SUMMARY UPDATE — Positive activity can be reported in all major operating areas in North America. In the U.S. South, demand for pine sawtimber increased, with all major publications reporting marked rises. Pacific Northwest unit prices increased further, growing past notable increases experienced in the third quarter. Many key species in the Pennsylvania wood markets are experiencing increased demand. Lumber and panel prices retracted early in the fourth quarter; however, prices rebounded in December, pushing back up to near all-time highs. The Random Lengths® Framing Lumber Composite Price ended the quarter down 7.1%; however, prices remain 134% above year-ago levels.

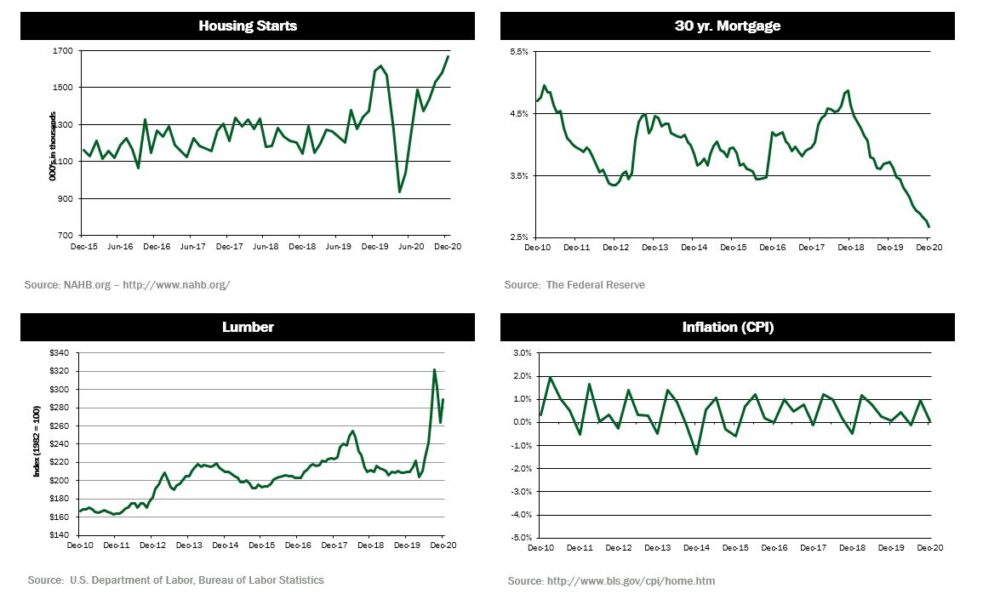

December housing starts were reported to be 1.669 million, which was 5.8% above the revised November rate of 1.578 million and 5.2% above the December 2019 rate of 1.587 million. Housing starts have increased 79% since April of this year. Interest rates continue to fall as the average rate for a 30-year fixed rate mortgage declined to 2.68% in December.

TIMBERLAND MARKETS — The biggest news of the fourth quarter was Weyerhaeuser closing on the purchase of 85,000 acres in northwest Oregon from Hancock for $426 million. In a separate transaction, Weyerhaeuser sold 149,000 acres in southern Oregon to Hancock for $385 million. The transactions combined to form the largest deal of 2020. Also in the Pacific Northwest, Lone Rock purchased 16,000 acres in Oregon from Al Pierce Company for a reported price of $96 million. In other news, Lyme Timber finalized its purchase of 92,000 acres in Pennsylvania and New York from National Fuel Gas for a reported price of $116 million. In the South, IKEA purchased 11,000 acres in Georgia from The Conservation Fund for an undisclosed price.

![]()

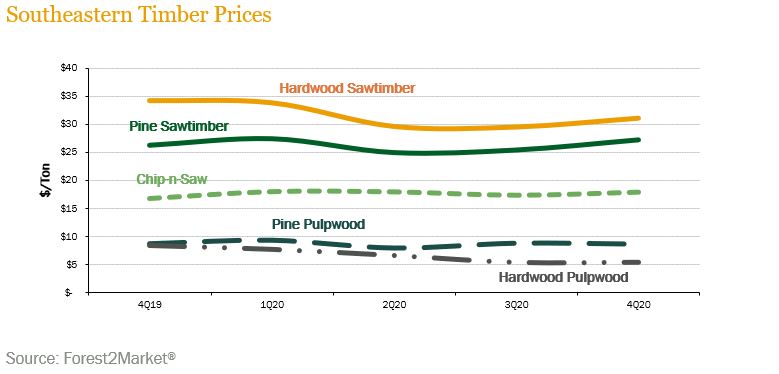

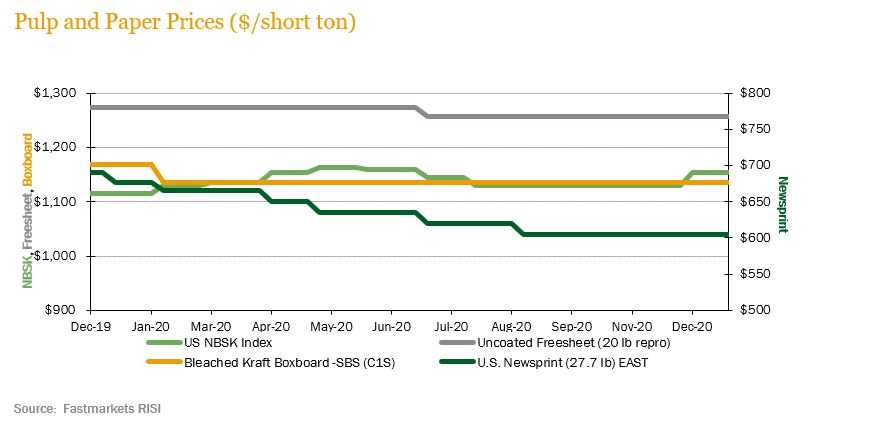

SOUTHEASTERN— Demand for pine sawtimber increased over the fourth quarter. Forest2Market® reported a 7.4% increase in Southern pine sawtimber prices over the final quarter of 2020. Sawtimber prices ended the quarter 3.8% above last year’s level. Pine chip-n-saw prices increased 2.9% over the quarter, ending the quarter 6.3% above year-ago prices. Pine pulpwood prices rebounded last quarter; however, prices retracted slightly over the fourth quarter, falling 1.8%. Pine pulpwood prices ended the year down 0.8% year-over-year. Hardwood sawtimber increased 5.3% over the quarter while hardwood pulpwood increased 0.4%.

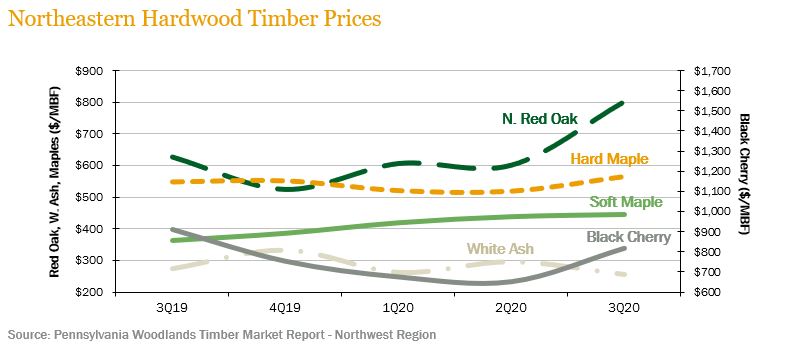

NORTHERN HARDWOODS — Hardwood demand increased late in the fourth quarter following construction and remodeling activity. Increased lumber and log exports, most notably to China, also became evident in November and December. According to the Pennsylvania Woodlands Timber Market Report, black cherry prices increased 25.6% during the third quarter (the most recent publicly reported pricing), ending the quarter 10.3% below year-ago levels. Northern red oak prices increased 33.2% over the quarter while hard maple prices increased 8.8%. Soft maple increased 1.6%, the fifth consecutive quarterly increase. White ash saw a retraction in pricing, falling 13.8% over the quarter.

Hardwood markets in Wisconsin performed well in the final quarter of 2020 due to continued strength in domestic consumption and increased demand for veneer grade logs. Hard maple, birch and basswood sawlogs saw increased demand as sawmills struggled to fill orders from distribution yards and secondary manufacturers. Hard maple veneer log sales were brisk with strong pricing and the bolt wood markets strengthened even further as flooring plants struggled to procure enough lumber. Hardwood pulpwood prices continue to struggle as paper mills contend with COVID-19 related disruptions.

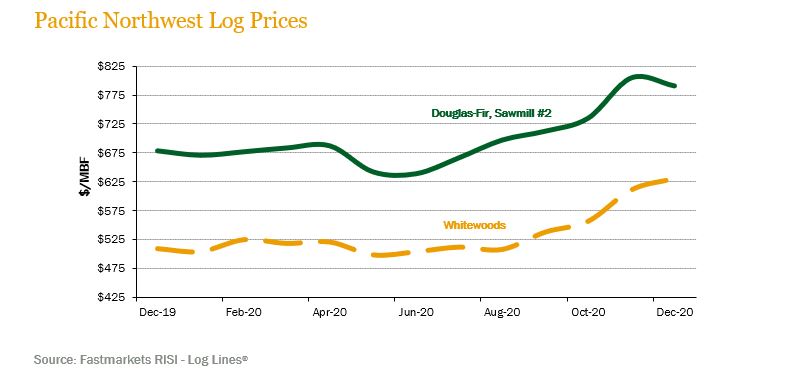

PACIFIC NORTHWEST — In the Pacific Northwest, increased demand experienced in the third quarter expanded further into the fourth quarter. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs increased 11.0% over the quarter, ending the quarter 16.6% above year-ago levels. Whitewoods (i.e., true firs and hemlock) average delivered log prices improved 17.0% and ended the quarter 23.5% ahead of last year’s level.

Log prices at Pacific Northwest domestic sawmills remain high. Delivered log prices for Douglas-fir increased to levels above $800 per/MBF in Washington and above $850 per/MBF in Oregon. Prices for export logs bound for China continue to be below domestic logs, while Japanese exports remain competitive, tracking domestic price trends.

![]()

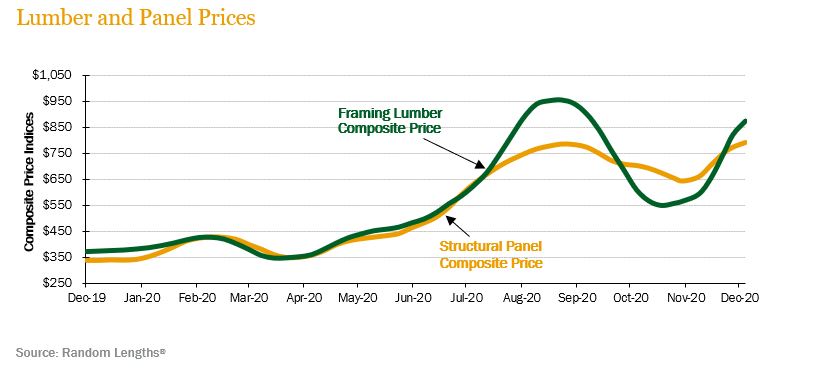

LUMBER AND PANELS — Lumber and panel prices retracted early in the fourth quarter; however, prices rebounded in December, pushing back up to near all-time highs. The Random Lengths® Framing Lumber Composite Price ended the quarter down 7.1%; however, prices remain 134% above year-ago levels. The Structural Panel Composite Price increased 1.0% over the quarter, ending the year 135% higher than year ago prices.

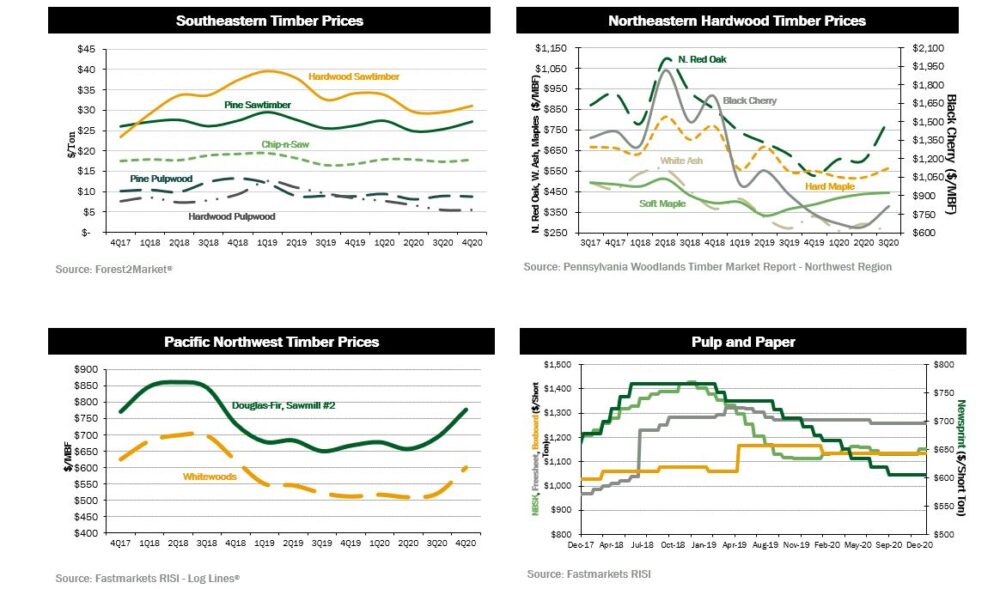

PULP AND PAPER — Major pulp, paper and boxboard markets ended 2020 generally below year ago levels. The benchmark NBSK (northern bleached softwood kraft) pulp price index increased 2.0% over the quarter, ending the year 3.4% above year-ago levels. U.S. Newsprint (27.7 lb.) prices remained unchanged over the quarter, however prices ended the year 12.4% below last year. Freesheet and boxboard demand remained unchanged quarter over quarter. Both products ended the year down, falling 1.3% and 2.8% respectively.

![]()

TRANSACTIONS — The headline deal of the fourth quarter was Weyerhaeuser’s purchase of 85,000 acres in northwest Oregon from Hancock for $426 million. In a separate transaction, Weyerhaeuser announced that it also sold 149,000 acres in southern Oregon to Hancock for $385 million. The transactions combine to form the largest deal of 2020. Also in Oregon, Lone Rock purchased 16,000 acres from Al Pierce Company for a reported price of $96 million. In California, Soper-Wheeler is reportedly under contract to sell 90,000 acres to Sierra Pacific.

In the Northeast, Lyme Timber finalized the purchase 92,000 acres in Pennsylvania and New York from National Fuel Gas for a reported price of $116 million.

Finally, in the South, IKEA purchased 11,000 acres in Georgia from The Conservation Fund for an undisclosed price.

TRANSACTIONS IN PROGRESS — While the ongoing coronavirus pandemic impacted transaction activity in 2020, total transaction value still topped $2 billion for the year. A few large deals made up most of the value, but activity should hopefully pick up in 2021. The biggest deal on the market right now is a 69,000-acre offering in Alabama from Soterra. There are also a handful of smaller offerings on the market that investors will be watching closely in the coming months.

![]()

The year 2020 has concluded. Before the buzz wears off from a most welcomed new year, reflection is warranted. Early year lockdowns in 2020 and other protective measures used to control the spread of the novel coronavirus (SARS-CoV-2) caused massive halts to economic activity. Sadly, these efforts have not ‘controlled’ the spread of the virus, but they did provide the health care system and the vaccine development process much needed time. Late in the first quarter, the associated disease, COVID-19, was formally defined as a pandemic by the WHO and the ramifications to the markets are still being felt. The pandemic entered the most acute phase as the year ended; however, effective vaccines have been developed and are actively being distributed in parts of Asia, Europe and North America.

Monetary and fiscal stimulus poured out of most major governments to help quell the pain of the sudden economic stop and support workers around the globe that were directly impacted by these convulsions. Asset prices were supported as interest rates compressed while virtually every major rate setting central bank trimmed overnight rates and expanded asset purchasing programs in scope and scale across a variety of asset classes. A notable observation in U.S. equity markets was the amazing bounce off multi-year lows in March to all-time highs by year end.

As described in earlier QNLs, the forest products sector was deemed necessary in most major markets except for New Zealand. In some cases, as in the U.S., markets become heated as remodeling and housing took a leg up. With its early control of COVID-19, China resumed almost normal consumption by Q2 and continued its import of raw logs, pulp and lumber. Globally, timber markets were amazingly resilient and not nearly as volatile as other segments of the ‘real’ economy. These data points are a reminder of the role of timberlands in investors’ portfolios: a store of wealth with steady returns and limited fundamental volatility in the underlying cash flow generation.

As we look forward, the pandemic is likely to remain a story to consider through 2021. Vaccine deployment, travel restrictions and the new administration in the U.S. will drive much of the narrative. Ripples from previous events are still working through the system. These include the legacy of the trade war between the U.S. and China but also a more recent trade friction between Australia and China which began to take shape Q4. Across the board, pulp, lumber and log markets performed well to close off the year. New Zealand logs into China have had upward price support as inventories reduced into the latter part of the year. Australian markets should remain tight as local timber supplies remain constrained in a post-brushfire world. To the extent further rate accommodation and fiscal stimulus is available, the macro landscape should remain relatively unchanged for timber demand. In aggregate, global forest product markets generally feel well supported and hope for a year that ushers in a post-COVID tailwind can’t be ignored.

CHILE — Through the fourth quarter, Chile continued to strictly manage its response to the COVID-19 pandemic and reported 29,438 active cases at the end of the quarter. As the South American summer and holiday season progressed, managing the active cases continued to prove challenging for Chile but are still substantially lower than the peak of over 73,000 active cases from mid-2020. Chile’s border has been opened to both residents and non-residents, although with strict health controls. Vaccines have been approved with the goal to have 5 million doses administered by the end of Q1. Due to direct impacts from the pandemic, the Chilean economy is expected to contract by 6.25% during 2020 according to the IMF’s most recent report, but also expected to rebound and expand by 3.0 to 4.0% during 2021 assuming global progress in controlling the pandemic.

The forest industry continues to operate as an essential activity under Chilean regulation and during November (latest data available) forest exports registered a growth of 0.7% versus the previous month. As of November, year to date accumulated Chilean forest exports reached $4.5 billion USD which is 14% lower than the same figure in 2019. The global economic slowdown due to the pandemic has been the main driver for the challenges in forest exports during 2020, with the worst performers being large drops in exports of bleached eucalyptus pulp, radiata pine bleached and raw pulp and eucalyptus wood chips. China and the U.S. continued to be the main destinations for exports of Chile’s forest products exports. About 85% of the forest industry is operating steadily and adopting the appropriate health policies to avoid any breakouts of the virus. Headwinds on forest exports have been partially neutralized with a surprisingly robust, domestic market for forest products supporting some of the attractive resilience of Chilean timber markets.

BRAZIL — Based on officially reported cases, Brazil is now under a second wave of COVID-19 infection after a consistent reduction of daily case counts during Q3. Still without an approved vaccine, the official government body responsible for vaccine approval (ANVISA) is reviewing the submitted data from two vaccines for emergency use. Brazil is up to approximately 8MM cases ranking third behind the U.S. and India.

Brazilian GDP is forecasted to be -4.4%. The GDP forecast accounts for a 7.7% increase in GDP in Q3. Inflation is forecasted to come in at 4.43% for the year. The SELIC overnight lending rate remained at an all-time low of 2.00% with some indications there might be some upward movement as the effects of COVID-19 hopefully dissipate. The Brazilian Real strengthened by 8.67% to 5.20 concluding a bumpy and volatile 2020.

Brazilian pulp producers in both soft and hardwood grades enjoyed upward price pressure towards the end of the year. Softwood pulp prices have had the biggest lift, but hardwood producers reportedly will be exploring another round of price hikes in the new year. This highlights the demand for packaging and other consumer products which has nicely substituted weaker printing, writing and newspaper grades. Domestic production of wood panels has expanded significantly and demand for Brazilian moldings has been strong. The weak BRL has supported most export-oriented markets. Watchful eyes will be on further lockdowns in North American and Europe through the latest wave of COVID 19 which could affect end use demand.

![]()

Housing — U.S. home construction starts rose in December by 5.8% to a 1.67 million annualized rate, the best pace since late 2006.

Mortgage Rates — Mortgage rates continued their trending decline into the new year, averaging around 2.75%.

Jobs — Employers cut 140,000 jobs in December, the first decline since the pandemic hit the country last spring. The jobless rate held steady at 6.7%, far below its April peak of 14.8%—a post-World War II high—but still almost twice its pre-pandemic level.

Consumer Confidence — U.S. consumer confidence stumbled to 88.6 in December, down from a revised 92.9 in November, its lowest level since August and the second-lowest reading since the pandemic lockdowns earlier this year.

Inflation — Inflation has been low since the pandemic struck. Core consumer prices, excluding volatile food and energy costs, rose 1.6% in December from a year earlier. The U.S. 10-year inflation breakeven rate, the yield difference between 10-year Treasuries and 10-year TIPS, shows that investors expect inflation to average 2.1% a year over the next 10 years.

Trade Deficit — The U.S. trade deficit widened 8% in November to $68.1 billion from $63.1 billion in the prior month. Economists surveyed by the Wall Street Journal had forecast a deficit of $67.3 billion.

Interest Rates — The Federal Reserve has promised to keep interest rates low for an indefinite period of time, and markets are pricing in rate hikes only by the second half of 2023.

Oil Prices — Prices have moved from around $40 a barrel to the low $50s over the last quarter.

U.S. Dollar — The U.S. dollar index, which measures the currency against a basket of other currencies, hit a 2.5 year low of just over 89 at the beginning of the year. U.S. dollar net shorts have also increased to its largest level since May 2011, indicating a bearish outlook.

![]()

![]()