SUMMARY UPDATE — Despite a softening in pricing quarter-over-quarter, log markets in the Pacific Northwest remain strong. Demand for pine products in the U.S. South decreased in the fourth quarter. Hardwood markets in the Northeast softened over the third quarter as looming economic concerns affect end-use markets. Lumber and panel prices declined for the fourth consecutive quarter.

Mortage rates continued to climb in the beginning of the fourth quarter and leveled off. Nontheless, mortgage rates still continue to cause affordability issues and apply downward pressure on housing demand. As a result, housing starts remained flat in November but are down 16% year-over-year.

TIMBERLAND MARKETS — Rayonier grabbed headlines in the fourth quarter with its announcement that it had purchased 137,800 acres of Southern timberland from Manulife for $454 million. The package consisted of four separate offerings in Texas, Louisiana, Alabama and Georgia. Although state-level allocations were not reported, analysts anticipate record-high prices approaching $4,500/acre for the coastal Georgia package and over $3,000/acre for the Alabama land. Carbon-minded Bluesource Sustainable Forests also made waves at year-end by acquiring the remainder of The Forestland Group’s timberland portfolio for a reported $1.8 billion. The mostly hardwood portfolio stretched across 20 states, totaling 1.7 million acres. The price represents a premium to the timberland value of the portfolio, which was located in remote areas with limited access to end-use markets. There were several other announcements and closings in the fourth quarter, cementing 2022 as the largest timberland transaction year since 2013 with a total transaction value of over $5.1 billion.

![]()

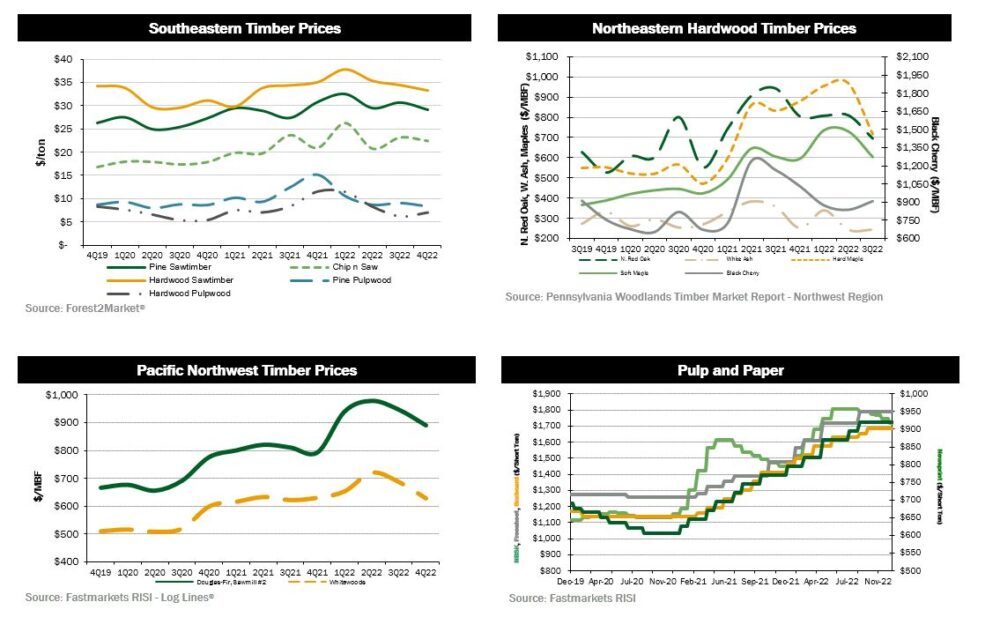

SOUTHEASTERN — Forest2Market reports a softening in pricing for the three main pine products in the U.S. South during the fourth quarter. Pine sawtimber decreased 5.0% over the quarter and 5.4% year-over-year. Pine chip-n-saw prices fell 3.3% during the quarter but remain up 7.1% for the year. Pine pulpwood prices fell for the third consecutive quarter with a decrease of 8.2% and ended the quarter 45.1% below last year’s level. Hardwood pulpwood saw a strong increase of about 13.7% during the fourth quarter but could not regain traction lost earlier in the year, finishing 38.9% below last year’s level. Hardwood sawtimber experienced a slight decrease of 3.4% and fell 5.1% for the year.

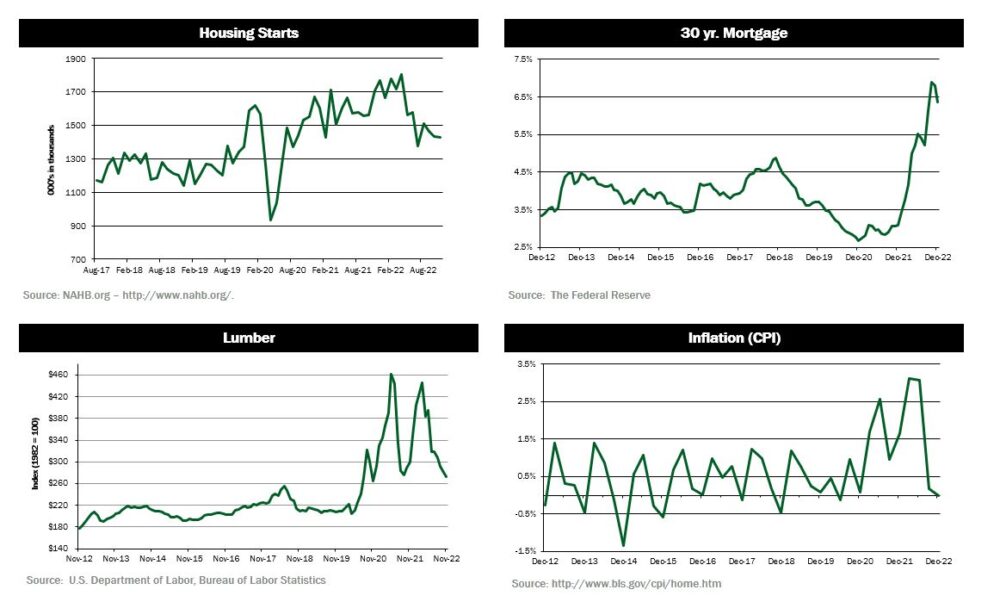

NORTHERN HARDWOODS — Demand varied across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices held constant, increasing about 0.7% during the third quarter (the most recent publicly reported pricing), and ended the quarter 31.8% below year-ago levels. Soft maple prices fell 17.4%, and in conjunction, hard maple and red oak prices decreased 26.1% and 14.2%, respectively, over the quarter. Conversely, black cherry prices experienced a bump in pricing of 8.5% during the fourth quarter.

In Pennsylvania and New York, hardwood lumber and log demand continued to soften throughout the fourth quarter. Domestically, economic uncertainty along with the impact of higher mortgage rates and a corresponding slowdown in home construction led to weakening lumber sales as flooring, cabinetry, and millwork inventories increased. Export lumber and log demand also continued to soften due to weak economic conditions in Asia and Europe. Throughout the later part of the fourth quarter, wet weather conditions hampered logging operations and kept sawmill log inventories manageable. Pulpwood demand was stable but began to soften toward the end of the quarter.

Hardwood markets in Wisconsin remained subdued during the fourth quarter due to lower domestic lumber consumption and lower exports. Hard maple, yellow birch, and basswood sawlog pricing stabilized at lower levels than were seen in the first half of the year. Veneer demand and pricing were normal while boltwood demand remained suppressed due to declines in the housing and end-use markets. Wet logging conditions in the latter part of the quarter helped keep inventories reasonable. Pulpwood demand was also relatively stable but inventories began to build late in the quarter.

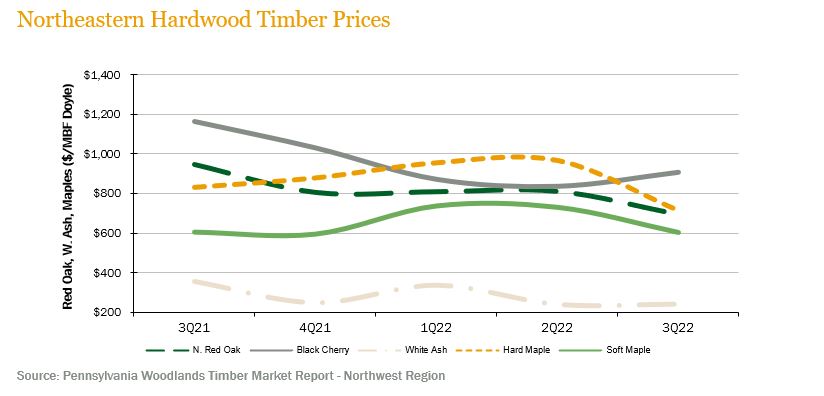

PACIFIC NORTHWEST — Pacific Northwest pricing continued to soften for the second consecutive quarter, yet prices remain generally higher than historic trends. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs decreased 6.0% over the quarter but rose 12.2% year-over-year. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices decreased 8.53% over the fourth quarter and modestly declined 0.3% year-over-year.

Log markets continue to be strong. Favorable weather has allowed log supplies to build and prices to flatten compared to values seen in the second quarter. Domestic prices for Douglas-fir are holding at upwards of $800/MBF, with prices reaching to nearly $875/MBF in select log markets. Export demand from China remains flat with pricing averaging around $700/MBF for Douglas-fir and upwards of $550 for whitewoods. Japan exports remain at premium levels, with pricing averaging around $1,000/MBF.

![]()

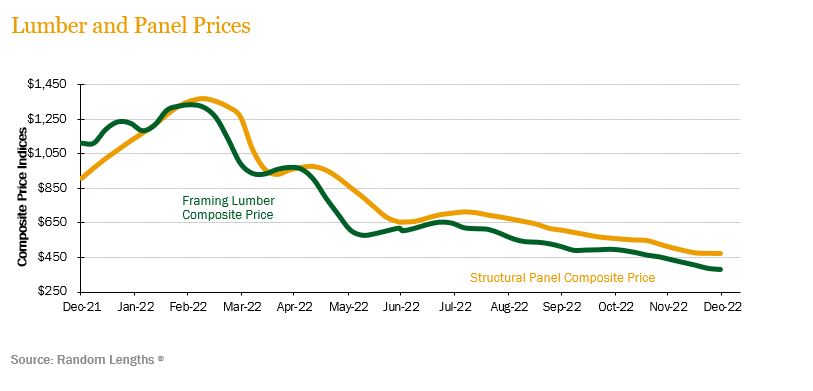

LUMBER AND PANELS — Lumber and panel prices continued to fall, as they have for the past three quarters. The Random Lengths® Framing Lumber Composite Price ended the quarter down 25.8% and down 65.8% year-over-year. Structural panel prices decreased 22.2%, ending the quarter down 47.9% from last year.

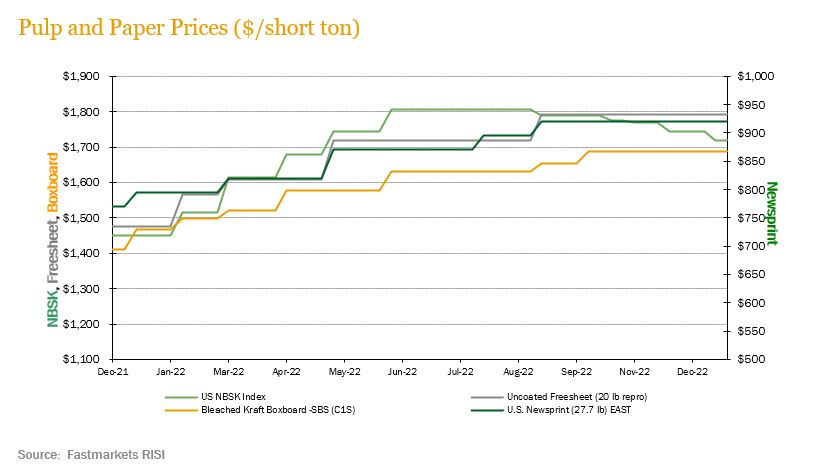

PULP AND PAPER — Over the fourth quarter, demand for paper and paper products remained relatively flat, however, pulp prices fell slightly. The benchmark NBSK (northern bleached softwood kraft) pulp price index decreased -3.9% but ended the quarter 18.6% above year-ago levels. U.S. Newsprint (27.7 lb.) prices had no noticable change over the quarter, ending 19.5% above last year’s level. Freesheet prices also remained flat during the quarter, ending 21.3% above last year’s level, while boxboard prices increased 2.1% over the quarter, ending 19.6% above last year’s level.

![]()

TRANSACTIONS — In the South, the biggest news of the fourth quarter was Rayonier’s purchase of 137,800 acres in four states from Manulife for $454 million. The package consisted of four separate offerings in Texas, Louisiana, Alabama and Georgia. Although state-level allocations were not reported, analysts anticipate record-high prices approaching $4,500/acre for the coastal Georgia package and over $3,000/acre for the Alabama land. Elsewhere in the South, Manulife completed its purchase of 90,000 acres in Florida from Lyme Timber for a reported price of $111.4 million. Approximately half of the property is subject to an existing conservation easement. In Arkansas, Resource Management Service (RMS) and Southern Pine Plantations teamed up to purchase 45,000 acres from Green Diamond for an undisclosed price. RMS also completed its purchase of 7,300 acres in Alabama from Manulife for an undisclosed price.

Across multiple regions, Bluesource Sustainable Forests announced its acquisition of 1.7 million acres across 20 states from The Forestland Group for a reported price of $1.8 billion, or just over $1,000/acre. The portfolio mainly consisted of hardwood timberlands located in remote areas with limited access to mill outlets. Bluesource, a carbon-minded investment manager, paid a premium to timberland value for the assets. Bluesource also purchased 27,000 acres in Tennessee and Alabama from a private seller for a reported price of $27.5 million. Finally, in Michigan, Bluesource purchased 29,000 acres from Lyme Timber for an undisclosed price.

TRANSACTIONS IN PROGRESS — There are a few offerings on the market expected to close in January and another handful with offers due in the first quarter of 2023. Total transaction value for 2022 topped $5 billion, making it the largest transactions year since 2013.

![]()

After an unprecedented spike in US inflation not seen in almost a quarter of a century, 2022 ended the year recording annualized inflation at 6.5%, definitely high, but trending in the right direction from its record breaking 9.1% annualized inflation in the middle of the year. At its last monetary policy meeting of the year, the U.S. Federal Reserve raised the fed funds rate by 50 basis points to a target range of 4.25% to 4.5%. This records the highest U.S. borrowing costs since 2007. Fed officials and markets expect the rate to continue increasing to the 5% level during 2023.

In Australia, according to the most recent Timber Market Survey (September 2022), timber markets in the region continued showing strong performance. Yet these strong sales are beginning to show signs of possible headwinds especially related to labor availability and logistics challenges. In some regions of Australia, this was further aggravated by weather events. According to the Australian Bureau of Statistics, housing demand in the country is also showing signs of cooling which has improved timber supply for industrial producers. In New Zealand, export prices for forestry products saw a weak end of 2022, and in general, did not seem to be poised for a rebound soon. Yet one small positive piece of news that could help ease the weakness in export markets from NZ was the fact that China began relaxing covid restriction and shutdowns, with the government beginning to support real estate developers to spark action in the manufacturing and construction industries.

CHILE — Two major items marked 2022 for Chile: the decisive rejection of the newly proposed Constitution and the highest inflation in over 30 years. Regarding the new Constitution, Chilean authorities continued to make progress during the fourth quarter to propose a new course of action, seeking to avoid the errors of the recent process that resulted in the rejection of the newly proposed Constitution. As it relates to inflation, Chile’s consumer price index registered an increase of 0.3% and 12.8% year-over-year for December. Although four times than Chile’s Central Bank’s annualized inflation target of 3.0%, inflation is slowing, and the first decrease in interest rates could be seen during the first quarter of 2023.

Chile’s foreign trade saw an increase in 2022, registering growth in both exports and imports and leaving a surplus trade balance of $2.858 billion USD. In total, $97.491 billion USD exports were registered, an increase of 3.0% versus the same period in 2021 and pointing to its highest historical record. Despite the trade surplus, the price of copper, Chile’s main export, fell off almost 14% and shipments dropped about 18%. Forestry exports fell for the third consecutive month; however accumulated total exports rose to $6.045 billion USD through November (latest data available), a 15.4% increase for the same period last year. Full year exports for 2022 are expected to come in at approximately $7 billion USD. On the supply front, it seems unlikely that the volumes available for exports should have any significant drops in the short term given how maritime transport services have recovered and reorganized after the global supply chain challenges of the global pandemic. For demand, Chile’s main export partners: China (29% of forestry exports, with the principal product being pulp) and the United States (26% of forestry exports, with the principal products being solid wood and remanufactured products) do not show signs that could lead to an abrupt drop in demand for Chilean forest products, although potential headwinds may be on the horizon given the war in Ukraine and global inflation that continues to be stubbornly high.

BRAZIL — On October 2nd, Brazilians went to the polls in the most recent election cycle. The most important position on the ballot was the presidential election. The incumbent Jair Bolsonaro faced off against Brazil’s ex-president Luiz Inacio Lula da Silva. Lula captured 48.3% of the votes with Bolsonaro registering a surprising 43.3% of the votes, forcing a runoff election held on October 30th. The runoff election was very close with Lula (left party) winning 50.9% versus 49.1% for Bolsonaro. Although it was a close election, the transition of power was carried out during the last months of the year, and Lula took office on January 1st. With the country split almost evenly down the middle, Lula will have to quickly deliver results for all the population. Inflation is relatively controlled at about 6.5% levels but with interest rates at 13.75%.

In the forest sector, global pulp shipments rose by 2% year-over-year for the month of November (latest data available), with hardwood up by 1% and softwood up by 3% for the period. The main driver for shipments during November was strong exports to China, which were up 14% year-over-year and more than offset declines to Western Europe, down 9%, and North America, down 11% for the period.

![]()

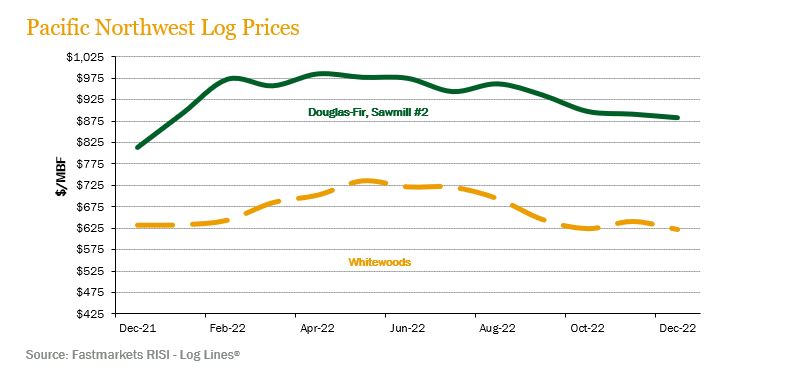

HOUSING — Housing starts hit a 2-1/2-year low in November, and permits for future construction plunged as higher mortgage rates continued to depress housing market activity. Single-family housing starts dropped 4.1% to a seasonally adjusted annual rate of 828,000 units. That was the lowest level since May 2020.

MORTGAGE RATES — The average rate for a 30-year fixed-rate mortgage stood at 6.3% as of mid-January, nearly 3% higher than one year prior when it was 3.45%.

JOBS — December’s jobs report showed the labor market remained strong at the end of the year, even as the Federal Reserve raised interest rates to the highest level in 15 years. Nonfarm payrolls increased by 223,000 in the last month of the year, while the unemployment rate in December fell to 3.5%. In 2022, the U.S. economy added 4.5 million new jobs, an average monthly increase of 375,000.

CONSUMER CONFIDENCE — U.S. consumer confidence rose to an eight-month high in December, hitting a level of 108.3, as inflation retreated, and the labor market remained strong.

INFLATION — The December CPI data confirmed that inflation is cooling off in most of the U.S. economy, with the headline annual CPI rising 6.5% in December, down from a 7.1% gain in November. Core CPI inflation, which excludes volatile food and energy prices, was up 0.3% on a monthly basis and 5.7% from a year ago. Year-over-year CPI inflation hit a 40-year high of 9.1% back in June, but it has now fallen for six consecutive months.

TRADE DEFICIT — The U.S. monthly international trade deficit decreased in November from $77.8 billion in October (revised) to $61.5 billion.

INTEREST RATES — After hitting a high of just over 4.2%, the yield on the 10-year Treasury Note declined to levels just over 3.5%, as of mid-January. However, the yield curve remains very steeply inverted, with the 6-month T-Bill yielding over 4.8% as of this writing.

OIL PRICES — After spiking to well above $110 a barrel in June of 2022, oil prices ended 2022 in the low-$70s, with prices increasing through mid-January to $80 a barrel.

U.S. DOLLAR — The U.S. dollar strengthened significantly through 2022, with the U.S. Dollar index hitting 114, while ending 2022 at a level closer to 104.

![]()