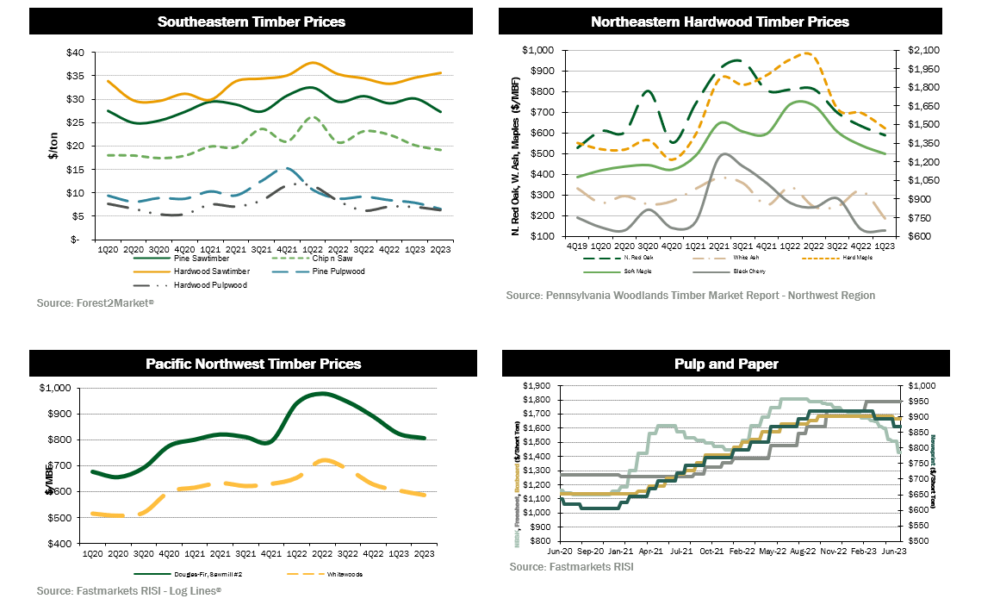

SUMMARY UPDATE — Log markets in the Pacific Northwest continued to soften due to high inventory. In the U.S. South, demand for all pine products decreased for the second consecutive quarter. Hardwood markets in the Northeast softened for most species due to a decrease in domestic and export lumber demand. Lumber and panel prices rose for the second consecutive quarter. Mortgage rates climbed throughout the quarter, ending around 7% for a 30-year, fixed rate. The housing market saw a strong surge during the middle of the quarter, only to fall again as rates increased toward the end of the quarter.

TIMBERLAND MARKETS — The second quarter was fairly quiet from a timberland transactions standpoint. Roseburg purchased a 5,100-acre property in North Carolina from Forest Investment Associates (FIA) for $10.7 million. Molpus also completed its sale of 13,200 acres in east Texas to a private buyer for an undisclosed price. Finally, FIA ran a successful sales process on a nearly 14,000-acre package in Georgia and Florida to a private buyer for an undisclosed price. While deal volume has been down in 2023 compared to last year, transaction prices remain strong. One noticeable trend has been fewer public sales processes but more private negotiations so far this year. Investors continue to wait for news on several long-running processes, and more offerings are poised to hit the market in the coming months.

![]()

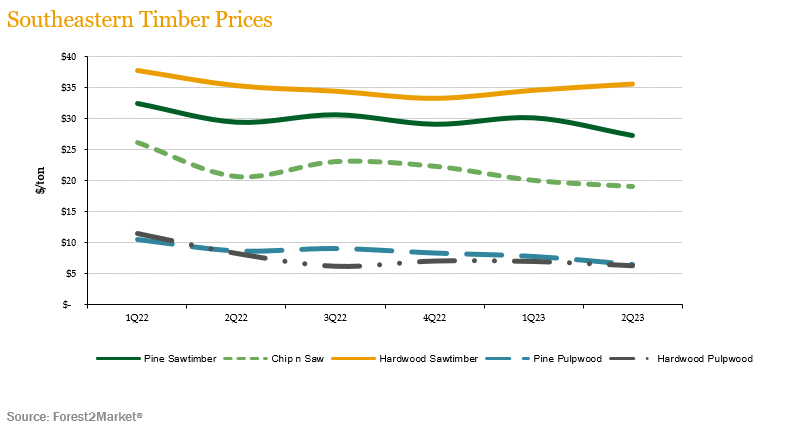

SOUTHEASTERN — Forest2Market reports an overall decrease in pricing for pine and hardwood sawtimber products, except hardwood sawtimber, in the U.S. South. Pine sawtimber fell 9.5% over the quarter and 7.4% year-over-year. Pine chip-n-saw prices fell 4.9% during the quarter and 7.8% for the year. Pine pulpwood prices fell 17.1% and ended the quarter 25.8% below last year’s level. Hardwood pulpwood fell about 9.8% during the quarter and finished 23.8% below last year’s level. Hardwood sawtimber experienced a modest increase of 2.9% during the quarter and 0.8% for the year.

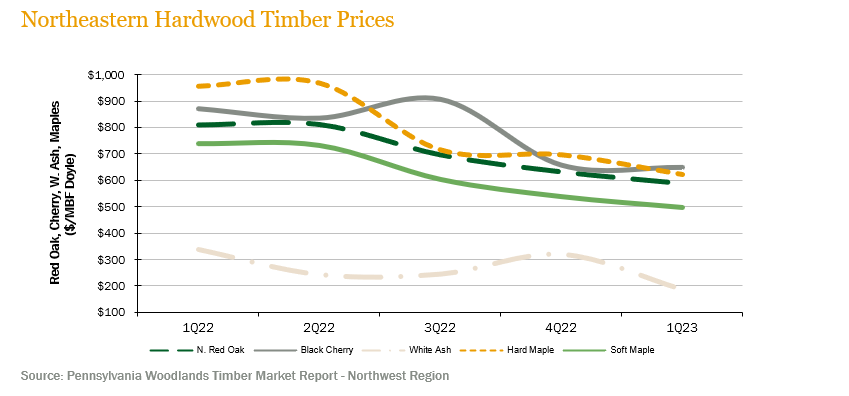

NORTHERN HARDWOODS — Demand generally softened across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices fell about 42.3% during the first quarter (the most recent publicly reported pricing) and ended the quarter 45.5% below year-ago levels. Soft maple prices fell 7.5%, and in conjunction, hard maple and red oak prices decreased 10.7% and 7.0%, respectively, over the quarter. In addition, black cherry prices fell 1.3%, a modest decrease compared to other species.

Hardwood lumber and log demand remained moderately strong for most of the second quarter but started to show signs of weakening just after Memorial Day. After a wet winter and spring, the weather turned warmer and drier allowing loggers to increase production dramatically. Sawmills welcomed the infusion of logs early in the quarter but soon found that there was not enough domestic and export lumber and log demand to consume the increased output. As a result, stumpage prices began to decline for red oak, soft maple, hard maple, and black cherry. White oak was the only outlier with prices remaining elevated. Pulpwood demand continued to weaken during the second quarter.

Hardwood markets in Wisconsin weakened throughout the course of the second quarter. Sawmills built up log inventories quickly because of improved logging conditions. Sawlog prices retreated while veneer prices and demand remained fairly strong. Boltwood demand was stable but with lower pricing. Similar to the Northeast, hardwood pulpwood markets continued to weaken.

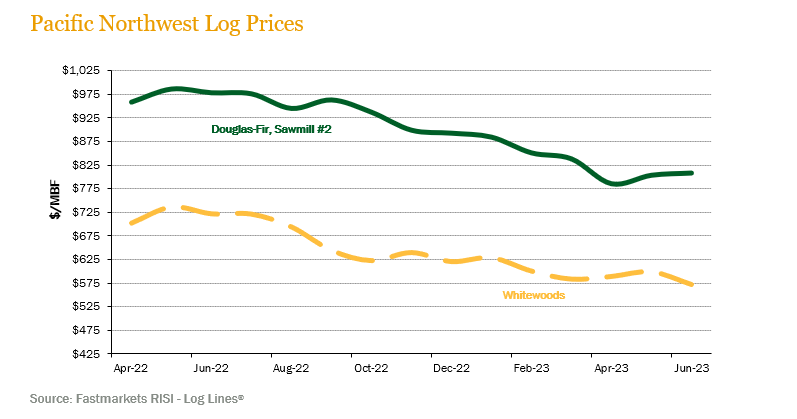

PACIFIC NORTHWEST — Pacific Northwest pricing continued to soften for the fourth consecutive quarter. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs decreased 2.1% over the quarter and 17.6% year-over-year. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices decreased 2.9% over the fourth quarter and 18.4% year-over-year.

Log markets continued to soften over the quarter. Similar to previous quarters, log inventories remained high at most domestic sawmills, and prices dropped slightly but remain comparable to those seen in the first quarter. Domestic prices for Douglas-fir are holding around $800/MBF, with prices reaching over $825/MBF in select log markets. Export demand from China remains similar to the first quarter with pricing averaging around $700/MBF for Douglas-fir and about $620 for whitewoods. Exports to Japan have fallen but remain competitive at $840/MBF relative to domestic pricing.

![]()

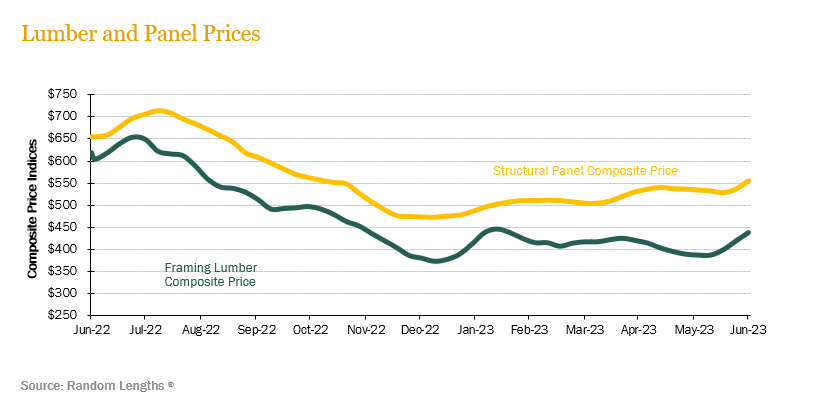

LUMBER AND PANELS — Lumber and panel prices increased for the second consecutive quarter. The Random Lengths® Framing Lumber Composite Price ended the second quarter up 5.0%; however, prices remain 29.2% below year ago levels. Structural panel prices increased 10.1%, remaining 15.3% below June 2022 levels.

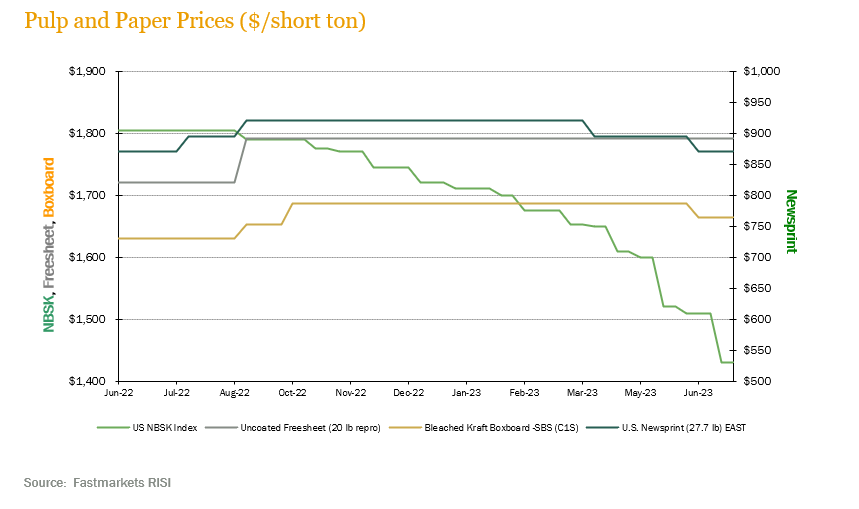

PULP AND PAPER — Demand for paper and paper products generally softened. The benchmark NBSK (northern bleached softwood kraft) pulp price index decreased 13.5% and ended the quarter 20.8% below year-ago levels. U.S. Newsprint (27.7 lb.) prices fell 5.4% over the quarter, resulting in no change year-over-year. Freesheet prices also remained flat during the quarter, ending 4.1% above last year’s level. Boxboard prices fell slightly, ending 2.0% above last year’s level.

![]()

TRANSACTIONS — In the South, three sales were notable. FIA’s closed a sale of 5,100 acres in North Carolina to Roseburg for $10.7 million, or nearly $2,100/acre. Molpus completed its sale of 13,200 acres in east Texas to a private buyer for an undisclosed price. Finally, FIA ran a successful sales process on approximately 14,000 acres in Georgia and Florida to a private buyer for an undisclosed price. The package, located in some of the strongest timber markets in the U.S. South, garnered healthy interest from prospective buyers.

TRANSACTIONS IN PROGRESS — Activity looks to rebound in the third quarter as several lingering offerings are scheduled to close in the coming weeks. There are also a handful of new offerings expected to hit the market prior to September. Overall, deal activity in 2023 is lagging the pace of last year when transaction totals eclipsed $5 billion.

![]()

The world continues to respond to macro forces not seen in in several decades. As many central bankers are slowing or pausing key overnight lending rates, there remain several areas of concern. Some economists suggest the current slowdown in inflation could be temporary as oil prices spiked meaningfully toward the end of the quarter, well above recent lows. General economic activity remains stable; however, China continues to exhibit a slow recovery and is operating well below trend GDP levels. Additionally, geopolitical risks are a constant in the background and at times, pushing to the foreground.

The forest products sector has had several notable developments. Firstly, our thoughts are with the Hawk’s Bay community of New Zealand as they deal with the aftermath of Cyclone Gabrielle. Some loss estimates have exceeded NZ$150 million of timber and infrastructure value. In market news, China decided to lift its quarantine and trade ban on log imports from Australia which has been in place since late 2020. As previously reflected, the ban significantly impacted the annual log trade into China, but many market observers doubt trade will resume at the same level due to the general malaise in the China market. General weakness in the China market is further demonstrated by PF Olsen’s log index currently sitting NZ $15 below the five-year average and well off prices observed in the early days of the COVID pandemic.

CHILE — Chile remains focused on keeping inflation in check but saw an opportunity to come off overly restrictive rates during the June 28th Monetary Policy Meeting, where the monetary policy interest rate was lowered by 100 basis points, to 10.25%. The decision was adopted unanimously by its members with some analysts calling a dovish tone. Subsequent minutes will be instructive.

The rate cut was supported by inflation indicators with June headline inflation falling to 7.6% and core inflation fell to 9.1% annually. The market’s two-year inflation expectation from both the Survey of Economic Expectations (EEE) and the Survey of Financial Operators (EOF) are at 3% supporting market belief in the central bank’s focus on achieving the inflation target. The labor market has not seen major changes from its previous trends, with an unemployment rate that remained at 8.5% in the quarter ending in June. Wages continue to rise in real terms. Consumer and business expectations remain pessimistic, although they have improved.

The 2023 constitutional process is underway as a new draft of the Political Constitution of the Republic of Chile is beginning after the affirmative “Rejection” of the constitutional plebiscite of 2022. The process will be carried out through three bodies: the Expert Commission, which will develop a preliminary draft of the constitutional text; the Constitutional Council which will approve and may modify the text; and the Admissibility Technical Committee, which will act as an arbitrator when there are requirements regarding proposals for regulations that could violate current regulations. The 2023 process appears to be staffed with more balance across stakeholders.

Forest products markets in Chile ended the first half of the year with nominal prices of the main products of radiata pine traded in the country decreasing when compared to March 2023. This decline is due to reduced demand for these products in the domestic market, resulting from lower economic activity in the country. The price of radiata pine sawlogs, delivered to sawmills in the Biobío region, dropped by 2.9%. Meanwhile, the price of radiata pine pulpwood, delivered to plants in the Maule and Biobío regions, decreased by 5.6%. Additionally, the price of sawn radiata pine, delivered to sawmills in the Biobío region and to warehouses in the Metropolitan Region, declined by 2.2% and 3.1%, respectively. General market softness from domestic as a well as Asian markets has contributed to these price trends.

BRAZIL — As Lula’s administrative agenda continues to take shape, details of potential tax reform in Brazil are becoming clearer although the certainty of the final shape still remains unclear. Brazil’s lower house is expected to approve the main structure of the country’s complex consumption taxes. If approved, the bill moves to the Senate where two rounds of votes will occur. One of the main features of the reform is the creation of a Value Added Tax (VAT) to replace five different federal and regional taxes and is expected to simplify several aspects of the Brazilian tax code.

Inflation over the past 12 months has moderated at 3.16% and the year-to-date settled in at a lower level of 2.17%. With inflation expectations in check, the market expects cautious rate cuts. With the expected rate cuts, the BRL has appreciated 5.15% over the quarter. Broader costs of energy, fertilizers, and other important inputs have stabilized and are far removed from 2022 volatility.

While year-over-year pulp production increased 2.6% with pulp exports increasing 12.9%, the general outlook consensus is that pulp prices will continue to remain under pressure given China’s slower activity. It is conceivable that Brazilian pulp producers will continue to take market share from higher cost producers. Evidence of this is taking place in North America, where with capacity rationalization is ongoing in the current pricing environment.

It is notable that wood panel exports are down 38.3% versus last year, largely from the strengthened BRL, reduced Asian demand and a moderation in the U.S. softwood log prices for smaller diameter products have come under pressure in virtually every market while larger logs have been flat in general. The market is clearly integrating the new BRL position and demand cycle. Eucalyptus logs across most main markets continue to be in demand and see price increases over the past 12 months.

![]()

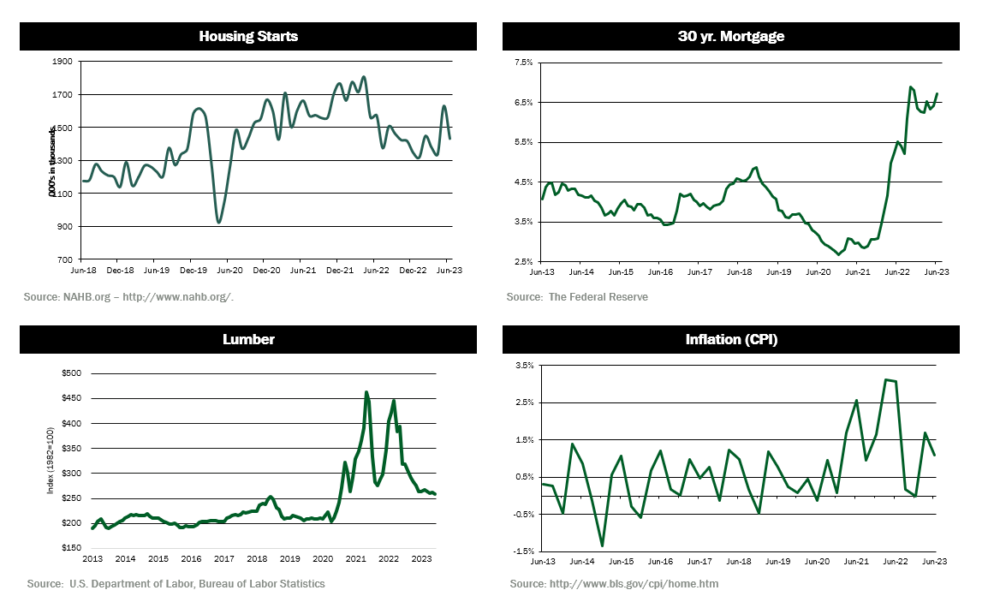

HOUSING — New home construction fell 8% in June to a 1.43 million annual pace, down from 1.56 million in May. Building permits, a sign of future construction, fell 3.7% to a 1.44 million rate.

MORTGAGE RATES — Average 30-year mortgage rates ended the quarter around 7%, up approximately 25 basis points from the beginning of the quarter.

JOBS — Nonfarm payrolls increased 209,000 in June, below the consensus estimate for 240,000. The unemployment rate was 3.6%, down 0.1 percentage point, though a more encompassing unemployment rate that includes discouraged workers and those holding part-time jobs for economic reasons rose to 6.9%, the highest since August 2022. Wages rose 4.4% from a year ago, slightly higher than expectations.

CONSUMER CONFIDENCE — The consumer confidence index jumped in June to 109.7 (from 102.5 a month earlier), its highest level in 18 months as a strong labor market continues to buoy the U.S. economy.

INFLATION — The consumer price index rose 0.2% in June and was up 3% from a year ago, the lowest level since March 2021. Excluding food and energy, core CPI increased 0.2% and 4.8%, respectively.

TRADE DEFICIT — The U.S. trade deficit in goods narrowed in May as imports fell, but the improvement was probably insufficient to prevent trade from being a drag on economic growth in the second quarter. Imports dropped 2.7% to $254.0 billion. While the decline in imports helped shrink the deficit, it suggested that domestic demand was softening. The drop was led by a 7.3% plunge in consumer goods imports.

INTEREST RATES — After pausing in June, the United States Federal Reserve is widely expected to hike interest rates again, adopting its most restrictive monetary stance for 22 years despite recent signs of slowing inflation. After 10 consecutive hikes in just over a year, the Fed halted its aggressive campaign of monetary tightening last month to give policymakers more time to assess the health of the U.S. economy, and the impact of recent banking stresses on lending conditions.

OIL PRICES — Oil ended the second quarter at around $75 a barrel, though prices have climbed north of $80 as of late July.

U.S. DOLLAR — The U.S. dollar index ended the second quarter around 103.

![]()