SUMMARY UPDATE — Despite flat pricing quarter over quarter, log markets in the Pacific Northwest remain very strong. Demand for pine products in the U.S. South increased in the third quarter. Hardwood markets in the Northeast softened over the third quarter as mill inventories increased. Lumber and panel prices declined for the third consecutive quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter down 17%; however, prices are slightly higher than year ago levels.

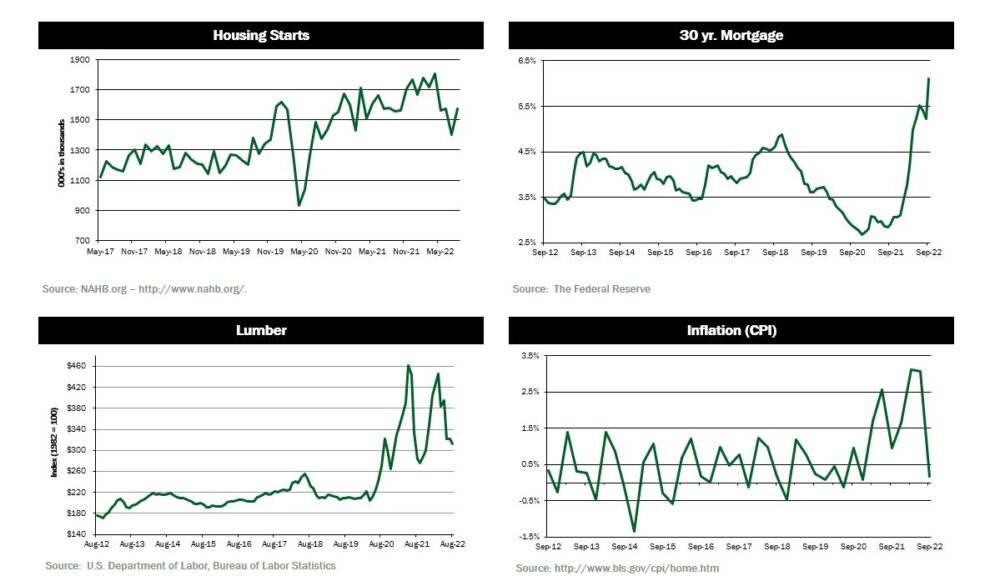

Housing starts increased 12% in August; however, building permits dropped 10%, suggesting volatility in the sector. Mortgage rates continue to climb, doubling in just over one year and applying downward pressure on housing demand.

TIMBERLAND MARKETS — The headline closing of the third quarter was Manulife’s Ceres sale of 237,000 acres in Texas and Louisiana to Molpus Woodlands Group and BTG Pactual. The offering, which was split into two relatively equal sized packages, sold for a reported price of $505 million. PotlatchDeltic (PCH) also grabbed headlines in the third quarter. In addition to officially closing on its purchase of CatchMark Timber Trust, PCH also completed the purchase of three separate properties in Mississippi and Arkansas totaling over 45,000 acres for a combined price of just above $100 million. Greenwood Resources, part of Nuveen Natural Capital, closed on its purchase of nearly 70,000 acres in Oklahoma and Texas from Manulife for a reported price of nearly $115 million. There were several other announcements and closings in the third quarter with a handful of other offerings in process, setting 2022 up to be one of the largest timberland transaction years in recent history.

![]()

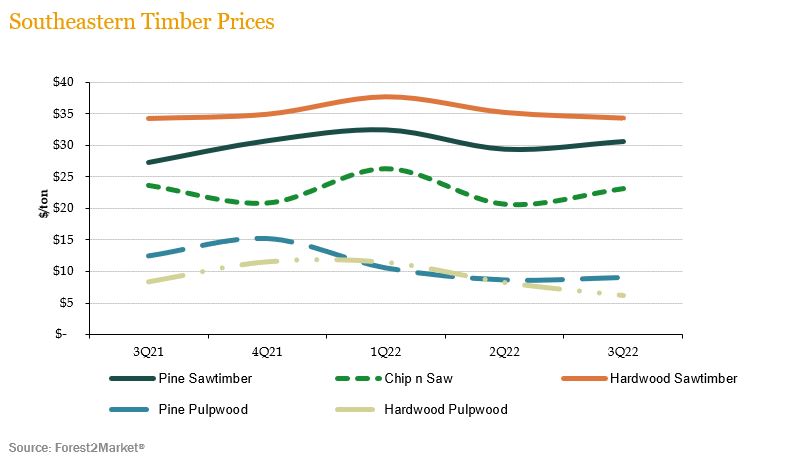

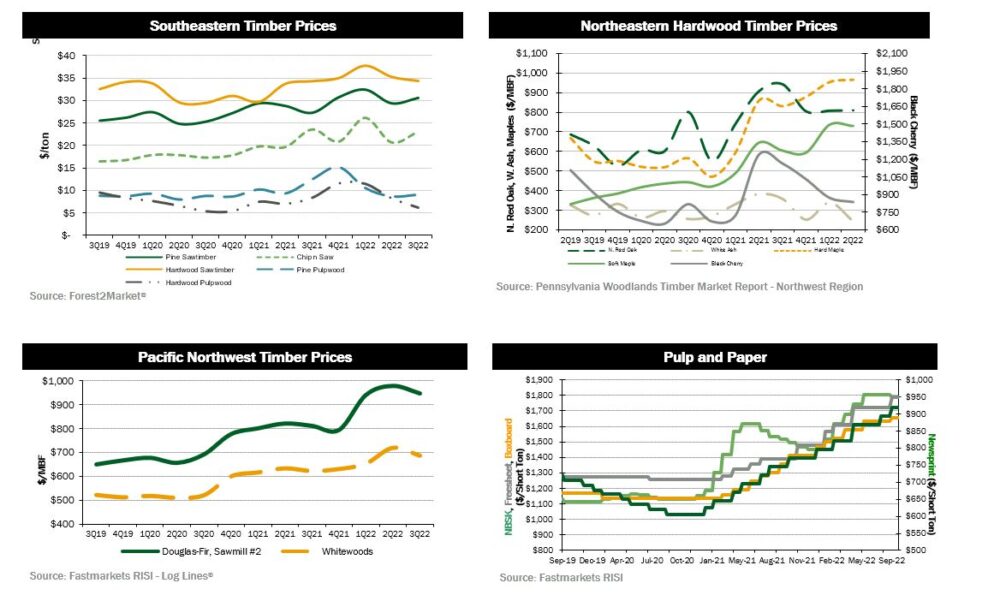

SOUTHEASTERN — Over the third quarter, demand for pine timber increased across the South. Forest2Market® reports price increases for the three main pine products in the U.S. South. Pine sawtimber increased 4.1% over the quarter and prices are 12.1% above year ago levels. Pine chip-n-saw prices increased 11.6%, gaining back some of the decline experienced over the second quarter. Pine pulpwood prices increased 4.5%; however, prices ended the quarter 27.1% below last year’s level. Hardwood pulpwood and sawtimber decreased for the second consecutive quarter, dropping 24.8% and 2.5%, respectively, over the third quarter.

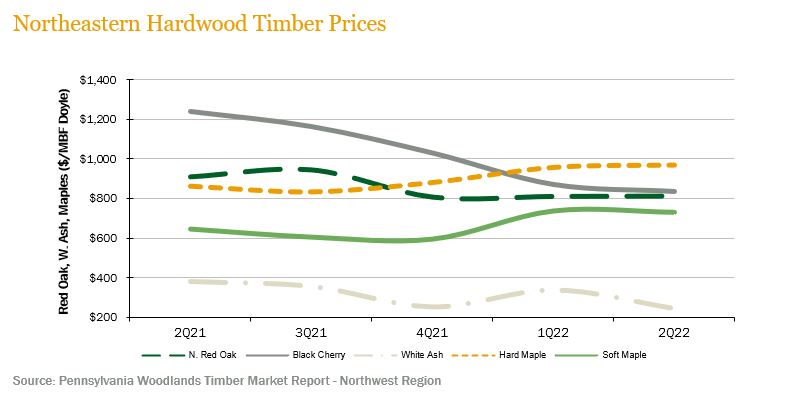

NORTHERN HARDWOODS — Demand varied across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices decreased 28.5% during the second quarter (the most recent publicly reported pricing), ending the quarter 36.7% below year-ago levels. Soft maple prices held flat, only dropping 0.9%, while hard maple and red oak prices increased 1.2% and 0.2%, respectively, over the quarter. Black cherry prices declined 4.1%, continuing to drop from peak prices reported a year ago.

In Pennsylvania and New York, Hardwood lumber and log demand softened around the middle of the third quarter. Favorable logging conditions led to large increases in sawmill log inventories, and the mills were able to catch-up and eventually surpass domestic and export log and lumber demand. Higher mortgage rates, increased input costs, continued supply chain disruptions, and labor shortages combined to dampen domestic lumber consumption. Pulpwood demand was generally stable over the quarter.

Hardwood markets in Wisconsin softened over the course of the third quarter as domestic lumber consumption decreased considerably due to lower demand from new home construction and home remodeling. Hard maple sawlogs and veneer demand and pricing decreased but stabilized toward the end of the quarter. Basswood sawlog demand and pricing was also lower. Boltwood demand decreased as demand for hardwood flooring and interior fixtures decreased. Pulpwood demand was stable.

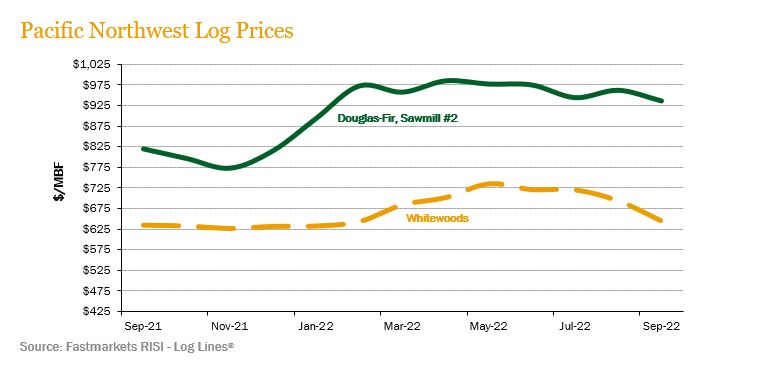

PACIFIC NORTHWEST — Pacific Northwest pricing softened during the third quarter of the year; however, prices remain generally higher than historic trends. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs decreased 4.0% over the quarter, ending at 14.3% above year-ago levels. Whitewoods (i.e., true firs and hemlock) average delivered log prices decreased 10.7% over the third quarter and ended 1.6% above last year’s pricing.

Log markets continue to be strong. Favorable weather has allowed log supplies to build and prices to flatten compared to values seen in the second quarter. Domestic prices for Douglas-fir is holding around $850/MBF, with prices reaching over $900/MBF in select log markets. Export demand from China remains flat with pricing averaging around $750/MBF. Japan exports remain at premium levels, with pricing averaging around $1,200/MBF.

![]()

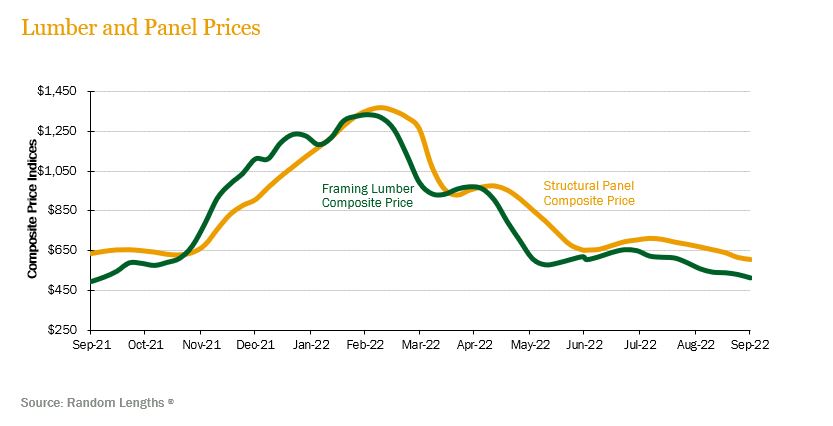

LUMBER AND PANELS — Lumber and panel prices retracted for the third straight quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter down 17.3%, though 3.6% above year ago levels. Structural panel prices decreased 7.2%, ending the quarter down 4.7% from last year.

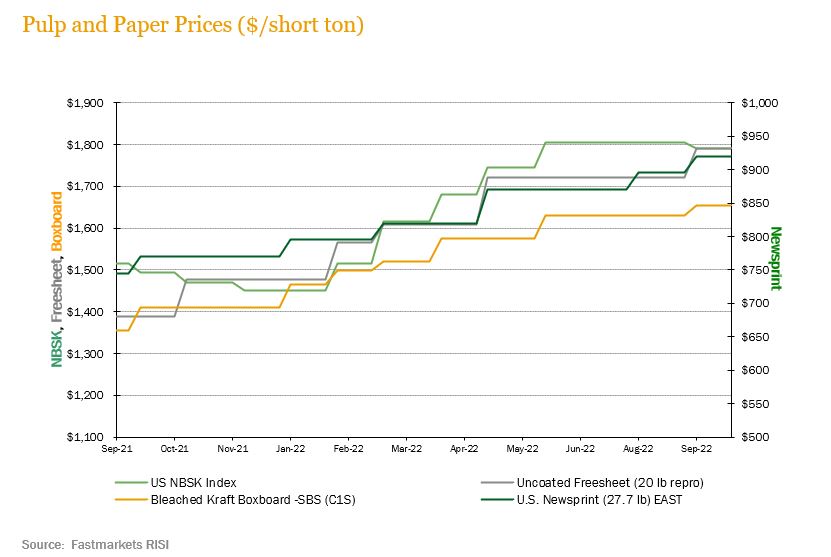

PULP AND PAPER — Over the third quarter, demand for paper and paper products increased causing prices to respond positively. Pulp prices, however, remained flat quarter over the quarter. The benchmark NBSK (northern bleached softwood kraft) pulp price index decreased 0.8% yet still ending the quarter 18.2% above year-ago levels. U.S. Newsprint (27.7 lb.) prices increased 5.7% over the quarter, ending 23.5% above last year’s level. Freesheet prices increased 4.1% over the quarter, ending 28.9% above last year’s level, while boxboard prices increased 1.3% over the quarter, ending 21.9% above last year’s level.

![]()

TRANSACTIONS — In the South, the biggest news of the third quarter was the closing of Manulife’s 237,000-acre Ceres offering in Texas and Louisiana. The deal was split into two relatively equally sized packages, with Molpus acquiring one portion for nearly $270 million and BTG Pactual acquiring the other for just under $240 million. PotlatchDeltic (PCH) finalized its purchase of CatchMark Timber Trust (CTT) and its 350,000 acres of timberland in Alabama, Georgia, and South Carolina in an all-stock transaction. In Mississippi, PCH closed on two separate transactions in the third quarter. The first was a 22,000-acre property from Campbell Global purchased for a reported price of $46.2 million. The second was a 17,000-acre Manulife property purchased for approximately $45 million.

Finally, PCH also purchased 7,000 acres in Arkansas from BTG for $15.2 million to cap off a busy quarter of transactions for the publicly-traded REIT. Greenwood Resources, part of Nuveen, purchased approximately 70,000 acres in Oklahoma and Texas from Manulife for approximately $115 million. In Alabama, IKEA closed its purchase of nearly 10,000 acres from a private seller for a reported price of $24.7 million. IKEA also purchased another 17,000 privately held acres in Alabama for approximately $21.2 million in the third quarter. Several other transactions in the South are set to close before year-end.

In the Northwest, Hampton completed its acquisition of 18,000 acres in western Washington from Campbell Global for a reported price of $107 million, or approximately $6,000/acre.

TRANSACTIONS IN PROGRESS — Investors continue to wait for word on several large-scale timberland offerings, particularly in the South, that are set to close in the fourth quarter. Investors will be closely monitoring the outcome of these offerings in the coming months as total value of pending transactions is likely to surpass $500 million.

![]()

During the third quarter of 2022 the inflationary cycle continued to create challenging conditions for the global economy and the post-pandemic recovery. In the U.S., after closing the second quarter with 9.1% annual inflation (the highest U.S. inflation in the last quarter of a century), the third quarter saw three straight months of inflation moderating to end the quarter at a still stubbornly high 8.2% annual rate. During its September meeting, the U.S. Fed raised the federal funds rate by 75 basis points to the target range of 3.00% to 3.25%, the highest level since 2008. In the UK, a failed fiscal plan proposed by newly elected prime minister Liz Truss backfired and caused turbulence in the country and through global financial markets, sending the British pound plunging and challenging global efforts to combat inflation.

In Australia, according to the most recent Timber Market Survey (June 2022), structural softwood timber markets showed stability through the first half of the year with availability of supply continuing to improve. As for hardwood timber products, markets continue to show robust demand through the first half of the year driven mainly by strong residential markets (alterations and additions). In neighboring New Zealand, the kiwi government, through its Ministry for Primary Industries, launched a “Draft Industry Transformation Plan,” which among other things, seeks to push for more volumes of forest products to be transformed in New Zealand instead of being exported as logs. In 2020, New Zealand exported 22 million cubic meters of logs. Through this plan, the goal seeks for exports by 2030 to be reduced to 13 million cubic meters of logs so that remaining volumes can be processed in-country for exports of higher value-added products.

In Japan, the world’s second largest importer of wood chips for pulp production behind China, import volumes rebounded during 2021 and continued to climb during the first half of 2022 (latest data available). After the historic low volume of imports of less than 10 million oven dry metric tons (odmt) in 2020, 2021 saw a healthier volume closer to 11 million odmt and continued to trend higher in 2022. According to Wood Resource Quarterly, long term average imports of woodchips to Japan have historically been around 12 million odbt. The main sources of hardwood chip fiber exports to the country have historically been Australia, Chile and South Africa.

CHILE — September 4th marked a historical election referendum for Chile. More than thirteen million Chileans, 85.86% of registered voters, cast their votes for the proposed new Constitution. The result was a landslide rejection with 61.89% of the population voting against the disruptive new document. This confirms that Chileans, in the long term, continue to choose being a moderate country that, although acknowledging areas of improvement for their Constitution, is also not willing to quickly forget the more than forty years of progress that has made Chile one of the region’s most successful economic stories. With this rejection, the current Constitution and status-quo is maintained while Chileans and their government revisit the path forward to update or replace the Constitution in the future. On the economic front, Chile’s local economy surprised to the upside during August (latest data available) registering a modest 0.6% month-over-month growth. But global headwinds are still expected to test Chile’s resilience and dampen growth in September, leading to an expected annual growth by end of year of 2.25%. Annualized inflation reached 13.7% during the quarter, still below historic records, and began to show signs of moderation. Inflation is estimated to cool slightly to 12.7% by the end of the year and targeted to get back to the 3.0% goal of Chile’s central bank over the next twenty-four months. Chile’s central bank raised the target policy rate by 50 basis points to 11.25%, the highest level in the cycle, as it joins other global central banks’ efforts to control inflation.

In the forest industry, Chile’s exports of forest products ascended to $4.642 billion USD during the first eight months of the year (latest data available), representing year over year growth of 22.7% versus the same period last year. Exports peaked for the quarter during the month of August with $655 million USD of products exported (12% higher versus August of last year). China and the United States continue to be the main drivers for demand of Chilean forest products exports, representing 29% and 25% of market share, respectively. Although strong forestry export growth is welcome news, the sector remains concerned about rising freight rates and continued global logistical problems.

BRAZIL — During the quarter Brazil’s COPOM (Monetary Policy Committee) met twice and increased the reference interest rate once to 13.75%. It is expected to be maintained at this level for the remainder of the year. Brazil’s swift actions to control inflation earlier in the year started showing results by the third quarter as YTD inflation through the end of the quarter registered 4.09%, and annual inflation for the year is expected to come in at approximately 5.71%. Energy, fertilizer and other commodity prices which were key drivers for high inflation earlier in the year showed signs of stabilization and cost reduction by end of the third quarter.

In the forest sector, although the global economy starts showing signs of deteriorating macro conditions, pulp prices through the end of the quarter are still expected to continue to be stable given global supply constraints. Pulp production in Brazil through June 2022 (latest data available) increased by 7.8% versus the same period last year. Export volumes of pulp during this period also rose by 15.9% when compared to the same period last year.

Finally on October 2nd, a couple of days after the end of the quarter, Brazilians went to the polls in the most recent election cycle. The most important position on the ballot was the presidential election, which saw the incumbent Jair Bolsonaro face off against Brazil’s ex-president Luiz Inacio Lula da Silva. Lula captured 48.3% of the votes with Bolsonaro registering a surprising 43.3% of the votes and forcing a runoff election to be held on October 30th. Other positions on the ballot were certain governors, senate and congress positions.

![]()

HOUSING — Housing starts in August hit a level of 1.575 million units, up 12.2% from the month prior, though building permits dropped 10% indicating continued volatility in the sector.

MORTGAGE RATES — Mortgage rates are heading closer to 7% as of the start of Q4, more than double the average rate a year ago, putting a significant strain on the housing market.

JOBS — Initial filings for unemployment claims fell to their lowest level in five months as of the end of September. Claims hit 193,000, coming in below the average estimate of 215,000.

CONSUMER CONFIDENCE — The University of Michigan’s consumer sentiment index for September stood at a level of 58.6, up slightly from the final August reading of 58.2. Those numbers are up from a low of 50 in June, but down substantially from the low 70s a year ago.

INFLATION — In August, The Fed’s Personal Consumption Expenditures (PCE) index increased 6.2% from the year prior. The so-called “core” PCE price index climbed 4.9% on a year-on-year basis in August after increasing 4.7% in July. Other inflation measures are running much higher. The consumer price index increased 8.3% year-on-year in August.

TRADE DEFICIT — The U.S. trade deficit in goods narrowed for the fifth month in a row in August to $87.4 billion, reflecting reduced demand for imports and the negative effects of a strong dollar on sales of American-made products. Just five months ago, the gap peaked at a record $125 billion. It has now slid to the lowest level since October 2021.

INTEREST RATES — The yield on the 10-year treasury has approached 4% recently, up from 1.5% a year prior. The Fed Funds target rate is 3.25%, up from 2.5% a month ago.

OIL PRICES — Oil prices tracked lower over the third quarter, to around $80 per barrel, reflecting fears of a global slowdown in growth.

U.S. DOLLAR — The U.S. dollar has strengthened significantly relative to currencies globally, reflecting an increase in U.S. interest rates and the potential for a meaningful recession in Europe. Reflecting this, the U.S. Dollar hit parity with the Euro in late August, and has continued to track higher.

![]()

![]()