SUMMARY UPDATE — The second quarter of 2025 was shaped by cautious optimism in global markets, as key sources of macroeconomic uncertainty began to ease. U.S. trade negotiations with several major partners, most notably with the EU and select Asia-Pacific countries, moved toward resolution, helping to reduce headline risk for export-oriented sectors, including forest products. Meanwhile, the long-debated U.S. budget bill progressed through Congress and was ultimately passed in early July, bringing greater clarity to fiscal policy and averting a potential government shutdown. Inflation trends moderated further during the quarter, yet interest rates remained elevated, continuing to weigh on housing demand and construction activity. At the same time, policy signals around domestic manufacturing and infrastructure investment continue to support long-term tailwinds for timberland and sustainable land use. For institutional investors, these crosscurrents reinforced the value of diversification and resilience—characteristics inherent to long-duration real asset strategies like timberland.

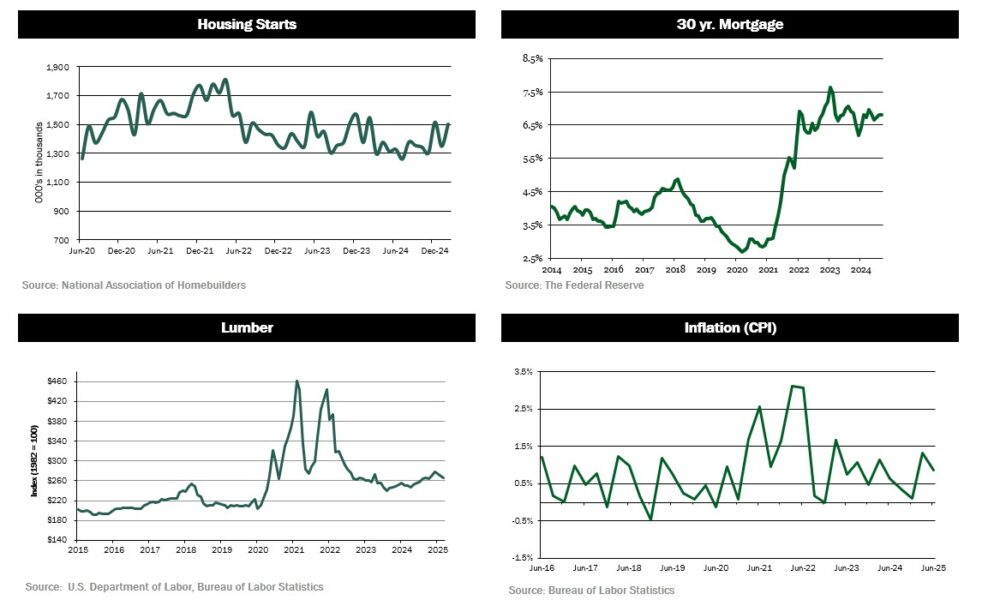

The U.S. housing market faced notable headwinds, with housing starts falling in May to 1.253 million — the lowest seasonally adjusted annual rate in over five years — before recovering slightly to 4.6% to 1.321 million in June. The slump, anticipated to continue into 2026, can be attributed to higher home inventories and moderate mortgage rates, which have depressed construction activity and building permits.

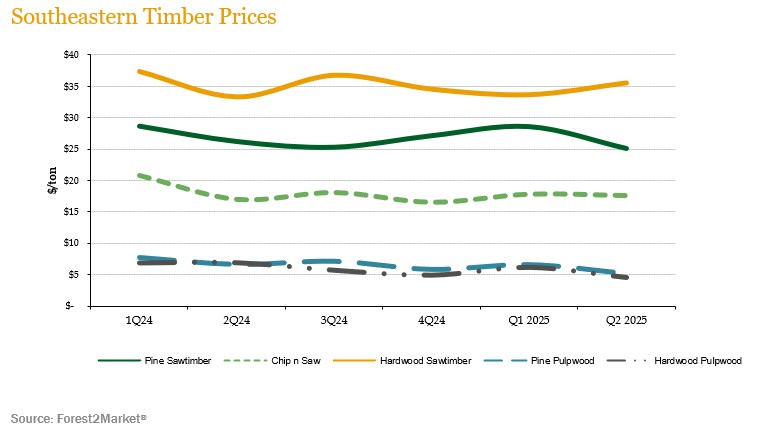

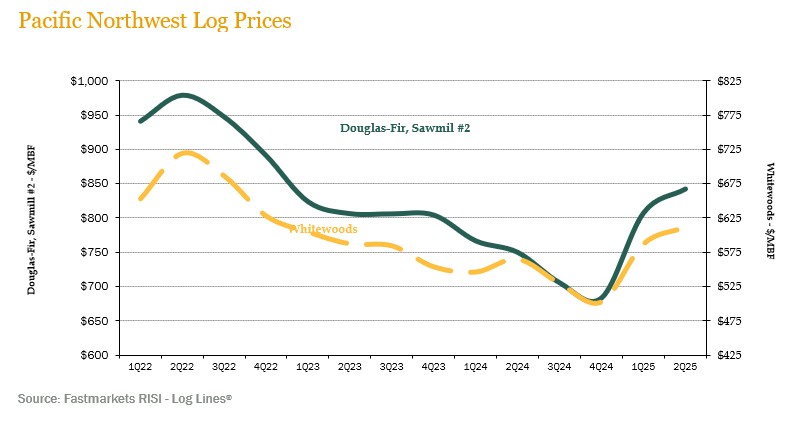

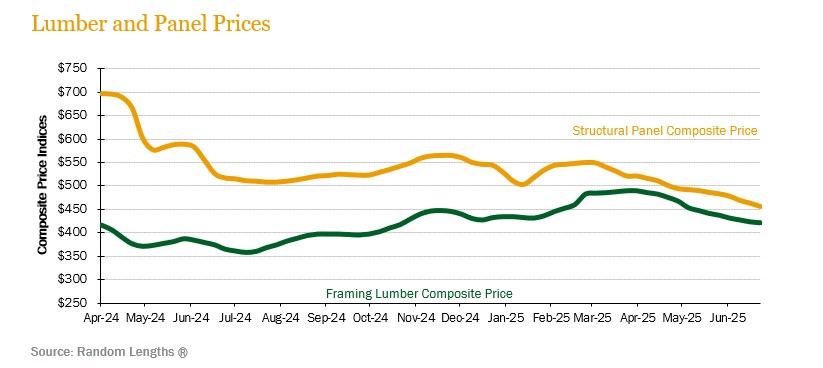

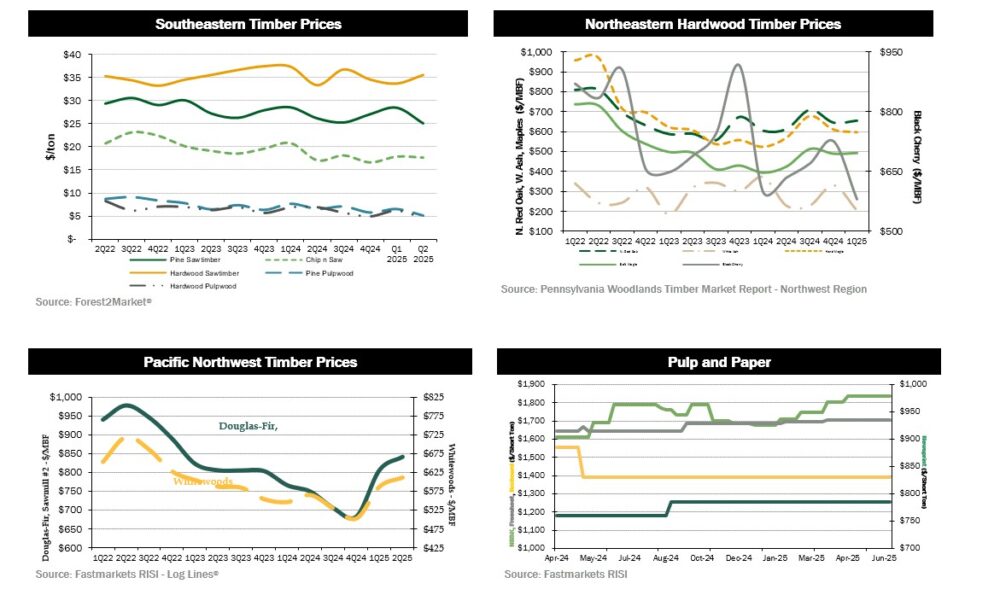

Volatility in the housing and lumber markets combined with the impact of pulp mill closures in select southern markets pushed standing timber prices in the U.S. South downward over the second quarter. Prices in the Pacific Northwest had strong performance across the same time period despite the lack of exports to China. Hardwood markets in the Northeast remained muted across the quarter. Lumber and panel prices continued the previous quarter’s trend of softening. Mortgage rates rose from 6.65% at the beginning of the quarter to 6.82% by the end.

TIMBERLAND MARKETS — The headline news of the second quarter was Weyerhaeuser’s announcement that it was purchasing 177,000 acres of timberland in North Carolina and Virginia from Roseburg for $375 million. The deal is expected to close in the third quarter. Also in North Carolina, Weyerhaeuser sold 5,700 acres to Salm Schulenburg for a reported price of $17.9 million. Finally, Manulife closed its purchase of 10,700 acres in Alabama and Mississippi from a private seller for $28 million. Several notable large-scale transactions remain on the market with anticipated third quarter closings. New offerings continue to hit the market as transaction activity remains steady in 2025.

SOUTHEASTERN — Forest2Market reports that pricing for pine products in the U.S. South fell across the second quarter. Pine sawtimber prices dropped 11.9% across the quarter and are down 4.1% year-over-year. Pine chip-n-saw prices softened 1.2% during the quarter while maintaining 3.5% above year-ago prices. Pine pulpwood prices dropped 21.4% quarter-over-quarter and 21.8% year-over-year. Hardwood pulpwood prices fell significantly across the quarter, with prices down 26.3% during the quarter and 34.3% annually. Hardwood sawtimber pricing had a positive quarter with prices increasing 5.5% over the quarter and 6.6% year-over-year.

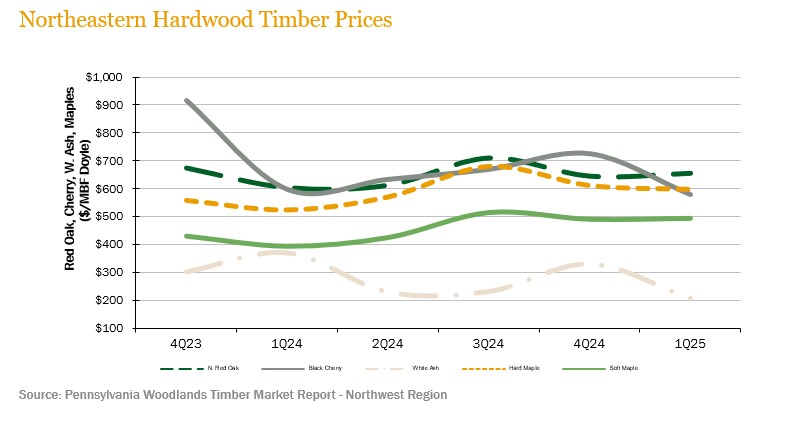

NORTHERN HARDWOODS — Demand remained low across the key species in the Pennsylvania wood market across the last quarter. According to the Pennsylvania Woodlands Timber Market Report, as of the end of March (the most recent available data), price responses varied throughout the quarter. Red oak prices recovered 1.6% during the first quarter following a 9.1% drop the previous quarter. Hard maple softened 2.2% over the quarter while soft maple experienced a slight increase of 0.7% over the first quarter. Annually, both hard maple and soft maple prices increased 13.9% and 24.9% year-over-year, respectively. Black cherry prices fell 20.1% over the quarter and are down 3.1% year-over-year. White ash prices experienced a significant drop this quarter of 37.9% while prices remained 44.7% below year-over-year levels.

Hardwood markets continued to struggle throughout the second quarter. Lumber and log exports faced challenges due to the U.S. Government’s tariff announcements coupled with China’s ban on log imports from the U.S. Exporters rushed to get shipments on the water to beat the start of the tariffs and diverted shipments to lower tariff countries like Vietnam. The weakness of domestic lumber markets continued in light of sustained high mortgage rates, slower home construction numbers, and economic uncertainty. Many sawmills attempted to throttle back their production in the second quarter to match the lower demand, and wet weather in May and June helped keep sawmill log inventories low. White oak logs continued to be in demand but at weaker prices than earlier in the year. Demand for red maple and hard maple remained steady, while red oak held stable throughout the quarter. Black cherry demand stayed stagnant. However, hardwood pulpwood markets saw notable improvement, as several mills lifted their monthly delivery quotas.

In the Lake States, hardwood markets remained subdued throughout the second quarter, looking for a catalyst to help spur increased demand both domestically and internationally. Continued reduced home construction numbers and tariff turmoil kept markets quiet throughout the quarter. Demand for hard maple and ash sawlog was steady with prices increasing slightly. Birch sawlog demand was stable while basswood demand continued to be muted. Veneer logs moved well at good prices. Boltwood for flooring was steady with hard maple bolts bringing the best prices. On a more positive note, hardwood pulpwood markets were very good as wet weather during the second half of the quarter prevented mills from building woodyard inventories.

PACIFIC NORTHWEST — Pacific Northwest pricing strengthened during the first two months of the second quarter of 2025. Log Lines® reported that average delivered prices for Douglas-fir #2 logs rose 4.3% over the previous quarter and are up 4.2% over June 2024 prices. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices increased 12.3% over the previous quarter and 8.3% over June 2024 prices.

Log demand continued to be strong throughout the quarter in certain markets. Log prices increased from first quarter averages with Douglas fir sawlog prices averaging between $850 and $950/MBF in domestic markets. The Willamette Valley of Oregon continues to be a bright spot where purchasers are willing to pay to keep key mills supplied. In this region, sawlog prices have exceeded $1,000/MBF. Chip-n-saw and pulp logs continue to have lower demand and minimal markets across the region.

Exports to China have ceased as tariffs have been implemented. Exports to Japan remain competitive as export sawlog pricing is averaging around $850/MBF, which is in line with pricing in domestic markets.

![]()

LUMBER AND PANELS — Lumber and panel demand softened during the quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter down 13.9% while maintaining 15.3% above June 2024 prices. Structural panel prices fell 12.5% during the quarter and are 11.8% below year-ago levels.

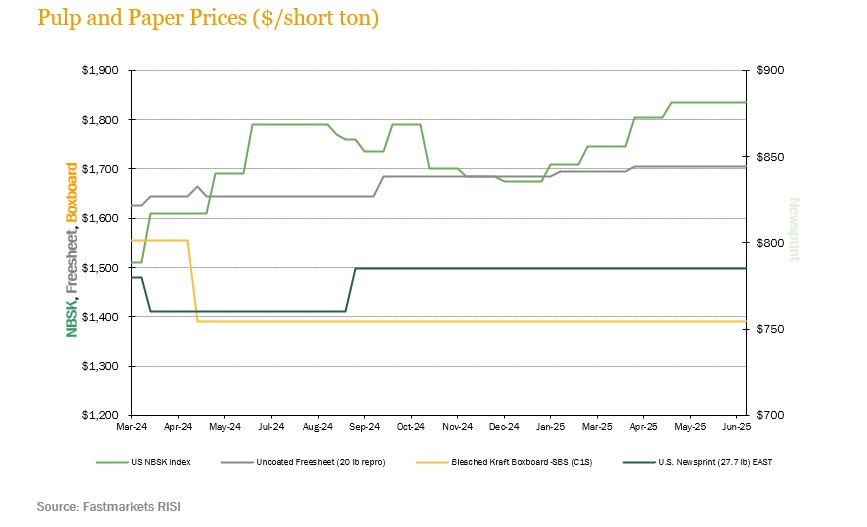

PULP AND PAPER — Demand for paper products remained relatively flat though the second quarter, and pulp demand strengthened during the same period. The benchmark NBSK (northern bleached softwood kraft) pulp price index increased 5.2% for the quarter and finished 2.5% above year-ago levels. U.S. newsprint (27.7 lb.) prices stayed flat quarter-over-quarter and ended 3.3% above June 2024 levels. Boxboard prices remained consistent across both the quarter and the year. Freesheet prices rose 0.6% over the quarter and are up 3.6% over June 2024 prices.

![]()

TRANSACTIONS — The biggest news of the second quarter was Weyerhaeuser’s announcement that it was purchasing 177,000 acres of timberland in North Carolina and Virginia from Roseburg for $375 million. The deal, trading for over $3,200/acre, is expected to close in the third quarter. Also in North Carolina, Weyerhaeuser sold 5,700 acres to Salm Schulenburg for a reported price of $17.9 million. Manulife closed its purchase of 10,700 acres in Alabama and Mississippi from a private seller for $28 million. In Florida, FIA completed its sale of 12,243 acres in the panhandle to the State of Florida for conservation purposes for an undisclosed price. The property will be permanently protected as part of a larger conservation corridor. Visit FIA’s website to learn more about this exciting transaction.

TRANSACTIONS IN PROGRESS — Several notable large-scale transactions remain on the market with anticipated third quarter closings. FIA received second quarter bids on four properties in four Southern states totaling over 20,000 acres and nearly $68 million, with expected settlement in the third quarter. New offerings also continue to hit the market as transaction activity remains steady in 2025.

![]()

In the second quarter, international timberland markets reflected both region-specific developments and broader global trends in trade, inflation, and climate policy. Brazil and Chile remained focal points, shaped by shifting export dynamics, local policy updates, and their strategic role in meeting global demand for sustainable forest products.

CHILE — Chile continues to demonstrate economic resilience in the face of global uncertainty. According to recent OECD projections, GDP growth is forecast at 2.4% for both 2025 and 2026, supported by a rebound in private consumption, higher real wages, and stronger labor market conditions. Investment is also picking up as financing costs ease and business sentiment improves.

While export performance remains a positive contributor—driven in part by rising demand from China—Chile’s external sector is still exposed to shifting global trade dynamics. Tourism is recovering steadily, though rising U.S. tariffs present a modest headwind despite exemptions for many Chilean products.

Inflation ticked up to 4.5% in April due to electricity price adjustments but is expected to be short-lived. Core inflation is trending downward, and long-term expectations remain well-anchored near the 3% target. Overall inflation is projected to return to that target by the end of 2026.

The Central Bank continues to gradually normalize monetary policy, with the benchmark interest rate expected to reach 4.25% in the second half of 2026. On the fiscal front, authorities remain committed to consolidation efforts, with measures equivalent to 0.6% of GDP planned for 2025. A new mining royalty is expected to help stabilize public debt while funding priority programs.

Chile’s forest product exports marked a high in the fourth quarter of 2024 at over USD 700 million, but have declined in the second quarter of 2025. This contraction, breaking the previous growth trend, particularly impacted the top five markets: China, U.S., Mexico, South Korea, and Japan.

BRAZIL — Brazil’s GDP is projected to expand by 2.21% in 2025. Inflation exceeded expectations in the first half of 2025, reaching 5.20% despite the Brazilian Central Bank being committed to correcting inflation to 3.00%. The Central Bank raised the interest rates by 25 basis points to 15.00% during second quarter COPOM meetings. The external environment remains challenging due to overall uncertainties brought by additional volatility from U.S. tariffs. Domestically, economic activity and the labor market have demonstrated more momentum than expected. Financial conditions and the exchange rate have continued to fluctuate, with the appreciation of the Brazilian real up 5.2% over the second quarter.

In Brazil’s forest sector, Banco Itau projects pulp prices to bottom out as the paper market remains challenged by overcapacity and weak economic activity, especially in European markets. Additionally, local wood is becoming increasingly available, reducing the demand for imported BHKP. Brazilian-based Suzano recently acquired Kimberly-Clark’s international tissue and professional unit, while J&F Investimentos in partnership with Paper Excellence have agreed to purchase a 49% stake in Eldorado Brasil Celulose. The implementation of U.S. tariffs is expected to have mixed impacts on Brazilian wood products such as lumber, panels, and flooring, though the longevity of these impacts is unknown.

![]()

HOUSING — Housing starts were at an adjusted annual rate of 1.321million in June, hitting a five-year low during the quarter. Total housing unit permits mirrored the drop in housing starts, reaching a near five-year low in May and recovering only 0.2% in June to 1.397 million permits.

MORTGAGE RATES — The average 30-year fixed-rate mortgage ended Q2 at around 6.8%.

JOBS — Revisions to jobs data caused waves when released in early August, with May and June job growth figures being revised downward by 258,000 jobs across the two months. July figures reported 73,000 new nonfarm jobs, and the unemployment rate rising to 4.2% from 4.1% in June.

CONSUMER CONFIDENCE — Consumer confidence increased for the first time in six months in June, with The Michigan Consumer Sentiment Index rising 16.3% (8.5 points) to 60.7. This is the largest monthly increase in over 30 years. Yet consumer sentiment has fallen by 11.0% (7.5 points) compared to a year ago. Overall, consumer sentiment remains volatile and low compared to historical averages.

INFLATION — The consumer price index increased 0.1% in May and .3% in June, putting the annual inflation rate at 2.7%. Excluding food and energy, core CPI came in at 0.2% in June, and 2.9% for the year, while the food index increased 3.0% over the year.

U.S. TRADE DEFICIT — The U.S. trade deficit widened sharply in May, increasing 18.7% to $71.5 billion as exports dropped significantly.

INTEREST RATES — The yield on a 10-year Treasury note ended the second quarter around 4.3%, declining from an intra-quarter high closer to 4.6% in mid-May.

OIL PRICES — By the end of the second quarter, oil prices had fallen to just under $70 a barrel.

U.S. DOLLAR — The U.S. Dollar Index ranged between 104 and 110 throughout the first quarter but dropped below the 100 level in the second quarter, as markets reacted to the tariff announcements. Overall, the index declined by 7.11% during the quarter, bringing its total loss to 10.4% over the first half of 2025.

![]()

Disclaimer: Certain information contained in these materials has been obtained from third-party sources. While such information is believed to be reliable for the purposes used herein, FIA makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. This does not constitute an offering of any investment or an inducement to participate in any investment or investment advice. Past performance does not guarantee future performance. FIA is a Registered Investment Adviser with the Securities and Exchange Commission in the United States.