quarter with boxboard prices ending 5.3% below last year’s level.

![]()

TRANSACTIONS — In the South, the biggest news of the fourth quarter was Weyerhaeuser’s announcement of a buy/sell agreement with FIA. Weyerhaeuser purchased approximately 60,000 acres in Mississippi, North Carolina, and South Carolina from FIA for $163 million. Meanwhile, FIA purchased nearly 70,000 acres in South Carolina from Weyerhaeuser for $170 million. In south Georgia and Alabama, IKEA acquired 16,000 acres from Rayonier for $35 million. Green Diamond purchased 24,000 acres in Alabama from a private seller for $30.5 million. Finally, Jamestown sold a package in South Carolina and Georgia to RMS and another buyer for an undisclosed price.

In the Pacific Northwest, Rayonier announced its sale of 55,000 acres in Oregon to Manulife for $242 million. Manulife also sold 11,000 acres in Oregon to Hampton Lumber for $56.4 million. Manulife also sold a 34,600-acre package in Washington to a conservation buyer and a 20,000-acre package in northern California to another buyer, both for undisclosed prices.

TRANSACTIONS IN PROGRESS — Several offerings closed late in the fourth quarter, while others carried over into 2024. There are also a handful of new offerings set to hit the market in January. Most of the pending or upcoming deal flow is in the Southeast, which was the most active region in 2023. Overall, deal activity in 2023 lagged well behind the pace of 2022 when transaction totals eclipsed $5 billion, but we believe valuations remained strong.

![]()

In Australia, a report published by the Australian Bureau of Agricultural Economics (ABARES) highlighted the long-term contraction of Australia’s plantation footprint, which has decreased by over 250,000 hectares (from 1.973 million to 1.716 million hectares) since 2014. During the 2021-2022 period, the plantation footprint was reduced by 28,000 hectares. Given Australia’s tight housing market, where the government is aiming to build 1.2 million new homes in the next five-year period, this decrease in domestic supply is expected to impact the country’s already high reliance on imported timber. Currently, Australia imports about a quarter of the timber required domestically.

Log prices for New Zealand exports had a surprisingly robust finish to the year. This lift in prices, which ended the year above the key threshold of $130 NZD/m3 mark in the North Island ports for A grade logs, was mainly driven by tight supply rather than increased demand since the Chinese construction industry continues to show weakness. The stout pricing is expected to level off and remain flat in the near future. Supply is also expected to be constrained given reduction during recent years of contractor capacity.

CHILE — The main spotlight during the fourth quarter in Chile was the second constitutional process aiming to draft a new proposal for the Political Constitution of the Republic of Chile. The first constitutional proposal in late 2022, which heavily leaned towards radical left-wing tendencies, was rejected by a significant percentage of the population. The outcome of this second vote once again resulted in rejection, although with much tighter figures (55.8% compared to 61.9% rejection of the 2022 version). Widespread perception was that the proposal was now overly conservative and regressive, this time with a right leaning bias. This new rejection confirms that the Chilean population is predominantly centered in the political spectrum, not comfortable with either of the right or left leaning options for the Constitution. As a result, Chile carries on with its existing constitution, originally established 30 years ago and amended through various democratic governments. This Constitution allowed Chile to grow and achieve a high level of prosperity in recent decades. Currently the topic of reforming the Constitution is considered concluded.

Forest products markets in Chile faced complex challenges during 2023 and have not yet fully recovered. With more than half of Chile’s exports focusing on China and the United States, Chilean forest products exports suffer the cyclical weakness in both of these key markets. Other destinations, such as Mexico, South Korea and Japan also show variations, emphasizing the importance of diversifying markets. The geographical distribution towards Latin America, Europe, Asia and other regions reflects a successful diversification strategy by Chile’s forest products sector, crucial for the long-term stability and growth of the forestry sector. Total year-to-date exports by October (latest data available from INFOR) amounted to $4.676 million USD, a 18.2% decrease when compared to the same period in 2022.

BRAZIL — During the last quarter of 2023, Brazil’s COPOM (Monetary Policy Committee) decreased the reference interest rate from 13.75% to 11.75% as expected. Current inflation results, which recorded 4.65% year-over-year inflation by end of 2023, indicate that additional rate cuts should be expected by Brazil’s COPOM in 2024. The BRL appreciated by 3.4%, from 5.007 to 4.841 during the last quarter to end the year with a 7.8% appreciation from 5.218 to 5.007 BRL per USD.

Global pulp markets, a key export from Brazil’s forest products industry, finished the year in positive territory with both softwood and hardwood pulp increasing year-over-year by 5% and 12% respectively. A rebound in Chinese demand, which rose by 36% when compared to the same period a year ago, was the main driver for the strong closing of the year since both Western Europe and North America continued to show weakness. In local timberland markets, two landmark transactions were announced before end of year. Klabin, one of Brazil’s key forest product companies, announced the acquisition of approximately 85,000 hectares of land and standing timber from Arauco, a major Chilean forest product company with presence in Brazil, for $1.16B USD (equivalent to almost a quarter of Klabin’s market cap). In parallel, Suzano, one of the world’s largest market pulp producers, announced the acquisition of approximately 70,000 gross hectares (50,000 estimated productive hectares) in Mato Gross do Sul, where Suzano is also building one of the largest pulp mills in the world. The facility is expected to come online in 2024. This deal is expected to close during 2024 once regulatory approvals are concluded.

![]()

HOUSING — Housing starts surged in November 2023 to a seasonally adjusted annual rate of 1,560,000, 14.8% above the revised October 2023 estimate of 1,359,000, and 9.3% above the November 2022 rate of 1,427,000.

MORTGAGE RATES — Mortgage rates fell each week in December, dipping below 7% before the start of the new year. The general expectation is that mortgage rates will continue to trend downward as long as the economy continues to see progress on inflation.

JOBS — Employers added 216,000 jobs in December, with the unemployment rate remaining unchanged at 3.7%.

CONSUMER CONFIDENCE — The Conference Board’s consumer confidence index increased to 110.7 in December, the highest reading since July, from a downwardly revised 101.0 in November.

INFLATION — Consumer prices increased more than expected in December, showing prices ticked up slightly at 0.3% over the prior month, an increase from the 0.2% seen in November. Prices rose 3.4% over the prior year, an increase from the 3.1% increase seen the month prior.

TRADE DEFICIT — The U.S. trade deficit unexpectedly narrowed in November, driven by a pickup in services exports and a slight decline in imports of merchandise.

INTEREST RATES — After hitting a high close to 5% in October, yields on the 10-year dropped to below 4% as of the end of the year.

OIL PRICES — As of the beginning of January, U.S. oil prices fell to their lowest level in three months, with West Texas Intermediate crude trading at roughly $75 a barrel. The decline in prices was driven in part by record U.S. oil production.

U.S. DOLLAR — The value of the U.S. dollar declined over the fourth quarter, with the U.S. Dollar Index dropping from a level of around 107 to approximately 101 as of the end of the year.

Disclaimer: Certain information contained in these materials has been obtained from third-party sources. While such information is believed to be reliable for the purposes used herein, FIA makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. This does not constitute an offering of any investment or an inducement to participate in any investment or investment advice. Past performance does not guarantee future performance. FIA is a Registered Investment Adviser with the Securities and Exchange Commission in the United States.

![]()