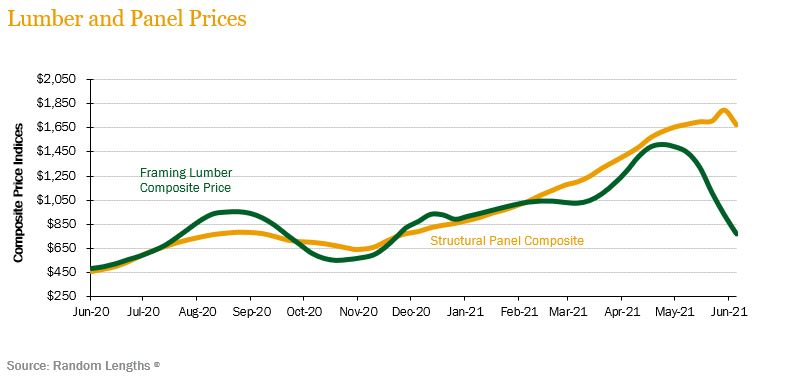

SUMMARY UPDATE — Overall log prices continued to see increases in the second quarter. Lumber and panel prices increased compared to where they were a year ago. The Random Lengths® Framing Lumber Composite Price ended the quarter down 25% and prices were 60% above what they were a year ago.

May housing starts were reported to be 1.572 million, which was 3.6% above the April rate of 1.517 million, and 50.3% above the May 2020 rate of 1.046 million. Interest rates for 30-year fixed mortgages varied over the quarter, resulting in an average rate of 3.00%.

The trend of more intense weather patterns across the U.S. continued through the quarter, characterized by intense heat in the western U.S., including across the Pacific Northwest, portending the start of fire season earlier than normal.

TIMBERLAND MARKETS — The biggest news of the second quarter was CatchMark’s announcement that it had agreed to sell 18,063 acres in coastal Oregon to Roseburg Resources for $100 million. The deal, which rings in at a strong valuation of $5,536/acre, is set to close in the third quarter. CatchMark had recently acquired the property from Forest Investment Associates in 2018 for $4,917/acre. The Pacific Northwest market was very active in the second quarter, with three additional contracted transactions totaling over $350 million. Several offerings are on the market in the South, Pacific Northwest, and Lake States with bids expected in the third quarter.

![]()

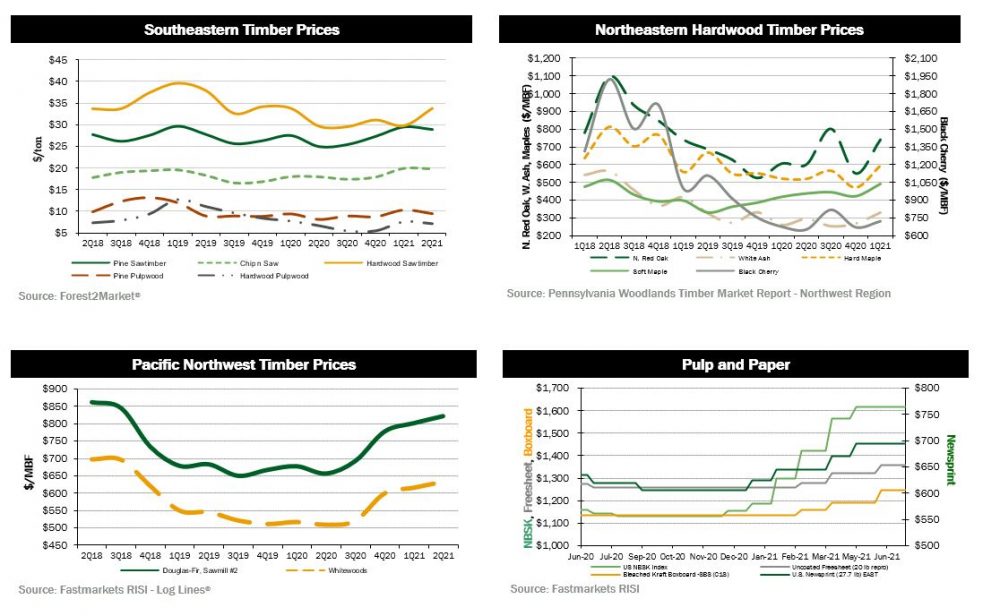

SOUTHEASTERN — In the South, all major pine products saw slight decreases in reported stumpage prices. Forest2Market® reported a 2.0% decrease in Southern pine sawtimber prices over the second quarter of 2021; prices ended the quarter 15.9% above last year’s level. Pine chip-n-saw prices held relatively stable, dropping only 0.6% over the quarter, ending at 10.1% above year-ago prices. Pine pulpwood prices fell 8.5% even though prices were up 17.0% from the previous year.

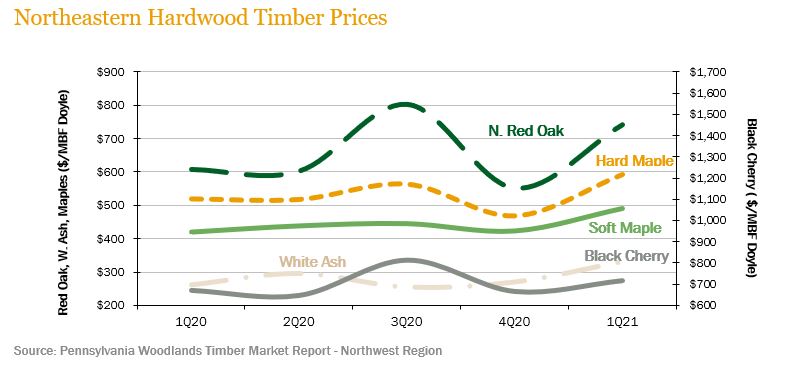

NORTHERN HARDWOODS — Hardwood markets rebounded in the first quarter of 2021. According to the Pennsylvania Woodlands Timber Market Report, northern red oak prices rose 34.5% during the first quarter (the most recent publicly reported pricing), ending the quarter 22.1% above year-ago levels. Black cherry prices increased 7.6% over the quarter. Hard maple prices rose 26.4%, ending the quarter up 14% year-over-year. Soft maple increased as well, rising 16.1% during the quarter, ending 17% above year-ago levels.

In Pennsylvania and New York, hardwood lumber and log demand continued to be strong throughout the second quarter both on the domestic and export fronts. White oak, hard maple, red maple, red oak, white ash, and black cherry were all favored species. For the first couple of months during the quarter, sawmills went on a buying spree to replenish depleted log inventories. By Memorial Day, many mills were full with logs/stumpage but were continuing to experience trouble finding the labor to make the lumber, trucks to haul it, and/or containers and ships to export it. Interest in available stumpage slowed and offering prices softened during June. There is currently plenty of domestic and export demand that is not expected to decrease any time soon. The bad news is that it looks like it is going to take a while before sawmills and log exporters can catch up to this insatiable demand. Hardwood pulpwood demand remained lackluster.

Wisconsin hardwood lumber and veneer log markets remained strong throughout the second quarter. Hard maple, yellow birch, and basswood lumber and logs were all in strong demand as the domestic and export end users couldn’t seem to get enough material to satisfy their needs. Boltwood markets continued their strong performance as the continued rapid pace of new home construction and remodeling kept flooring demand high. Hardwood pulpwood demand continued to be weak.

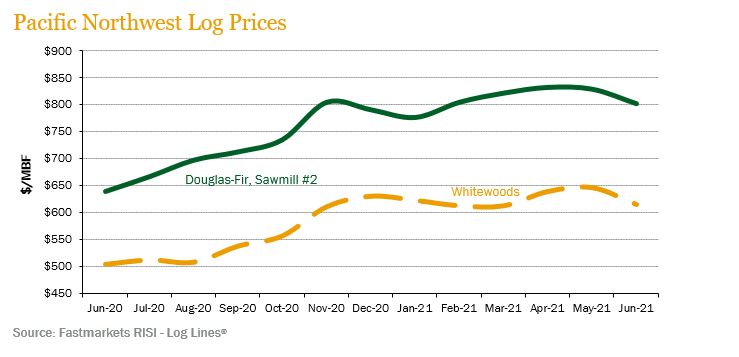

PACIFIC NORTHWEST — Pacific Northwest markets experienced increases in demand over the second quarter of 2021. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs decreased 2.4% over the quarter, ending the year 25.6% above year-ago levels. Whitewoods (i.e., true firs and hemlock) average delivered log prices increased 0.4% and ended the quarter 21.8% ahead last year’s level.

PNW domestic sawlog prices have continued to flatten over the second quarter but overall remained at very good levels. Domestically, log prices continue to be suppressed by the large amounts of salvage volume in Oregon and has held average Douglas-fir log prices near $800/MBF, with the value of salvage initially dropping in the 5-7” chip-and-saw and smaller diameter logs where bark has burned through and has caused sapwood to check. This will continue to work its way into the larger diameters as we have seen record high weather temperatures in both Oregon and Washington. The export market is still the bright spot in Washington. Western hemlock prices exported to China are now $750/MBF, which has put pressure on the domestic market in the “fringe” areas that are near ports of entry. Japan export continues to follow the highest rising domestic price trends to remain competitive.

![]()

LUMBER AND PANELS — Lumber prices declined over the quarter while panel prices increased. The Random Lengths® Framing Lumber Composite Price decreased 25% over the quarter, ending the quarter 59.4% above last year’s level. The Structural Panel Composite Price increased 39.1% over the quarter, ending 260.6% higher than year-ago prices.

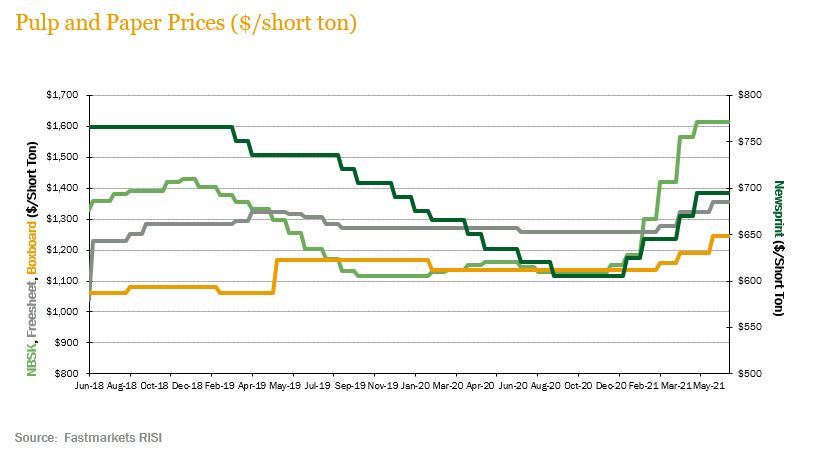

PULP AND PAPER — Pulp, paper and boxboard prices increased over the second quarter. The benchmark NBSK (northern bleached softwood kraft) pulp price index increased 13.7%, ending the quarter 39.2% above year-ago levels. U.S. Newsprint (27.7 lb.) prices increased 7.8% over the quarter, ending 9.4% above last year’s level. Freesheet prices increased 6.0% over the quarter, ending 6.5% above last year’s level and boxboard prices increased 7.7% over the quarter, ending 9.8% above last year’s level.

![]()

TRANSACTIONS — The biggest news of the second quarter was CatchMark’s announcement that it had agreed to sell 18,063 acres in coastal Oregon to Roseburg Resources for $100 million. The deal, which rings in at a strong valuation of $5,536/acre, is set to close in the third quarter. CatchMark had recently acquired the property from Forest Investment Associates in 2018 for $4,917/acre. In Washington, Weyerhaeuser announced an agreement to sell 145,000 acres to Hampton for $266 million. The property, which is largely comprised of high-elevation tracts in the North Cascades range, was part of Weyerhaeuser’s acquisition of Longview Timber in 2013. In western Oregon, Seneca reached an agreement to purchase 7,700 acres from Campbell Global for $57 million. The $7,402/acre price further signals strength in Pacific Northwest valuations. Finally, Rayonier has reportedly reached an agreement to sell two packages in western Washington totaling 22,700 acres to two separate buyers for an undisclosed price.

In the South, Weyerhaeuser closed its previously announced acquisition of 69,200 acres in Alabama from Soterra for a total of $149 million. MEAG, a large German investor, announced that it had closed on the purchase of a 150,000-acre package spanning multiple Southern states for an undisclosed price. The land, part of the original CalPERS Paramount portfolio, was managed by Campbell Global and transferred internally.

TRANSACTIONS IN PROGRESS — Investors continue to wait for word on several timberland offerings currently on the market in the South, Pacific Northwest, and the Lake States. Many of these offerings are taking bids in the third quarter. Investors will be closely monitoring the outcome of these transactions in the coming months. After a slow start to the year, deal activity continues to pick up in 2021.

![]()

During the second quarter of 2021, progress achieved thanks to swift vaccine deployment in developed economies such as the US and some European countries was dampened by the emergence of new COVID-19 variants that are more contagious, combined with slow vaccination programs in the rest of the world. This is generally seen as a real threat to maintaining momentum of the global economic recovery. Yet given the global shock to supply chains, as well as higher levels of liquidity in the hands of retail consumers thanks to savings and government support programs, inflation has begun to increase in the medium term. For example, in the US, during their June meeting, the Fed projected robust real GDP growth of 7.0% year over year for 2021; but additionally forecasted inflation in the US to reach 3.4%. Under this scenario, market experts now expect two rate hikes to the federal funds rate to happen in 2023.

In the second quarter the global forest products sector continued to show vitality even through the volatility of the global pandemic. A major announcement during the quarter was the acquisition of Campbell Global by J.P. Morgan as part of the bank’s strategy to position itself in the sustainability and carbon markets. This follows a global trend that includes major global corporations that are promising to reduce their carbon footprints and for whom the timber investment industry clearly presents a unique opportunity.

The Australian structural softwood product markets continued to show vigorous price increases with quarterly increases ranging from 3.3% to 6.0% within different products of solidwood and panels.

In New Zealand, the price of NZU’s (New Zealand’s carbon credits which are equivalent to 1 tonne of carbon dioxide) were trading at $37 during early June (up from approximately $24 during the first half of 2020) and continued spiking by almost 24% to $46 early after quarter close.

CHILE – During the second quarter of 2021, the COVID-19 pandemic continued to pose challenges in Chile. On the positive side, over twelve million people, almost 85% of the target population and 68% of the country’s total population, have already received at least one vaccine shot; and approximately 74% of the target population has completed their vaccine prescription (either one or two shots). But on the negative side, as the South American winter began and cases of new more infectious variants such as the Delta variant reached Chile, the government had to impose a new strict quarantine that lasted from mid-March until the end of the quarter and only began to slowly be lifted early July. The country’s borders continue closed except for some exceptional situations. Thanks to income-support measures for individuals and better adaptation of firms and households to the new pandemic dynamic, Chile’s economy has outpaced expectations. During their June Monetary Policy Report, Chile’s Central Bank raised its projected GDP growth for 2021 from 8.5% to 9.5% and raised its annual inflation projection to 4.4%. Midterm elections were finally held during May which included the election of the group that will draft Chile’s new constitution. This group held their first work session a few days after the end of the second quarter.

During the first half of the year Chile’s forest sector rebounded strongly from the pandemic related volatility of 2020 with exports of forest products of 2,603 million USD representing an 8.5% growth versus the same period last year. The main drivers for the strong results of Chile’s forest exports were stronger global pulp prices and increased demand for products such as wood panels and moldings. China and the United States continue to be the main destinations. Domestically, the construction sector has signaled concerns of shortages and increased costs for materials including lumber. Increased domestic demand for wood construction products has been driven by the income-support measures put in place in response to the pandemic.

BRAZIL – During the quarter Brazil continued to struggle with the COVID-19 pandemic, sinking into a deep second wave of virus cases with 19 million confirmed cases (18.8 million recovered) and a seven day average of approximately 48,000 new cases. ANVISA, the Brazilian government’s official entity responsible for vaccine approvals has given the green light already to four different vaccines, which helped boost the vaccination rate toward the latter part of the quarter. Almost 39% of Brazil’s population has received at least one dose of the vaccine.

On the economic front, first quarter GDP growth (latest data available) beat expectations and showed the Brazilian economy’s resilience to the pandemic and lifted 2021 growth expectations to 4.6%. In their latest COPOM meeting, the Brazilian interest rate was increased by 150 bps in two lifts to reach 4.25% with additional lifts expected during the rest of 2021 for a projected end of year rate of 6.25%. This monetary tightening is aligned with aims to make sure inflation during 2022 remains within the target of 3.5%.

In the forest industry, major announcements were made by Suzano whose board of directors approved the construction of a new pulp mill with 2.3 million tons capacity for bleached eucalyptus kraft pulp. This will require an almost fifteen billion BRL investment on behalf of the company with a target start of operations for the first quarter of 2024. Once the mill, which will be in Ribas do Rio Pardo, MS comes online, it will increase the company’s production capacity by 20%. An unrelated announcement was also made by Bracell (RGE) who announced the startup of its new plant in Sao Paulo for August of the present year with a capacity of 1.25 million tons of dissolving and market pulp (flexible).

Pulp price expectations are being adjusted to USD 650/ton (versus USD 670/ton previous forecast) with further softening during the period of 2022 to 2024 to a range of USD 550/ton given recent industry capacity addition announcements.

![]()

HOUSING — May housing starts rose 3.6% above the revised April estimate to an annual, seasonally adjusted rate of 1,572,000. The rate was 50.3% above the year-ago pace of 1,046,000.

MORTGAGE RATES — 30-year fixed rate mortgages ended the second quarter around the 3% mark.

JOBS — Nonfarm payrolls increased in June by 850,000 for the month, compared with estimates of closer to 700,000 and better than the upwardly revised 583,000 in May. The unemployment rate, however, rose to 5.9% against the 5.6% expectation.

CONSUMER CONFIDENCE — U.S. consumer confidence reached a fresh pandemic high with the Conference Board’s index increasing to 127.3 from an upwardly revised 120 reading in May.

INFLATION — The CPI jumped 0.9% in June, the largest one-month increase in 13 years, with prices up year-over-year by 5.4%, the biggest jump in annual inflation in nearly 13 years. The so-called core CPI also rose 0.9% in June and 4.5% over the last 12 months, representing the biggest 12-month increase in that closely watched measure in 30 years.

TRADE DEFICIT — The U.S. trade deficit widened in May to $71.2 billion as a small increase in exports was offset by a bigger rise in imports. The U.S. trade deficit had hit a monthly record of $75 billion in March.

INTEREST RATES — Yields on U.S. government bonds reached multi-month lows in early July, with the 10-year reaching nearly 1.25%, reflecting investors’ anxiety about the economic outlook and new concerns about the Delta variant of Covid-19.

OIL PRICES — Oil prices increased substantially over the quarter, reaching above $75 per barrel in early July, the highest price since November 2014.

U.S. DOLLAR — The U.S. Dollar index started the quarter at close to a 3-month high of nearly 93.

![]()

![]()