SUMMARY UPDATE — Prices for key products in the South varied across the quarter while prices in the Pacific Northwest softened across the same time period. Hardwood markets in the Northeast varied with white ash prices gaining traction. Lumber and panel prices saw positive movement throughout the quarter. Mortgage rates softened to below 6% during the quarter; housing starts continued to rise from last quarter though they continue to remain below last year’s numbers.

TIMBERLAND MARKETS — The biggest news of the second quarter was Weyerhaeuser’s announcement that it was acquiring 70,900 acres of timberland in Alabama from a private seller for $196 million. This transaction will leave Weyerhaeuser $225 million shy of its target to grow the timberland portfolio by $1 billion by the end of 2025. Another major transaction in the third quarter was Salm Schulenburg’s purchase of 22,300 acres in Washington from Nuveen for $155 million. Trading at nearly $7,000/acre, this transaction was on the upper end of value ranges in the Pacific Northwest.

Many other offerings, primarily in the Pacific Northwest, continued to linger on the market through the close of the quarter. Investors will continue to monitor these pending transactions, while a handful of other offerings are taking bids in advance of year-end. With just over $1 billion in closed transactions thus far, it will take a flurry of activity in the fourth quarter to match the $2.2 billion transaction total of 2023.

![]()

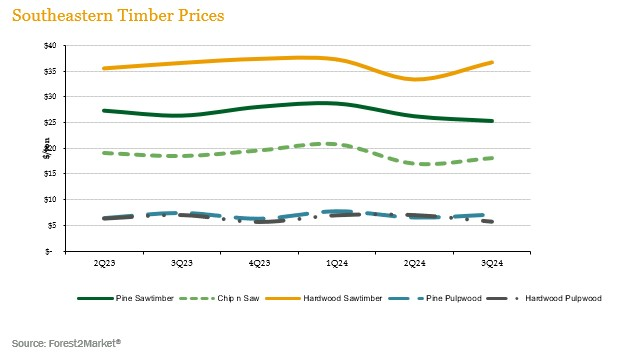

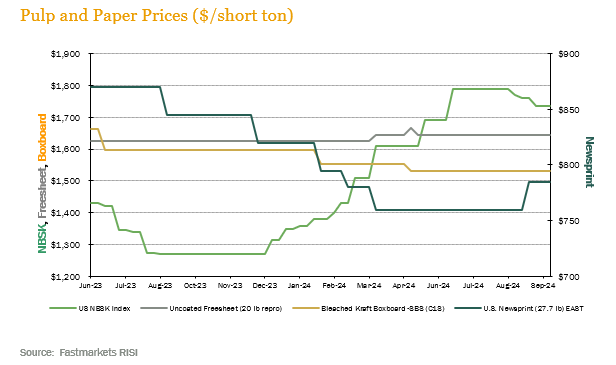

SOUTHEASTERN — Forest2Market reports that pricing for pine pulpwood and chip-n-saw increased in the U.S. South during the quarter while pine sawtimber prices fell across the same period. Pine pulpwood prices gained 7.2% during the quarter but are still down 4.1% year-over-year. Pine chip-n-saw prices rose 6.3% during the quarter but are down 2.1% year-over- year. Pine sawtimber fell 3.4% over the quarter and 3.8% year-over-year. Hardwood pulpwood decreased 17.4% during the quarter and ended 17.5% below last year’s level. Hardwood sawtimber rose 10.2% during the quarter and 0.3% for the year.

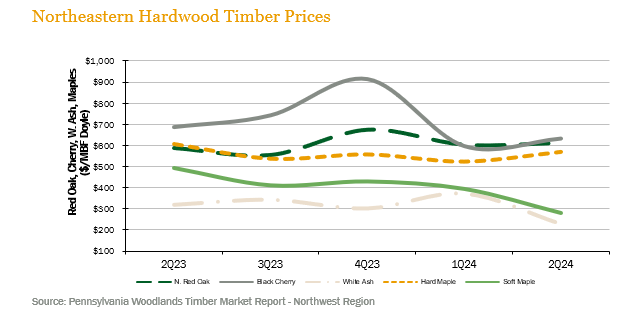

NORTHERN HARDWOODS — Demand varied across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices fell 38.4% during the second quarter (the most recent publicly reported pricing) and fell more than a quarter from last year’s levels. Hard and soft maple rose in tandem at 8.7% and 7.7%, respectively over the quarter. Red oak rose 1.4% during the quarter and further rose 4.0% year-over-year. Lastly, black cherry prices began to recover from a significant reduction in the prior quarter by increasing 5.9% during the third quarter but are still down 7.7% year-over-year.

Hardwood markets continued to weaken throughout the quarter. Similar to the third quarter of 2023, demand for hardwood lumber and logs softened significantly in both the domestic and export markets. Sawmills struggled to sell saw-grade lumber at profitable pricing given their high input costs which include stumpage prices. White oak continued to be the best performing species. Demand for red oak and hard maple was stable but at much lower levels than the first half of the year. Soft maple demand was fair while black cherry weakness continued both domestically and internationally. Hardwood pulpwood markets experienced continued weakness.

In Wisconsin, hardwood markets remained depressed due to lower domestic lumber consumption and reduced exports. Domestic demand continued to be reduced by the housing and remodeling slowdown that has plagued the U.S. for several years now. As an indication of prolonged unfavorable market conditions, Besse Forest Products announced in early August that they would be closing three facilities in Wisconsin including the Goodman Veneer and Lumber plant established in 1909 in the town of Goodman, Wisconsin. Boltwood markets saw little to no relief as demand for hardwood flooring remained depressed. One bright spot was the veneer log markets, which saw good pricing and stable demand for hard maple, ash, and birch logs. Hardwood pulpwood demand continued to be very weak.

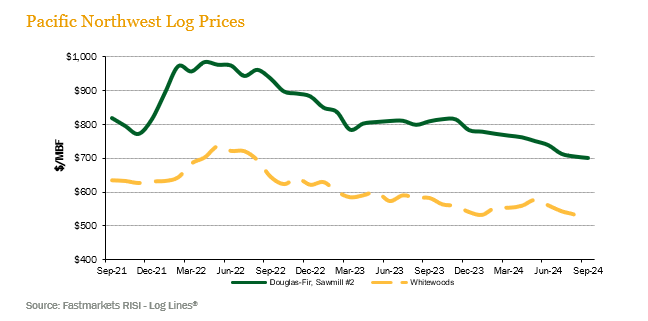

PACIFIC NORTHWEST — Pacific Northwest pricing continued to soften during the quarter. Log Lines® reported that average delivered prices for Douglas-fir #2 logs decreased 5.9% quarter-over-quarter and 12.4% year-over-year. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices fell 6.3% during the quarter and 9.4% year-over-year.

Log markets and demand continued to soften from last quarter, with average prices falling from the previous quarter as well. Domestic prices for Douglas-fir are holding between $650/MBF to $750/MBF, while prices reached $850/MBF in select log markets such as the Willamette Valley. These decreases in price are related to oversupply and high inventory coupled with slow movement in lumber markets. Export prices saw a small, short-lived bump following the Lunar New Year but dropped back below 2023 pricing levels. Export demand from China remains lackluster with pricing averaging around $575/MBF for Douglas-fir and about $525 for whitewoods. Exports to Japan remain competitive to domestic pricing at $800/MBF.

![]()

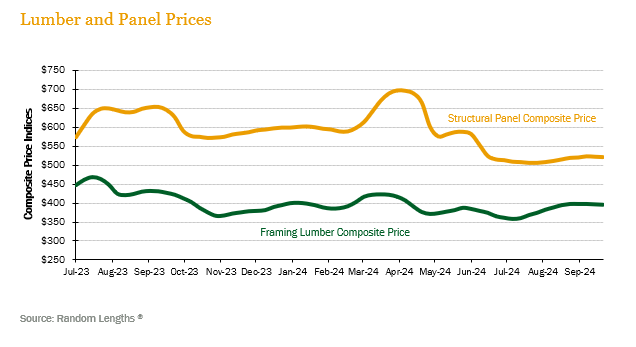

LUMBER AND PANELS — Lumber prices rose during the quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter up 8.2% and 6.2% below year-ago levels. Structural panel prices increased 1.2% during the quarter and finished 16.6% below September 2023 levels.

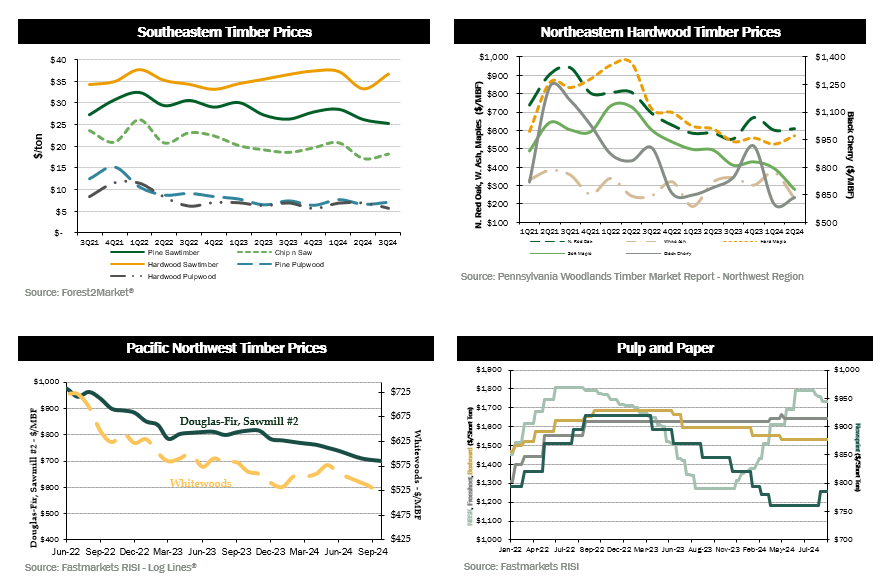

PULP AND PAPER — Demand for pulp and paper products varied during the quarter. The benchmark NBSK (northern bleached softwood kraft) pulp price index fell 3.1% for the quarter and while finishing 36.6% above year-ago levels. U.S. newsprint (27.7 lb.) prices rose 3.3% over the quarter but ended the quarter 7.1% below last September. Boxboard prices remained consistent quarter over quarter but are 4.1% below last year’s level.

![]()

TRANSACTIONS — The biggest news of the second quarter was Weyerhaeuser’s announcement that it was acquiring 70,900 acres of timberland in Alabama from a private seller for $196 million. The transaction will leave Weyerhaeuser $225 million shy of its target to grow the timberland portfolio by $1 billion by the end of 2025. The purchase by Salm Schulenburg of 22,300 acres in Washington from Nuveen for $155 million was another notable transaction;. trading at nearly $7,000/acre, this transaction executed on the upper end of value ranges in the Pacific Northwest.

TRANSACTIONS IN PROGRESS — All eyes are on the Pacific Northwest, as several offerings linger on the market. The largest is 115,000 acres from Rayonier in western Washington, the latest offering in Rayonier’s plan to divest $1 billion of timberland. Investors closely monitor other offerings in Washington and Oregon from Campbell Global, BTG Pactual, and Manulife. Few Southern deals are coming to the market, but a couple offerings will take bids early in the fourth quarter. Deal flow remains muted in 2024, with total transactions just over $1 billion compared to $2.2 billion in 2023.

![]()

The global economy continues to stabilize with growth driven by expansion in the American economy. Global trade in goods and positive trends in prices in the commodity cycle are key drivers underpinning this global stabilization, which is also benefiting from global inflation rates trending down to better align with central bank targets.

In New Zealand, log prices continue to struggle with export A grade logs holding flat at $113NZD/m3 during August and September. This weakness continued to be driven by China’s struggling housing sector where current unsold stock takes a significant amount of time to be absorbed by markets. Small signs of positive news in Chinese demand are evident for higher-quality logs.

The Australian domestic housing market, a key driver of Australian forest products demand, experienced a year-over-year decrease in new dwelling approvals in August (latest data available) at 166,233 approvals which is down 3.3% from the previous period. Monthly approvals in August of 13,991 indicated a drop of 4.0% when compared to July. Annual approvals still remain substantially below the 240,000 per year target set by the government.

CHILE — Economic activity in Chile grew by 1.6% in the second quarter (latest data available), with an annual inflation rate in August of 4.7% (last twelve months). Although banking interest rates have decreased from 5.75% to 5.5%, credit demand remains weak, particularly for business investments, due to restrictive supply conditions and heightened risk perception. The reduced depth of the capital markets, following pension fund withdrawals, has impacted long-term financing, and higher interest rates have increased the cost of corporate and mortgage financing.

Forest exports grew by 3.0% year-over-year as of May (latest data available), accounting for 5.8% of total national exports. Over the first five months of 2024, most forest products saw a decline in average prices, with Radiata pine moldings experiencing the most significant drop, while Radiata pine MDF recorded a slight increase. Plywood export prices have shown a tendency to stabilize, and volatility in sawn timber prices has reduced, with stability observed in 2023 and consistency continuing into 2024.

In the domestic market, the regions of Araucanía and Los Ríos have had the highest prices, while Ñuble shows the lowest, potentially due to lower production costs or weakened demand. The price stabilization of certain products indicates a favorable environment for long-term investments and strategic planning. Exploiting regional price differences can potentially help mitigate risks and enhance profitability through adjustments in production and sales strategies based on local market conditions.

BRAZIL — During the third quarter of 2024, the Brazilian economy continued to show greater dynamism than expected with economic and labor indicators trending positively. Brazil’s unemployment rate averaged 6.6% across three rolling months, ending in August (latest data available), which is the lowest since 2014. During the quarter, Brazil’s COPOM (Monetary Policy Committee) increased the reference interest rate by 25 basis points to 10.75%. The rolling twelve-month inflation rate was recorded at 4.42% during September. The BRL appreciated during the third quarter from 5.558 to 5.448 on the USD by the end of the quarter.

In Brazil’s forest sector, global pulp markets continue to be a core value driver given Brazil is home to the world’s largest producer of market pulp and other relevant global players. Global pulp shipment volume dropped by 10% year over year mainly driven by continued headwinds in China, which dropped 31% year over year. Positive volume growth in Western Europe of 8% year over year and North America of 5% year over year helped counter-balance the slump in Asia. On the pulp pricing front, markets expect the cycle to be close to the bottom since the more recent monthly reading of shipments to China showed an inflection point of growing 7% month over month.

![]()

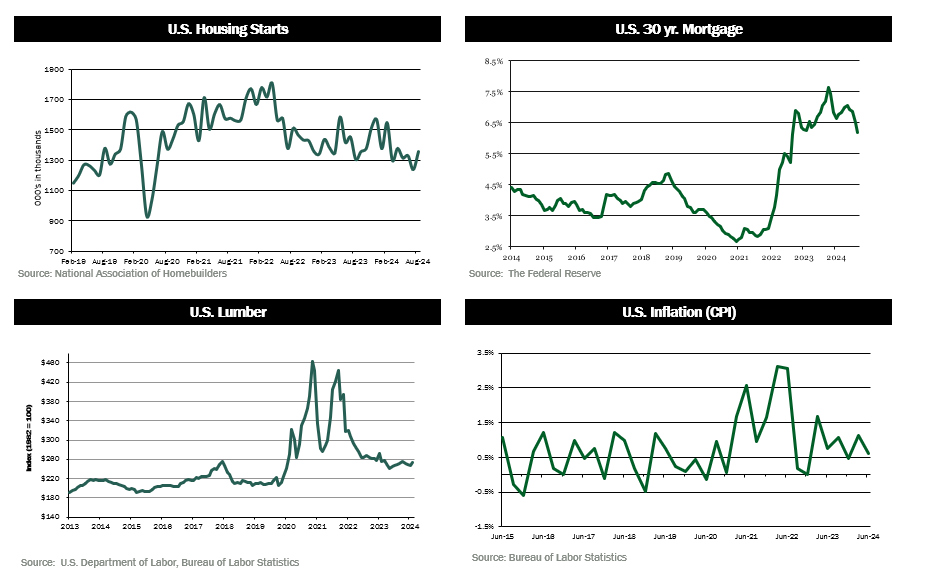

HOUSING — U.S. housing starts increased 9.6% in August to a seasonally adjusted annual rate of 1.36 million units. The slowdown seen over prior months pushed the number of housing units under construction down 11% year-on-year in August, primarily driven by the multi-family segment.

MORTGAGE RATES — The U.S. national average 30-year mortgage rate ended the quarter below 6% for the first time since early 2023.

JOBS — The September jobs report showed the economy added 254,000 jobs the prior month, far exceeding economists’ estimates.

CONSUMER CONFIDENCE — The Consumer Confidence Index dropped to 98.7 in September, down from an upwardly revised 105.6 in August. The decline was the largest since August 2021.

INFLATION — The Consumer Price Index rose 2.4% in the 12-month period that ended in September, with the so-called Core CPI (which excludes food and energy prices) rising to 3.3%. The CPI figure is the smallest increase since February 2021.

TRADE DEFICIT — The U.S. trade deficit narrowed sharply in August as exports increased to a record high, suggesting trade could have little or no impact on economic growth in the third quarter. The trade gap contracted 10.8% to $70.4 billion, the smallest in five months, from a revised $78.9 billion in July.

INTEREST RATES — The 10-year treasury hit a low of 3.6% in the third quarter but rose above 4% as of the beginning of the fourth quarter. The overall yield curve ended the quarter slightly inverted.

OIL PRICES — Oil prices fell over the third quarter, from a high of over $83 a barrel to a low below $66, ending the quarter in the $70 to $75 range.

U.S. DOLLAR — The U.S. Dollar Index fell over the quarter, ending at a level around 100.

![]()

Disclaimer: Certain information contained in these materials has been obtained from third-party sources. While such information is believed to be reliable for the purposes used herein, FIA makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. This does not constitute an offering of any investment or an inducement to participate in any investment or investment advice. Past performance does not guarantee future performance. FIA is a Registered Investment Adviser with the Securities and Exchange Commission in the United States.