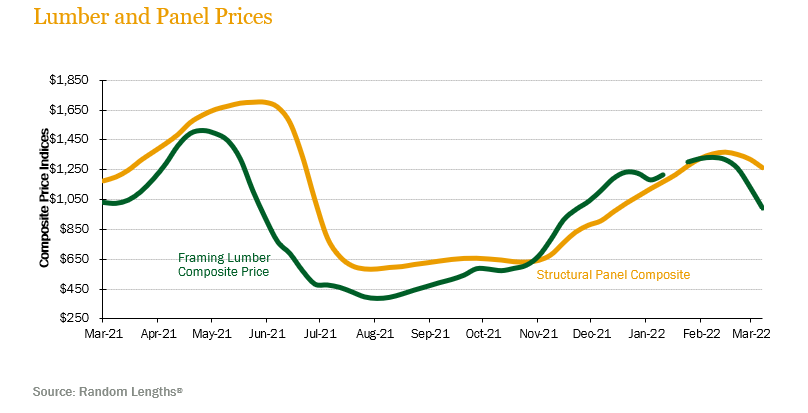

SUMMARY UPDATE — March housing starts rose to a multi-month high at 1.683 million, which was 0.1% above the February rate of 1.682 million, and 2.4% below the March 2021 rate of 1.725 million. Interest rates for 30-year fixed mortgages continued to increase over the first quarter of 2022, resulting in an average rate of 3.79%. Lumber prices retracted during the quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter down 4.7%. Panels, on the other hand, ended 50.4% higher and remained above year-ago levels (16.5%).

TIMBERLAND MARKETS — Timberland transaction markets remained strong in the first quarter, continuing the robust deal flow of 2021. All major timberland regions had transaction activity during the quarter, headlined by two large Southern transactions totaling over $240 million. Rayonier purchased 66,800 acres in Texas and Georgia from Nuveen (formerly Greenwood) for $124.2 million, while Potlatch purchased 51,300 acres in Arkansas and Louisiana from private seller Loutre for $118.5 million. Investors continue to monitor the status of two pending large-scale timberland offerings in the South totaling over 360,000 acres. The value of the pending transactions could total as much as $900 million, signaling continued strong timberland valuations.

![]()

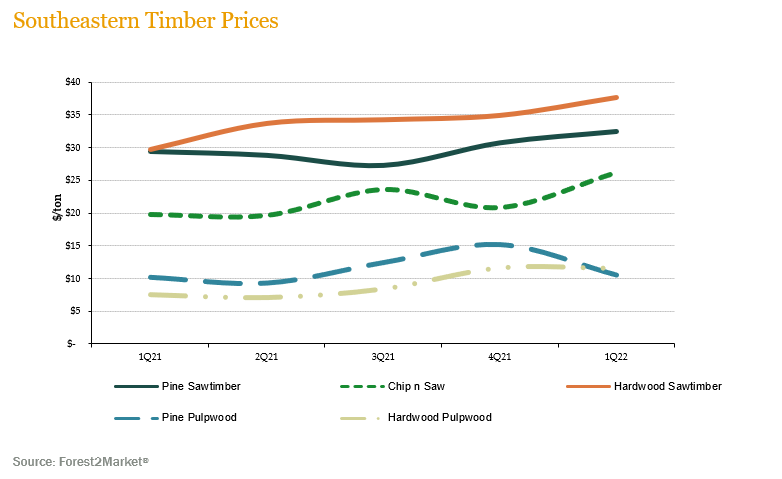

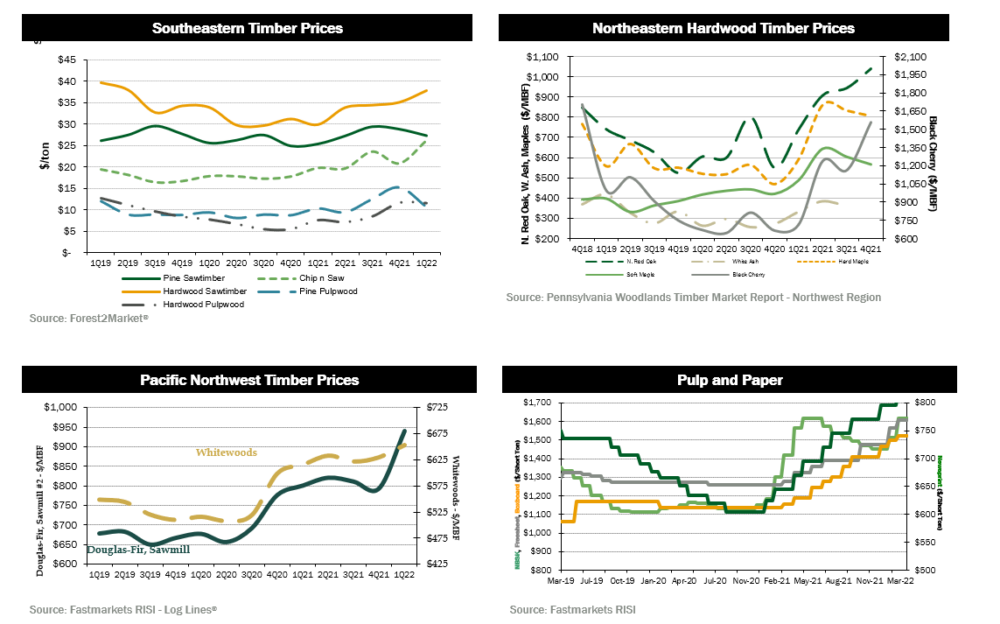

SOUTHEASTERN — Demand for southern pine timber products generally increased over the first quarter. Timber Mart-South reported marked increases for both sawtimber and chip-n-saw of 5.6% and 25.4% respectively. Pine pulpwood saw a substantial decrease over the quarter (down 30.4%) but remained up (3.4%) compared to year-ago levels. Both pine chip-n-saw and sawtimber remained above year-ago levels (32.1% and 10.3% respectively).

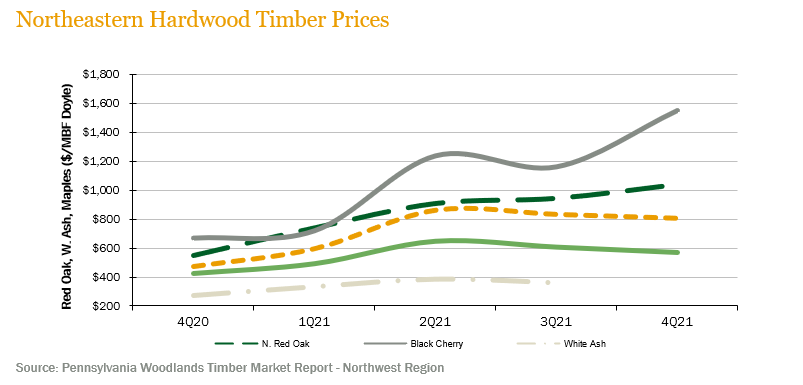

NORTHERN HARDWOODS — In the Pennsylvania wood markets, certain key species increased in demand. According to the Pennsylvania Woodlands Timber Market Report, black cherry increased 33.7% during the fourth quarter (the most recent publicly reported pricing), ending the quarter 132.7% above year-ago levels. Northern red oak also saw an increase over the quarter (10.1%) ending 88.6% above year-over-year levels. Both soft and hard maple saw a minimal decrease during the quarter (-6.2% and -3.3% respectively) but ended higher year-over-year.

Pennsylvania & New York – Hardwood lumber and log markets remained strong throughout the quarter in Pennsylvania and New York. Domestic demand showed little sign of abating as home construction and remodeling continued on a strong pace despite higher inflation numbers. Labor shortages and transportation issues continued to be a drag on domestic lumber/log production and delivery. Export demand finally showed a noticeable increase this quarter but slipped somewhat to China after new Covid lockdowns were announced there. Shipments to other Pacific Rim countries, Europe, and the Middle East were solid despite the continued transportation, shipping, and labor shortage problems. White oak, red maple, sugar maple, red oak, tulip poplar, and white ash were all in high demand both domestically and internationally while export demand for black cherry increased modestly. Domestic demand for black cherry remained low. Hardwood pulpwood markets were stable throughout the quarter.

Wisconsin – There was no let-up in the strong demand for hardwood lumber and logs that has persisted throughout the fall/winter months in Wisconsin. Sawmills and veneer log buyers scrambled to procure enough logs to build inventory for the coming Spring logging shutdown. There was continued strong US and Canadian demand for hard maple, white ash, birch, and basswood lumber and logs. Boltwood demand remained solid courtesy of a healthy flooring industry. Hardwood pulpwood markets were stable.

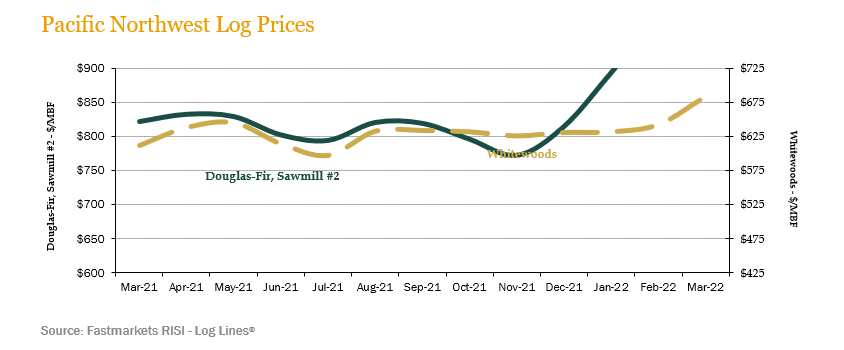

PACIFIC NORTHWEST — Pacific Northwest markets continued to experience increased demand into the first quarter of 2022. Log Lines® reported that average delivered prices for Douglas fir #2 logs increased 17.6%, ending the quarter 16.5% above year-ago levels. Whitewoods (i.e., true firs and hemlock) average delivered log prices increased by 8.4% compared to the previous quarter and ended at 11.8% ahead of last year’s level.

Favorable spring weather and all-time high sawlog prices created a sharp increase in log sales and purchasing, and domestic sawmill inventories increased rapidly (some to storage capacity) in the quarter causing log prices to flatten and drop slightly from those seen late in 2021. A rise in domestic log supply following very high prices and favorable spring weather has caused inventories to rise among domestic sawmills. Average domestic Douglas fir sawlog prices are now currently around $900/MBF, with prices still reaching over $1,000/MBF in some Oregon log markets. China log exports have followed domestic sawtimber, now averaging $800/MBF. Japan export also continues to be a premium, averaging $1,300/MBF.

![]()

LUMBER AND PANELS — Lumber and panel prices retracted in the first quarter of 2022. The Random Lengths® Framing Lumber Composite Price ended the quarter down 4.7%. Panels, on the other hand, ended the quarter up 50.4% and remained above year-ago levels (16.5%).

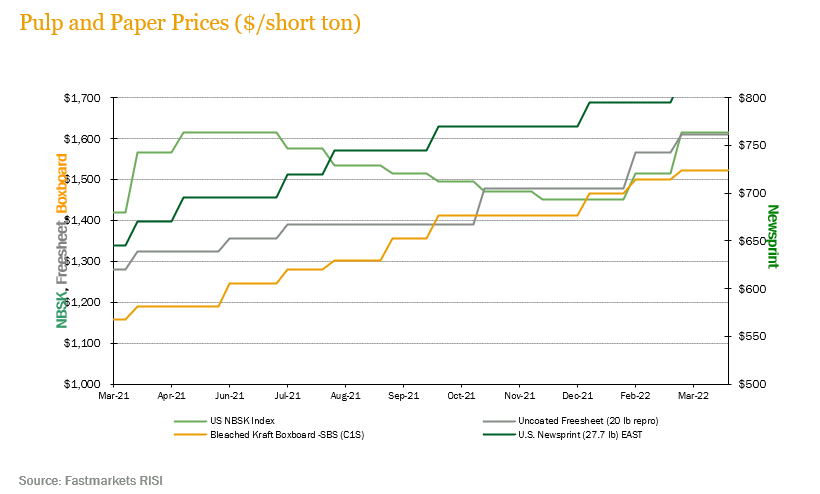

PULP AND PAPER — Newsprint, freesheet, and boxboard had positive changes over the first quarter. The benchmark (northern bleached softwood kraft) pulp price index decreased 3% over the quarter, ending 22.4% above year-ago levels. U.S. Newsprint (27.7 lb.) prices increased 3.2% over the quarter, ending 27.2% below last year’s level. Freesheet increased by 6.3% and is above year ago values at 17.5%. Boxboard prices increased 3.9% over the quarter and ended 29.2% above previous year levels.

![]()

TRANSACTIONS — In the South, the biggest news of the first quarter was Rayonier’s reported purchase of nearly 67,000 acres of timberland in Texas and Georgia from Nuveen (formerly Greenwood) for $124.2 million. Potlatch also completed its purchase of 51,300 acres in Arkansas and Louisiana from private seller Loutre for $118.5 million. In South Georgia, Langdale purchased 41,100 acres of privately held timberland from Sessoms for a reported price of $73.8 million. The price reached nearly $1,800/acre despite the young age-class profile of the forest and an existing easement on a portion of the property, an indication of strength in Southern timberland markets.

In the Pacific Northwest, Manulife (formerly Hancock) sold a 9,340-acre package in Oregon to Hampton for $55.1 million. Manulife also sold 4,200 acres in Washington to Weyerhaeuser for $17.8 million. The two deals further the recent trend of strong valuations by industrial buyers in the region. Also in Washington, Hampton sold nearly 51,000 acres to Chinook for a reported price of $94 million. The acreage was part of Hampton’s larger 145,000-acre purchase from Weyerhaeuser in mid-2021. Finally, Campbell Global closed its sale of 12,000 acres in Washington to a private buyer for $44 million.

In the Lake States, Keweenaw Land Association reportedly sold its 180,000-acre offering located primarily on the Upper Peninsula of Michigan to The Rohatyn Group (formerly GMO) for $181 million. In Pennsylvania and New York, FIA purchased 39,000 acres of high-quality hardwoods from a private seller for an undisclosed price. Carbon-focused investor Blue Source reportedly purchased two timberland packages in New York totaling over 52,000 acres for a combined price of $17.2 million from TIMO players Molpus and Forestland Group.

TRANSACTIONS IN PROGRESS — Investors continue to wait for word on several large-scale timberland offerings, particularly in the South, that received bids late in the first quarter. Investors will be closely monitoring the outcome of these transactions in the coming months as total transaction value of pending Southern transactions could reach nearly $900 million. With 2022 off to a fast start, deal flow looks robust again following a strong 2021 timberland transaction market that reached levels not seen since 2013.

![]()

The first quarter of 2022 began with the unwelcome news of Russia’s invasion of Ukraine, further stressing global markets and supply chains beyond the already challenging impacts of the global pandemic. With China at the center of Asian log markets, the Russia-Ukraine conflict could impact Asia-Pacific markets in several ways according to a recently published report by Margules Groome. On one hand, Russian log exports originally destined for Europe will now possibly be redirected to China increasing availability of logs to Chinese buyers. Rising bunker fuel costs derived from the conflict will also affect the Pacific rim log trade from sources such as New Zealand and Brazil.

In Australia, the latest Timber Market Survey reported continued robust lumber and panel markets with both volume demand and prices rising. During February, Australia’s Bureau of Statistics (ABS) reported seasonally adjusted estimates for total dwellings approved higher by 43%. In New Zealand, one possible impact for its log exports destined for China will be the possibility of the reversal of some of the log supply from Russia to China which could add competitive tension for log sellers into the market.

CHILE — After closing 2021 with notable economic growth of almost 12% per year, which more than offset the almost 6% drop in economic growth from 2020, this year that is just getting started is on track for growth to get back to annual levels of 2 to 3% per year. Main drivers for stabilization of growth are the strong fiscal stimulus unwinding, a fall in real terms of public expenditures, a contractionary monetary policy and lagging demand for investment and consumption. The latter is related to a lag in the recovery of the labor market. Inflation will remain above the target range but is expected to begin decreasing in the second half of 2022. While the exchange rate is generally expected to stabilize around current levels to the extent that the domestic political situation is maintained.

On the political front, after winning the presidency late in 2021, newly elected President Elect Gabriel Boric unveiled his cabinet which was well received by the markets. In particular, the selection of Mario Marcel, who previously served as Governor of the Central Bank of Chile, as the Minister of Finance is seen as a sign of continued responsible macroeconomic management. During the quarter, the new government was installed successfully on March 11th.

In the forest sector exports continued their positive momentum during the first quarter of the year and are expected to remain throughout 2022. Two points of concern though that could dampen the positive momentum in exports are rising freight rates and continued global logistical problems.

In February (latest data available), forestry shipments totaled US$ 396 million, a 12% increase versus the same period in 2021. With this, accumulated shipments through the first two months of the year reached US$ 862 million, an increase of 3% versus the same period in 2021.

For the full period of 2021, forestry exports were recorded at US$ 5,964 million, a 20.5% annual increase and the highest on record of the last three years.

BRAZIL — During the first quarter of 2022, 76% of Brazilians had received full vaccination against COVID 19, and 85% at least one shot. Booster shots are now being applied across the country. The arrival of the Omicron variant into the country late last year proved to have only a minor impact on Brazil’s health systems and hospitalizations. Daily new cases (seven-day average) have stabilized at 26,000, down from 33,000 at the end of the previous quarter.

On the economic front, Brazil’s COPOM further increased Brazil’s interest rate from 9.25% at the end of the previous quarter to 11.75%, with further increases expected throughout 2022 to end the year with a forecasted 13.00% as authorities strive to rein in inflation and bring it back closer to its target of 3.50% in 2023. As of February (latest data available) annual inflation reached 10.54% driven mainly by high energy, fertilizer and other commodity prices which continued to pressure local costs. But even with a volatile global and uncertain environment, Brazil’s stock market has benefited from inflows of foreign capital seeking opportunistic investments in commodities such as oil, iron and grains. The BOVESPA index (stock market) rose 18% for the first quarter of the year.

In the forest sector, pulp production in Brazil expanded by 7.4% during the twelve-month period ended December 2021 (latest data available) versus the same period last year. During the quarter, net hardwood and softwood pulp prices in China rose by approximately 124 USD/ton and 190 USD/ton respectively. The expectation remains for this tailwind to remain given resilient demand, constrained supply chains and the Russia-Ukraine conflict which has intensified inflation cost issues, particularly for fiber, energy, chemicals and logistics. Paper manufacturing facilities are paying close attention to capacity and operation as their margins continue to shrink given higher pulp prices and could announce temporary curtailments.

![]()

HOUSING — As of February, housing starts were up to a 1.77 million unit seasonally adjusted rate, while permits hit a level of 1.86 million.

MORTGAGE RATES — 30-year mortgage rates have now eclipsed 5%, the first time in 11 years. Given how quickly rates have risen over the last few months, it is not yet clear what impact this increase in borrowing costs will have on home prices.

JOBS — The March jobs report showed a creation of 431,000 jobs, and an unemployment rate of 3.6%.

CONSUMER CONFIDENCE — U.S. consumer confidence increased in March, suggesting solid job growth offset Americans’ concerns over decades-high inflation that poses a risk to spending and growth. The Conference Board’s index increased to 107.2 from a downwardly revised 105.7 reading in February, which was the lowest in a year.

INFLATION — Headline CPI in March rose by 8.5% from a year ago, the fastest annual gain since December 1981. Excluding food and energy, so-called core CPI increased 6.5% on a 12-month basis, in line with the expectation. However, there were signs that core inflation appeared to be ebbing, as it rose just 0.3% for the month, less than the 0.5% estimate. That in turn sparked some hope that inflation overall was easing and that March might represent the peak.

TRADE DEFICIT — The U.S. trade deficit narrowed slightly in February, shrinking 0.1% for the month but remaining close to a record. Both exports and imports climbed as the impending conflict in Ukraine pushed up commodity prices.

INTEREST RATES — While the current Fed Funds rate is 0.25% to 0.50%, most economists believe the Federal Reserve will increase this rate by at least 0.50% in the next two meetings, resulting in a Fed Funds rate of 1.25% to 1.50% by June.

OIL PRICES — Oil prices have been volatile, bouncing between approximately $100 and $120 a barrel as the market factors in supply disruptions around the conflict in Ukraine.

U.S. DOLLAR — The US dollar index has recently bumped to a level above 100, with the dollar gaining strength in anticipation of rising rates in the US.

![]()

![]()