SUMMARY UPDATE — The highlight of the quarter is that southern pine pulpwood hit a multi-year high. Northeastern, southern, and Pacific Northwest prices continue to be up compared to year-over-year values. Covid continues to pose a challenge, but vaccination rates are continuing to increase (33.5% of the world’s population has received full vaccination). Even though the Covid Delta-variant has caused increases in cases, due to the increasing vaccination rates many of the world’s major economies remain open and continue to recover. Housing starts decreased slightly from the previous quarter’s recovery. The period from July to September 2021 averaged 1.58 million starts. Generally, annualized housing starts in excess of 1.5 million signal a strong and robust housing market that positively impacts lumber demand.

TIMBERLAND MARKETS — The biggest news of the third quarter was CatchMark’s announcement that it sold 301,000 acres in Texas to Hancock for $498 million. The transaction, which was sold out of the Triple T joint venture, rings in as the largest of the year. The Pacific Northwest remained active in the third quarter, as Roseburg sold nearly 60,000 acres in Oregon to Chinook Forest Partners for $152.4 million. Several other large transactions were announced in California, Oregon, and Washington, though prices were not disclosed. Multiple offerings are on the market in the South, Pacific Northwest, and Lake States with bids expected in the fourth quarter. Total transaction value this year has already topped that of 2020, with a busy final quarter expected.

![]()

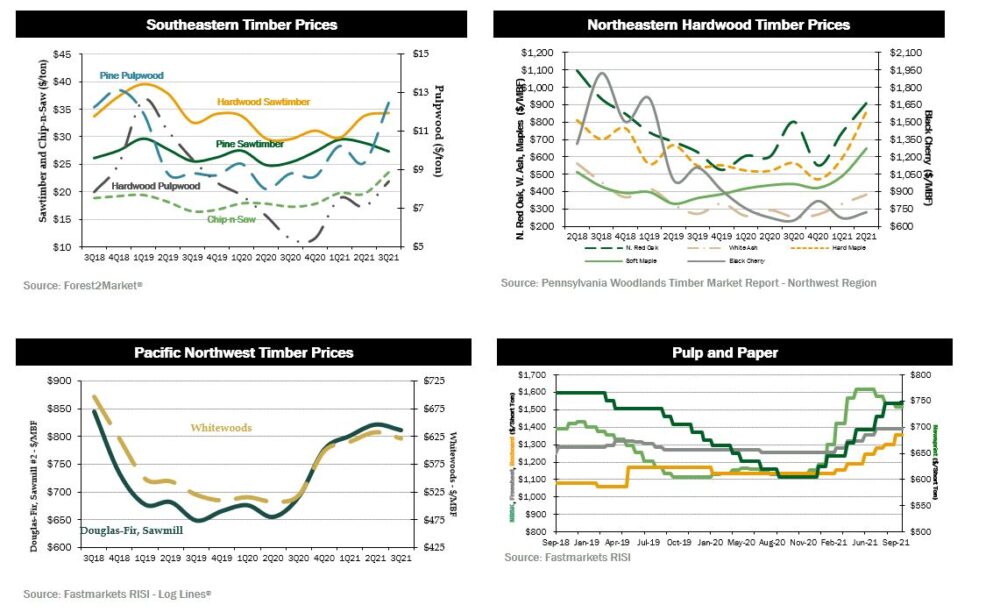

SOUTHEASTERN — The majority of southern products peaked in the third quarter. Forest2Market® reported a 5.3% decrease in Southern pine sawtimber prices over the third quarter, although prices ended the quarter 1.95% above last year’s level. Pine chip-n-saw prices hit a high at $23.63, 19.8% higher than the previous quarter and 36.2% above year-ago prices. Pine pulpwood prices rose 33.2% and prices were 41.5% year-over-year. Both major hardwood products saw increases. Hardwood pulpwood prices increased 18.37%, while hardwood sawtimber prices increased 1.66%.

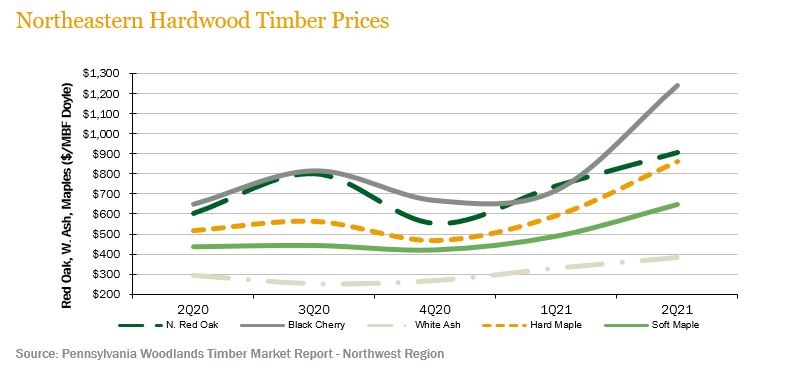

NORTHERN HARDWOODS — Overall, hardwood species were up over the second quarter 2021. According to the Pennsylvania Woodlands Timber Market Report, black cherry rose 72.4% during the second quarter (the most recent publicly reported pricing), ending the quarter 90.9% above year-ago levels. Northern red oak prices increased 22.7% over the quarter and are 51.0% higher than year-ago levels. Hard maple prices increased 45.1%, ending the quarter up 66.0% year-over-year. Soft maple increased for the second consecutive quarter, rising 31.8% during the quarter, ending 47.1% above year-ago levels. White ash followed the upward trend of all the other species ending the quarter 15.9% above previous quarter values and 29.9% year-over-year.

In the Pennsylvania/New York region hardwood lumber and log demand remained strong throughout the third quarter. Domestic demand rolled on, driven by new home construction and remodeling of existing homes. Export demand slowed because of increased Covid outbreaks (particularly in China and Vietnam), shipping/transportation bottlenecks, and labor shortages. Economic weakness and uncertainties in China also weighed heavily on hardwood lumber and log exports. Red maple, hard maple, and white oak saw continued strong demand in the third quarter. Red oak, white ash, and tulip softened a bit while black cherry demand deteriorated the most. Sawmills were able to work down a considerable amount of their log inventories and stumpage which should help increase interest in stumpage in the fourth quarter and into early 2022. Hardwood pulpwood demand has increased somewhat this quarter but still hasn’t recovered to pre-Covid levels.

In Wisconsin, hardwood lumber and veneer log markets remained strong throughout the third quarter. There was continued strong interest in hard maple, yellow birch, basswood, and white ash lumber and logs. Domestic and export demand both helped keep sawmills and log buyers busy and profitable. Boltwood markets kept up their strong run as flooring demand saw no let up. Hardwood pulpwood demand ticked up slightly but, with an ample supply of pulpwood available to purchase, prices remained weak.

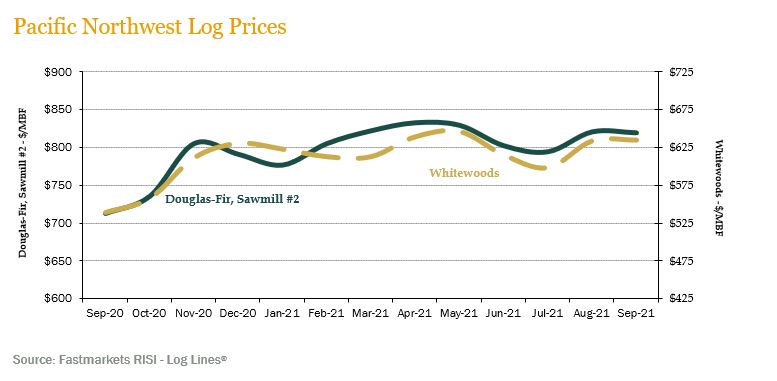

PACIFIC NORTHWEST — Pacific Northwest markets experienced increases in demand over the third quarter of 2021. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs increased 15% over the quarter, ending the quarter 2.1% below year-ago levels. Whitewoods (i.e., true firs and hemlock) average delivered log prices rose 17.8% and ended the year 3.2% above last year’s level.

Domestic sawlog prices have continued to flatten but overall remain at good levels. Domestically, there has continued to be an oversupply of logs and lumber has caused domestic log prices to fall when compared to second quarter. The average Douglas fir sawlog price is around $775/MBF. In the export market, China log exports have fallen back to levels below domestic sawtimber, averaging $675/MBF. Japan export continues to be a premium, averaging $950/MBF.

![]()

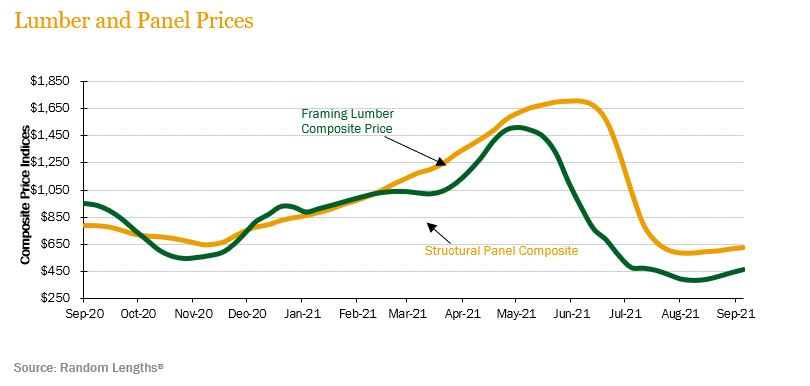

LUMBER AND PANELS — Lumber and panel prices decreased heavily over the quarter. The Random Lengths® Framing Lumber Composite Price decreased 49.6% over the quarter, ending the quarter 50.9% below last year’s level. The Structural Panel Composite Price decreased 63.3% over the quarter, ending 20.6% lower than year ago prices.

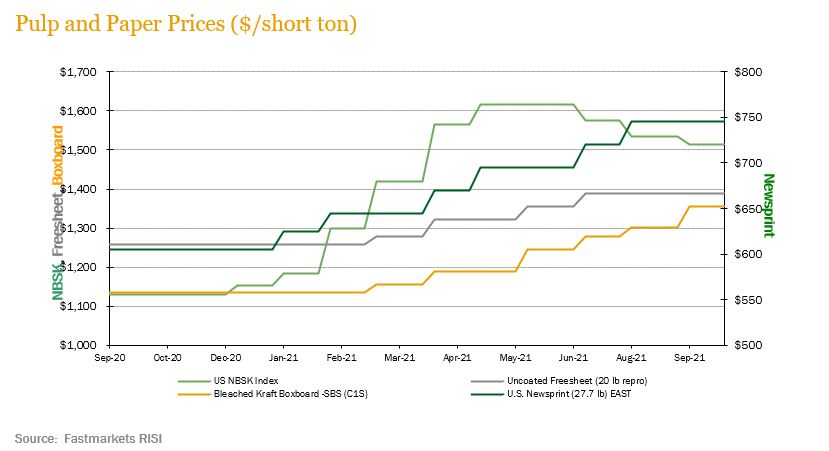

PULP AND PAPER — Pulp, paper and boxboard prices experienced varying changes over the third quarter. The benchmark NBSK (northern bleached softwood kraft) pulp price index decreased 6.2% over the quarter but remained 34.1% above year-ago levels. U.S. Newsprint (27.7 lb.) prices increase 7.2% over the quarter, falling 23.1% below last year’s level. Freesheet prices increased 2.4% and were 10.4% year-over-year. Boxboard prices saw high increases as well with an 8.8% increase over the year and 19.5% from the previous year.

![]()

TRANSACTIONS — The biggest news of the second quarter was CatchMark’s announcement that it sold 301,000 acres in Texas to Hancock for $498 million. The transaction, which was sold out of the Triple T joint venture, rings in as the largest of the year. Elsewhere in the South, Superior Pine Products has reportedly reached an agreement to sell over 70,000 acres in South Georgia to an undisclosed buyer for nearly $118 million. The deal is expected to close by year-end. Resource Management Service (RMS) sold a 17,000-acre package spanning from Alabama to North Carolina to two separate buyers for a total price of $32.6 million. IKEA is the reported buyer of the Alabama land, while the remainder was sold to a private buyer.

There was a flurry of transaction activity in the Pacific Northwest in the third quarter. Roseburg closed its sale of 59,600 acres in Oregon to Chinook Forest Partners for $152.4 million. SDS closed its sale of 96,000 acres in Oregon and Washington along with mill assets to a buyer group including Green Diamond, The Conservation Fund, and WKO for an undisclosed price. Sierra Pacific Industries (SPI) acquired privately-owned Seneca, along with its 175,000 acres and mill operations in Oregon for an undisclosed price. The deal represents SPI’s first purchase in Oregon. In California, New Forests announced the purchase of 156,000 acres from Fruit Growers Supply for an undisclosed price.

TRANSACTIONS IN PROGRESS — Investors continue to wait for word on several timberland offerings currently on the market in the South, Pacific Northwest, and the Lake States. Many of these offerings are taking bids in the fourth quarter. Investors will be closely monitoring the outcome of these transactions in the coming months. After a slow start to the year, deal activity for 2021 has already surpassed that of 2020 with a busy fourth quarter expected.

![]()

The third quarter of 2021 continued to be challenging and volatile. Yet among the day-to-day uncertainties, as we learn to live with COVID-19 as part of our daily lives, positive long-term momentum continues. An especially encouraging sign to pay attention to is that by the end of the quarter, more than a third of the world’s population (33.5%) had received full COVID-19 vaccination, up from only 8.1% at the end of the second quarter. And although global confirmed cases continue to be stubbornly high, hospitalization and deaths in countries with high vaccination rates are trending to be generally under control. This stabilization has allowed the world’s major economies to remain generally open even during the latest Delta-variant outbreak. The United States economic recovery continues with an expected expansion by end of 2021 of 5.9% according to projections from the Fed’s September meeting. The Chinese economy, one of the first countries to recover from the initial pandemic crisis, continues facing challenges with supply chain logistics and more conservative government spending, but is still targeting 2021 growth in the 6% range.

In the global forest sector, a recently published joint report in Australia by Master Builders Australia and the Australian Forest Products Association warns of possible lumber shortages for home building within the next fourteen years and urges emphasis on growing and improving the country’s plantation footprint to reduce reliance on imports.

In New Zealand, two European pension funds (APG and PPF) acquired a 62% stake in Wenita Forest Products which manages approximately thirty thousand hectares of forests. The remaining 38% is owned by a fund managed by New Forests.

CHILE — Chile’s strict management of the COVID-19 pandemic has yielded results which started to materialize during the quarter thanks to control measures and a vaccination program that has already reached 91.71% of the target population. Daily contagion rates are below 1,000 people per day, and PCR tests have positivity rates of less than 1%. Under this improved outlook, Chile has begun lifting quarantines and border control measures as the country reopens. The Chilean economy also continues surprising positively with experts now expecting GDP expansion by 11% for the year. However, these figures are accompanied by some alerts to pay attention to such as increasing inflation that has reached 5.5% in the last twelve months. This situation will probably drive the Central Bank to increase rates before the end of 2021. The country is also scheduled to go to the polls in November to elect a new president and twenty seven out of the fifty members of the Senate.

The forest sector in Chile is on trend to achieve in 2021 a significant recovery after the impact of the pandemic in 2020. This will mainly be driven by increases in the prices of pulp, boards, and moldings, together with growing appetite for Chilean forest products by China and the United States. These two countries, which are the main destinations for Chile’s forest exports, now jointly represent 54.2% of exports (up from 52.2% and 49.0% in 2019 and 2018 respectively). According to estimates by INFOR, Chile’s forestry institute, total forest shipments this year could reach $5.8 billion USD, a 17% increase versus the same period last year, but still lower than the record $6.8 billion USD exported during 2018. Best performers continue to be pulp, plywood, and moldings. Chile’s domestic demand for forest products also continues to show great dynamism in both volume and prices.

BRAZIL — Brazil made positive steps during the quarter in its efforts to contain the COVID-19 pandemic. It has reached 72% of its population with at least one shot of the vaccine, and 45% with two shots. It is currently also applying booster shots to both seniors and health care workers. Daily new cases (seven-day average) of 15,000 by end of the third quarter was a positive improvement versus the 48,000 at the end of the second quarter.

Despite the pandemic challenges, Brazil’s economy also showed positive signs with first half of the year growth (latest data available) of 6.4% versus the same period last year. Expectations for full 2021 GDP growth also improved to an estimated 5.2% which has favorably impacted local stock markets and foreign direct investments. During the quarter, Brazil’s COPOM increased interest rates by 100 basis points to 6.25%. Further increases are expected during the fourth quarter to end the year at 7.25% with aims to keep inflation for 2022 within expected bounds of 3.50%.

In the forest industry, Klabin began operations of the first stage of the Puma II project at their industrial unit in Ortigueira, in the state of Parana. This first step included the construction of a main fiber line to produce unbleached pulp integrated with a kraftliner paper machine and white top liner with 450,000 tons per year capacity. This production will be marketed under the Eukaliner brand and will be the world’s first kraftliner paper made from 100% eucalyptus.

Pulp markets although strong, continue slowly entering a slow down cycle with end of year price expectations forecasted in the USD 610 to 620/ton range (versus USD 650/ton in last forecast).

![]()

HOUSING — Single-family starts dropped 2.8% to a seasonally adjusted annual rate of 1.076 million units in August. The decline was, however, offset by a surge in starts for the volatile multi-family segment. As a result, overall housing starts advanced 3.9% to a rate of 1.615 million units.

MORTGAGE RATES — 30-year fixed rate mortgages have been increasing slightly, with average rates around 3.15% as of early October.

JOBS — Nonfarm payrolls rose by just 194,000 in September, compared with the Dow Jones estimate of 500,000. The unemployment rate fell to 4.8%, better than the expectation for 5.1% and the lowest since February 2020.

CONSUMER CONFIDENCE — U.S. consumer confidence dropped in September for a third straight month, suggesting concerns over the Delta variant and higher prices continue to dampen sentiment. The Conference Board’s index fell to 109.3 from a revised 115.2 reading in August. Economists in a Bloomberg survey had called for an increase to 115.0.

INFLATION — The Consumer Price Index rose 5.3 percent in August from a year earlier. That was a slightly slower annual pace than the 5.4 percent increase in July. On a monthly basis, price gains moderated to a 0.3 percent increase between July and August, down from 0.5 percent the prior month and a bigger slowdown than economists in a Bloomberg survey had expected. Price increases for key products — like cars — were beginning to moderate, helping to cool off overall inflation.

TRADE DEFICIT — The trade gap in goods and services expanded to $73.3 billion in August from $70.3 billion in July as the Delta variant of Covid-19 and supply constraints weighed on global trade. This is a record high, as American consumers continued to show a strong appetite for imported goods.

INTEREST RATES — The central bank’s most recent economic forecast for the next few years shows the Fed lifting U.S. interest rates next year by a quarter-point. Previously the Fed had indicated it would wait until 2023. The yield on the 10-year was just above 1.5% as of early October.

OIL PRICES — Oil prices were above $80 a barrel as of early October, the highest levels since October 2018. Prices climbed shortly after OPEC members recently opted against a big supply boost.

U.S. DOLLAR — The U.S. Dollar index started the quarter at around 94, up from 93 last quarter, reflecting the prospect of rising yields in the U.S. bonds market, and an anticipation of probable rate hikes at some point during next year.

![]()