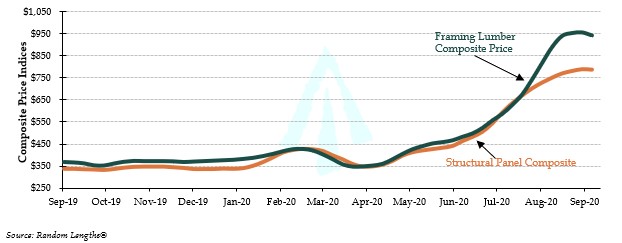

Summary Update — While the Pacific Northwest grapples with wildfire activity and the Gulf states recover from a very active hurricane season, all regions continue to deal with the effects of the COVID-19 pandemic. Strong housing starts combined with robust repair and remodel activity over the quarter propelled framing lumber and structural panels to all-time highs. The Random Lengths® Framing Lumber Composite Price increased a staggering 94.8% over the quarter. The overwhelming increase in lumber demand has not yet materialized into a noticeable increase in regional stumpage values.

Housing starts continued to rebound since the beginning of the pandemic. September housings starts were reported to be 1.415 million, which was 1.9% above the revised August rate of 1.388 million and 11.1% above the September 2019 rate of 1.274 million. Downward pressure on interest rates continued as the rate for a 30-year fixed rate mortgage declined in September, to an average of 2.89%.

Timberland Markets — The biggest news of the third quarter was Weyerhaeuser’s announcement that it had agreed to purchase 85,000 acres in northwest Oregon from Hancock for $426 million. In a separate transaction, Weyerhaeuser announced that it is also selling 149,000 acres in southern Oregon to Hancock for $385 million. The land Weyerhaeuser is acquiring is highly productive ground with older age classes, which should be accretive to the REIT’s cash flow. The transactions, which combine to form the largest deal of 2020, are expected to close in the fourth quarter. In other news, Lyme Timber has agreed to purchase 92,000 acres in Pennsylvania and New York from National Fuel Gas for a reported price of $116 million. This transaction is also expected to close in the fourth quarter. In the South, Green Diamond purchased 7,000 acres in Georgia from Rayonier for $13 million.

Timber Prices

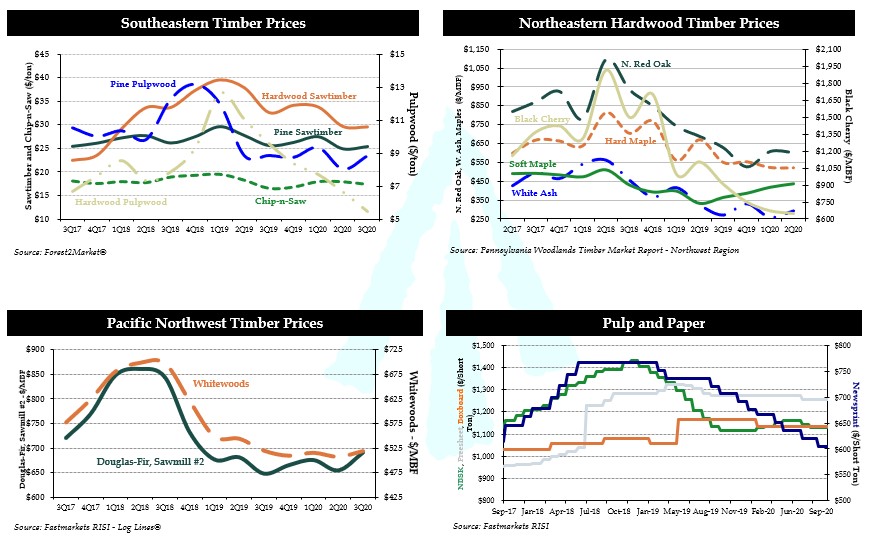

Southeastern — Timber markets in the Gulf region are rebounding from a very active hurricane season. Despite extremely high demand for lumber across the nation, demand for sawtimber across the South remains flat. Forest2Market® reported a 1.9% increase in Southern pine sawtimber prices over the third quarter of 2020. Sawtimber prices ended the quarter 0.8% below last year’s level. Pine chip-n-saw prices dropped 3.1% over the quarter, ending the quarter 5.1% above year-ago prices. Notably, pine pulpwood prices rebounded from last quarter, rising 10.1% over the quarter but remained down 0.2% year-over-year. Hardwood sawtimber and pulpwood prices retracted over the quarter, falling 0.34% and 17.95% respectively.

Southeastern Timber Prices

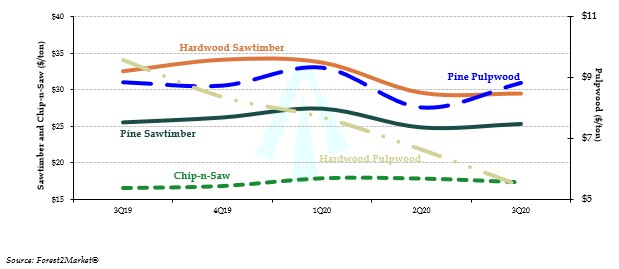

Northern Hardwoods — Hardwood demand remained low over the quarter despite signs of increasing demand. Until stronger domestic and export markets return, sawmills will continue to operate at lower levels which should help keep lumber inventories at a manageable level. According to the Pennsylvania Woodlands Timber Market Report, black cherry prices fell 3.5% during the second quarter (the most recent publicly reported pricing), ending the quarter 41.3% below year-ago levels. Northern red oak prices held flat, dropping 0.8% over the quarter. Hard maple prices showed very little change over the quarter, dropping 0.3% over the quarter. Soft maple increased for the fourth consecutive quarter, increasing 4.5% during the quarter, ending 31.6% above year-ago levels.

Hardwood demand in Wisconsin improved modestly in the latter part of the quarter as sawmills started preparing for the traditional fall inventory increase. Domestic lumber consumption helped increase sawlog prices on hard maple and kept basswood and birch stable. Veneer log demand held firm through the quarter with hard maple and basswood leading the way. Hard maple boltwood demand remained stable. Hardwood pulpwood markets continued to be weak as mills attempt to control excessive inventories.

Northeastern Hardwood Timber Prices

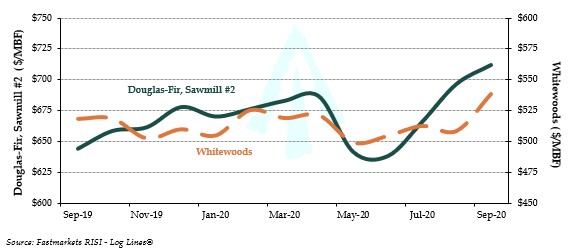

Pacific Northwest — Pacific Northwest markets showed marked improvement during the quarter. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs increased 11.5% over the quarter, ending the quarter 10.5% above year-ago levels. Whitewoods (i.e., true firs and hemlock) average delivered log prices improved 6.7% and ended the quarter 3.9% ahead of last year’s level.

Log inventories at domestic mills continued to drop over the quarter while lumber prices and subsequent log prices increased. Delivered log prices for Douglas-fir increased to levels above $750 per MBF in Washington and to levels above $800 per MBF in Oregon. The market for China export logs slid throughout the year and continues to stay well below the prices for domestic logs. Japan exports have followed domestic price trends, increasing in order to remain competitive and complete ship orders.

Pacific Northwest Log Prices

Product Prices

Lumber and Panels — Strong housing starts combined with robust repair and remodel activity propelled framing lumber and structural panels to all-time highs. The Random Lengths® Framing Lumber Composite Price increased a staggering 94.8% over the quarter, ending the quarter 156.4% above last year’s level. The Structural Panel Composite Price increased 69.4% over the quarter, ending 131.9% higher than year ago prices.

Lumber and Panel Prices

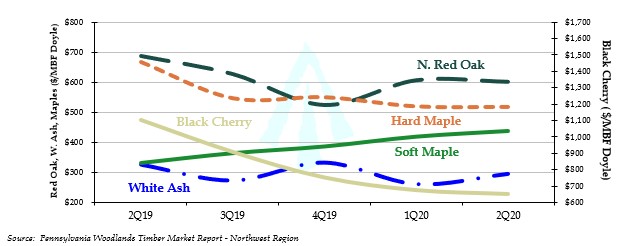

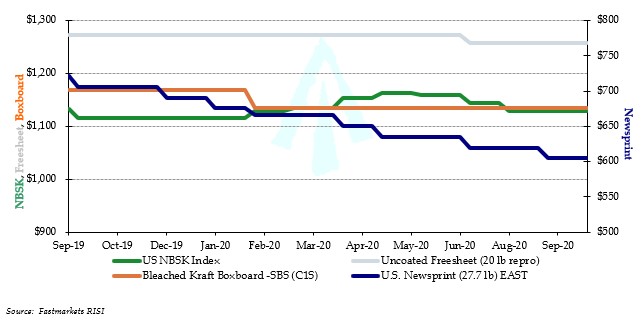

Pulp and Paper — Pulp prices retracted during the quarter, however paper and boxboard demand remained stable. The benchmark NBSK (northern bleached softwood kraft) pulp price index decreased 2.6% over the quarter, ending 0.3% below year-ago levels. U.S. newsprint (27.7 lb.) prices decreased 4.7% over the quarter, falling 16.1% below last year’s level. Freesheet prices dropped 1.3% over the quarter while boxboard prices remained unchanged.

Pulp and Paper Prices ($/short ton)

Timberland Markets

Transactions — The headline deal of the third quarter was Weyerhaeuser’s announcement that it had agreed to purchase 85,000 acres in northwest Oregon from Hancock for $426 million. In a separate transaction, Weyerhaeuser announced that it is also selling 149,000 acres in southern Oregon to Hancock for $385 million. The land Weyerhaeuser is acquiring is highly productive ground with older age classes, which should be accretive to the REIT’s cash flow. The transactions, which combine to form the largest deal of 2020, are expected to close in the fourth quarter. In California, Soper-Wheeler is reportedly under contract to sell 90,000 acres to an undisclosed buyer.

In the Northeast, Lyme Timber reached an agreement to purchase 92,000 acres in Pennsylvania and New York from National Fuel Gas for a reported price of $116 million.

Finally, in the South, Green Diamond purchased 7,000 acres in Georgia from Rayonier for $13 million.

Transactions in Progress — While the ongoing coronavirus pandemic has slowed transaction activity in 2020, deal flow is starting to pick up. In addition to the pending transactions mentioned above, there are several offerings on the market. Timberland Investment Resources is marketing a multi-state offering totaling 20,000 acres across the Southeast with bids due in the fourth quarter. Hancock is also taking fourth quarter bids on a 43,000-acre package in Georgia and Alabama. In the Northwest, Al Peirce Company is marketing 16,000 acres in Oregon. Despite the recent uptick in deal flow, 2020 is still on pace to be a below average year in terms of total transaction value.

International Update

It is impossible to ignore the impact of COVID-19 on so many people around the globe. Economically, certain components of the global economy continue to suffer the impacts of the virus while others remain relatively unaffected. The latter applies to global forest products markets where tissue and linerboard markets maintain strong performance while a robust housing market in the U.S. and near resumption of pre-virus wood demand out of Asia reinforce global wood flows.

Chile — The strict health and economic measures Chile implemented at the start of the pandemic are starting to bear fruit. At the end of the second quarter, Chile had 21,737 active cases, substantially down from the peak of over 73,000 active cases reached in early June. Importantly, with key indicators that track the spread of the virus, only 35 of Chile’s 345 municipalities remain under quarantine. More than half of Chile’s population is already in some form of gradual return to normal (Chile implemented a five-step process to get back to normal: 1. Quarantine Phase; 2. Transition Phase; 3. Preparing Phase; 4. Initial Reopening Phase and finally 5. Full Reopening Phase).

The Chilean economy is now expected to contract by 6% during 2020 according to the IMF’s most recent report, well above the 8.1% economic contraction that the IMF predicts for the Latin American region. For 2021, Chile’s economy is expected to expand by 4.5%.

The forest industry continues to operate as an essential activity under Chilean regulation. About 85% of the forest industry is operating steadily and adopting the appropriate health policies to avoid any breakouts of the virus. Headwinds on 2020 forest exports have been partially neutralized with a surprisingly robust, given the pandemic’s uncertainty, domestic market for forest products.

As of August, year-to-date forest exports were down 18.1% versus the same period a year ago although rebounded off the lows from earlier in the year. This downturn is mainly driven by global weakness in pulp prices of both pine and eucalyptus which represent 42% of Chile’s forest exports. Volume of pulp exports, for both pine and eucalyptus with price support have stabilized over the latter portion of the quarter.

Brazil — COVID-19 data have improved, but still represent challenges like most countries around the world. Daily cases are still running around 28,500 but showing continued reduction off peaks. Although less than previously estimated, the economic contractions in 2020 due COVID-19 are still significant with an IMF projected 2020 GDP of -5.8%. At the end of the second quarter, the BRL closed 3% lower at 5.64 per dollar. The Brazilian Central Bank further reduced the SELIC to an all-time low of 2.0%. Most activity in paper grades was reduced year-over-year; however, domestic and exported tissue consumption showed impressive gains of 5.7% and 26.3% respectively. Exported cardboard volumes increased 18.8% which is driven by the e-commerce/pandemic landscape.

Economic News

Housing — U.S. housing starts were slightly over 1.4 million in September, with single-family starts up 8.5% in a month, and up 22% year-over-year.

Mortgage Rates — As of mid-October, mortgage rates fell to a new record low, with the rates on a 30-year fixed rate mortgage at 2.8%, the lowest in the last 50 years.

Jobs — Job growth slowed in September, as employers added just 661,000 new jobs, with the unemployment rate dipping to 7.9% from 8.4% in August.

Consumer Confidence — Consumer confidence continues to improve but remains well below the levels seen before the coronavirus pandemic despite the rebound in housing and equity markets. The Current Conditions Index is down 26.5% from its December peak.

Inflation — In the 12 months through September, the CPI increased 1.4% after rising 1.3% in August.

Trade Deficit — The U.S. trade deficit climbed 5.9% in August to $67.1 billion, its highest level since August 2006. Exports rose 2.2% to $171.9 billion on a surge in shipments of soybeans, but imports rose more — up 3.2% to $239 billion — led by purchases of crude oil, cars and auto parts.

Interest Rates — The Federal Open Market Committee has vowed to keep interest rate near zero until inflation is on track to moderately exceed the central bank’s 2% target for some time. Fed officials also released projections showing they expected rates would stay near zero until the end of 2023 at least.

Oil Prices — Oil prices remained in the low $40s per barrel, as one of the hardest hit asset classes during the pandemic given the significant drop in demand, particularly for jet fuel.

U.S. Dollar — The U.S. dollar, as measured by the U.S. dollar index, stood around 93, having trended down over the last few months. The U.S. dollar is not expected to increase significantly in value so long as U.S. interest rates remain as low as they are.

The FIA Timber Economics “Quarterly Dashboard”