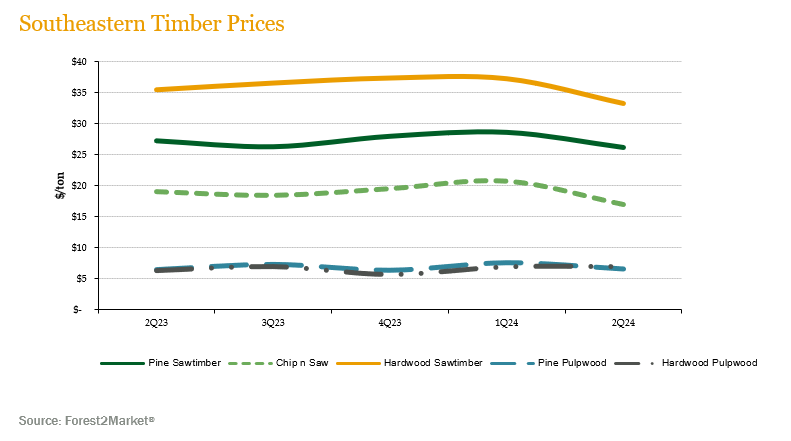

SUMMARY UPDATE — Prices for key products in the South and Pacific Northwest softened during the quarter. Hardwood markets in the Northeast varied with white ash prices making significant gains. Lumber and panel prices saw positive movement throughout the quarter. Mortgage rates remained relatively flat, while housing starts rebounded and saw the largest gain in the past nine months.

TIMBERLAND MARKETS — The biggest transaction update of the second quarter was Manulife closing two portions of a three-property offering in Alabama. The first, known as Clairmont Springs, totaled 33,700 acres and sold to Southern Pine Plantations for a reported price of $77.5 million. The second, known as Magnolia, totaled 13,400 acres and sold to Weyerhaeuser for a reported price of $46 million. Rendalia, the third and final package in the offering, did not sell. Forest Investment Associates closed its acquisition of 34,000 acres in Arkansas and Alabama from PotlatchDeltic for $58 million. Finally, Qarlbo, a Swedish family office, purchased 10,600 acres in Louisiana from a private seller for $10.5 million. Several other offerings, primarily in the Pacific Northwest, received bids late in the second quarter. Investors will be closely monitoring these pending deals to see if they can bolster what has been a slow first half of 2024. With only $600 million in closed transactions thus far, it will be an uphill climb to match the $2.2 billion transaction total of 2023. Internationally, Rayonier announced it intents to sell a large holding, about 140,000 hectares (343,000 acres) in New Zealand, marketing primarily to fund managers and select forestry companies and taking bids later this year.

![]()

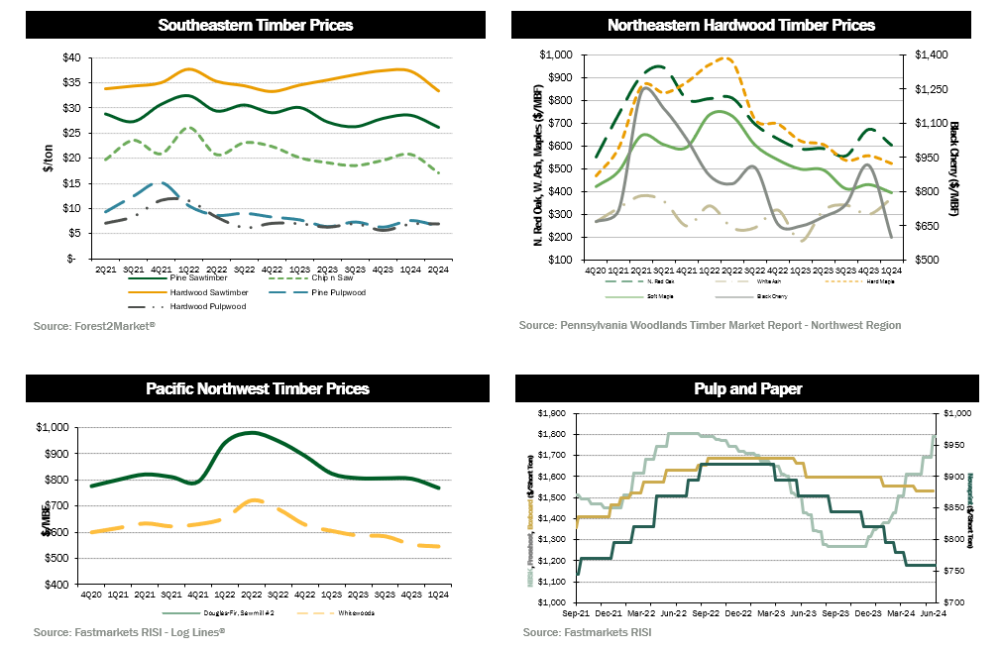

SOUTHEASTERN — Forest2Market reports that pricing for all pine products in the U.S. South fell during the quarter. Pine sawtimber fell 8.3% over the quarter and 3.9% year-over-year. Pine chip-n-saw prices fell 18.0% during the quarter and 10.8% year-over- year. Pine pulpwood prices saw a decrease of 14.2% during the quarter but rose 1.7% year-over-year. Hardwood pulpwood rose 0.5% during the quarter and ended 10.1% above last year’s level. Hardwood sawtimber fell 10.7% during the quarter and 6.2% for the year.

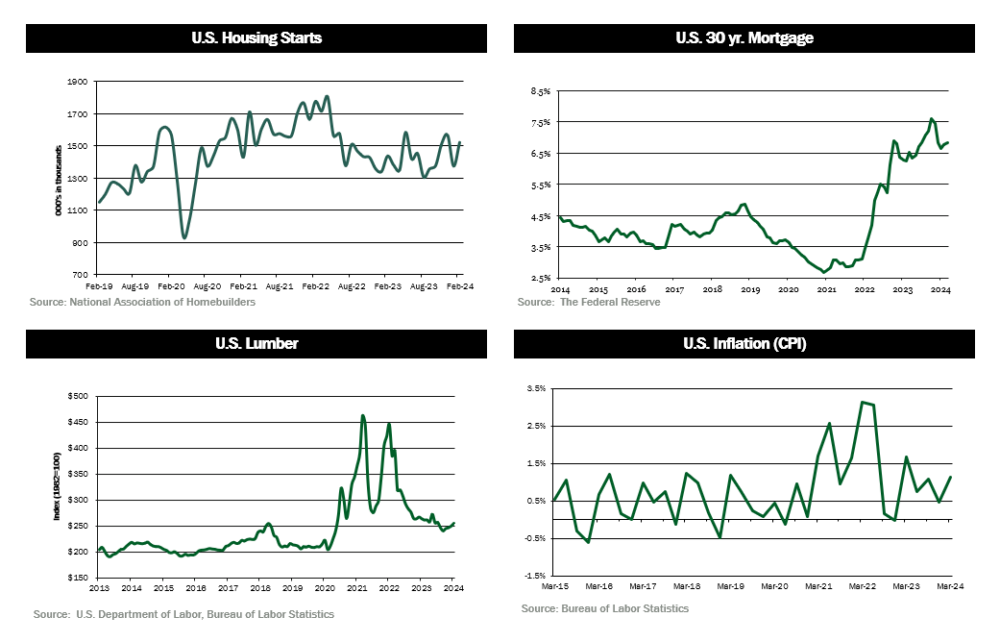

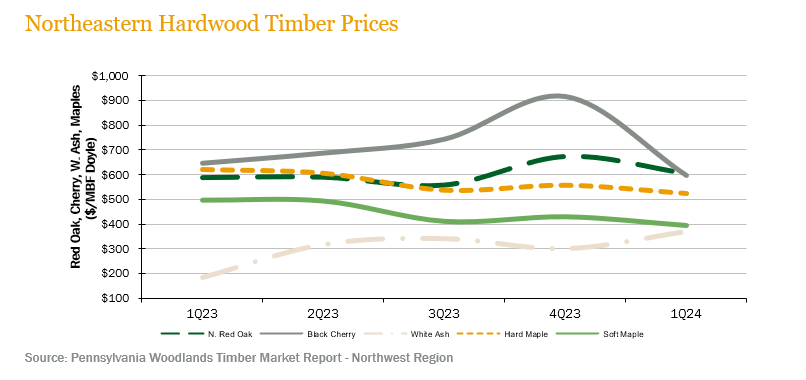

NORTHERN HARDWOODS — Demand varied across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices rose 23.0% during the first quarter (the most recent publicly reported pricing) and more than doubled year-ago levels. Hard and soft maple fell in tandem at 6.1% and 8.3%, respectively for the quarter. Red oak fell 10.3% during the quarter but rose 2.9% year-over-year. Lastly, after three strong quarters, black cherry prices fell 34.6% during the quarter and 7.6% year-over-year.

Hardwood markets were stable during most of the second quarter. However, similar to what happened in the second quarter of 2023, lumber and log demand began to weaken shortly after the Memorial Day holiday. Drier logging conditions allowed for increased production, which resulted in higher inventory at log sale facilities and sawmills. Many mills instituted weekly log quotas to try and stem the tide of logs coming into their yards as summertime spoilage and lumber inventory build-up became concerns. High mortgage rates, inflation, decreased home sales/remodeling activity, and economic and political uncertainties continued to drag down hardwood lumber demand in the U.S. Log and lumber exports were somewhat stable for the quarter but at reduced volumes. White oak demand continued to be increased. Red oak and hard maple demand was good. Red maple was decent. Black cherry fair to poor. Pulpwood markets continued to be weak.

In Wisconsin, hardwood sawlog markets stabilized somewhat during the second quarter but at reduced pricing. Hard maple and ash demand was good, yellow birch demand was fair, and basswood demand poor. Hardwood veneer markets performed well with hard maple, birch, and ash veneer logs attracting the most interest. Boltwood markets eroded throughout the quarter as hardwood flooring demand remained depressed. Pulpwood markets remained weak.

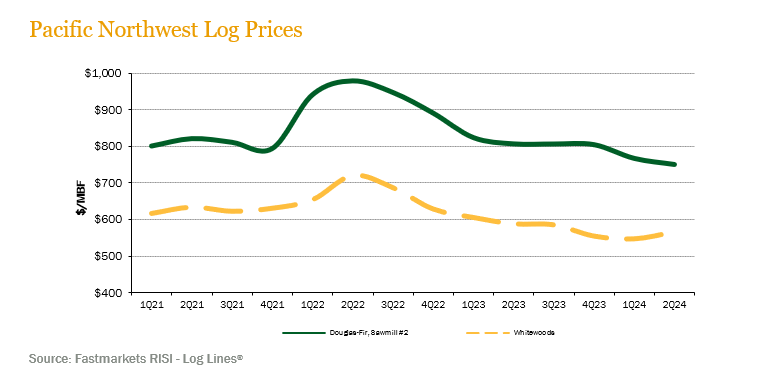

PACIFIC NORTHWEST — Pacific Northwest pricing continued to soften during the quarter. Log Lines® reported that average delivered prices for Douglas-fir #2 logs decreased 2.17% quarter-over-quarter but rose 3.46% year-over-year. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices fell 7.0% during the quarter and 3.8% year-over-year.

Log markets and demand remained softened slightly during the quarter. Domestic prices for Douglas-fir are holding between $675/MBF to $750/MBF, with prices reaching over $775/MBF in select log markets. Export prices saw a small, short-lived bump following the Lunar New Year but dropped back below 2023 pricing levels. Export demand from China remains lackluster with pricing averaging around $520/MBF for Douglas-fir and about $500 for whitewoods. Exports to Japan have fallen but remain competitive at $800/MBF relative to domestic pricing.

![]()

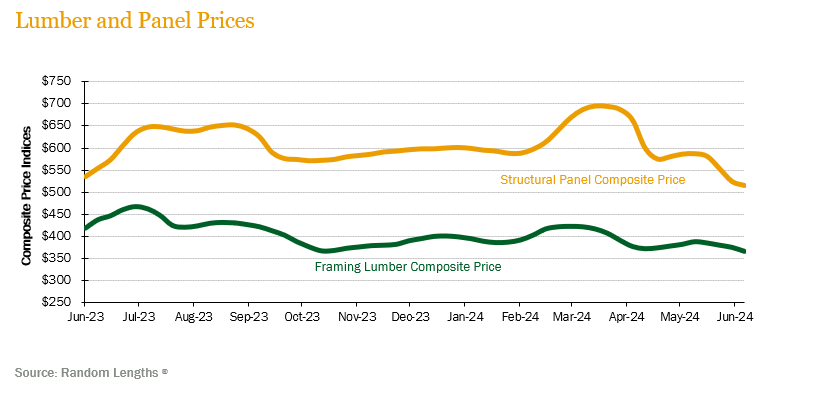

LUMBER AND PANELS — Lumber prices fell during the quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter down 13.3% and 12.6% below year-ago levels. Structural panel prices fell 25.0% during the quarter and finished 3.7% below June 2023 levels.

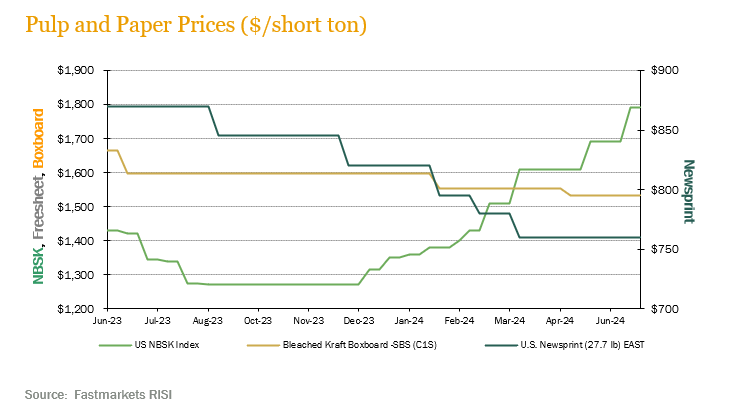

PULP AND PAPER — Demand for pulp and paper products varied during the quarter. The benchmark NBSK (northern bleached softwood kraft) pulp price index saw significant gains, increasing 18.5% for the quarter and finishing 25.2% above year-ago levels. U.S. newsprint (27.7 lb.) prices fell 2.6% over the quarter and 12.6% year-over-year. Boxboard prices fell 1.4% during the quarter and ended 7.9% below last year’s level.

![]()

TRANSACTIONS — As noted in the summary, Manulife closed two portions of a three-property offering in Alabama. The first, known as Clairmont Springs, totaled 33,700 acres and sold to Southern Pine Plantations for a reported price of $77.5 million. The second, known as Magnolia, totaled 13,400 acres and sold to Weyerhaeuser for a reported price of $46 million. Rendalia, the third and final package in the offering, did not sell. Forest Investment Associates closed its acquisition of 34,000 acres in Arkansas and Alabama from PotlatchDeltic for $58 million. Finally, Qarlbo, a Swedish family office, purchased 10,600 acres in Louisiana from a private seller for $10.5 million.

TRANSACTIONS IN PROGRESS — All eyes are on the Pacific Northwest, as several offerings linger on the market. The largest is 115,000 acres from Rayonier in western Washington, representing the latest U.S. offering in Rayonier’s plan to divest approximately $1 billion worth of timberland. Investors closely monitor other offerings in Washington and Oregon from Campbell Global, BTG, and Nuveen. New offerings in the South remain scarce. Deal flow remains low in 2024, with total transaction value of approximately $600 million. The second half of the year will need to be busy to match last year’s transaction total of $2.2 billion. Internationally, Rayonier announced it intents to sell a large holding, about 140,000 hectares (343,000 acres) in New Zealand, marketing primarily to fund managers and select forestry companies and taking bids later this year.

![]()

The global economy indicates signs of moderate recovery, with growth projections revised upwards for 2024 and 2025. Despite this positive trend, risks such as geopolitical tensions, extreme weather events, and potential reactivation of inflationary pressures remain, creating uncertainty in the short and medium term.

In New Zealand, after enduring weak markets driven by a struggling Chinese housing market, downward pressure on log pricing appears to be easing. Softwood log inventories in China held steady at around 4 million cubic meters and even showed signs of beginning to contract late May which should help buttress New Zealand log prices.

In Australia’s domestic housing market, a key driver for Australian softwood demand, new dwelling approvals appeared to reach the bottom of the cycle, ending year-over-year approvals in May at 163,236 units, a decrease of 9.2% when compared to the previous period. Monthly approvals in May of 14,175 indicated a rise of 5.5% when compared to April. Annual approvals still remain substantially below the 240,000 units per year target.

CHILE — The Chilean economy shows signs of recovery and growth, driven by supply factors and growth in the trade and services sectors. This positive trend is reflected in the latest Imacec report and the Central Bank of Chile’s upward revision of growth projections for 2024 and subsequent years. The reduction in the Monetary Policy Rate (TPM) by the Central Bank of Chile, along with the early start of these reductions compared to the United States and the Eurozone, has widened the interest rate gap with these economies. This has implications for the depreciation of the Chilean peso, the behavior of consumer loans, and the slow transfer of rate reductions to mortgage loans, which are partly influenced by external interest rates.

Weak domestic demand for forest products, particularly driven by low construction activity, resulted in a widespread decrease in prices in the domestic market. This trend, reflected in negative year-over-year price variations for all monitored forest products, poses an important challenge for the forest industry in Chile in the near term. To address this, industry players are focusing on maintaining production levels as a priority goal for 2024. In forest product export markets, growth in export volume of the main forest products during the first quarter and the beginning of the second quarter of 2024 (latest data available) was primarily driven by increases in Radiata Pine MDF Board (up 55%) and Radiata Pine Brushed Wood (up 45%). Despite the increased export volume, prices generally decreased, indicating a challenging pricing environment in the international market.

Finally, there has been a shift in export destinations, with China and the United States increasing their share of sector exports to 55%. While exports to China have significantly increased, sales to the United States have slightly decreased. Understanding these shifts in demand and adjusting export strategies accordingly will be crucial for maintaining and expanding market share in these key markets. China’s economy, a key trading partner for Chile and the forestry sector, is expected to moderate its growth. This slowdown, despite additional fiscal stimuli, is driven by weak consumer demand, high debt levels, and a sluggish real estate market. However, measures taken by authorities there, including restoring financing channels and easing home purchase restrictions, aim to address the contraction in the real estate market and support economic recovery.

BRAZIL — The Brazilian economy showed signs of moderate economic growth mainly driven by domestic consumption and the initial signs of industrial production recovery. Stiff commodity prices, supply chain disruptions, and other factors continued to elevate inflation levels. During the quarter, Brazil’s COPOM (Monetary Policy Committee) reduced the reference interest rate by 25 basis points to 10.50%. The rolling 12-month inflation rate was recorded at 3.9% during May (latest data available). The BRL continued depreciating during the quarter from 4.996 to 5.689 BRL/USD by the end of the quarter.

In Brazil’s forest sector, Suzano, Brazil’s largest forestry company and the world’s largest producer of market pulp, made a bold but unsuccessful attempt to grow in U.S. markets via an unsolicited offer to International Paper (IP). Suzano originally approached IP with an all-cash offer of $15 billion USD for the company’s assets. Subsequent attempts to negotiate and potentially improve on the offer were not enough to get IP to engage and led Suzano to abandon its acquisition attempt. On an unrelated front, post 2Q, Suzano succeeded in acquiring for $110 million USD the assets of Pactiv Evergreen in Arkansas and North Carolina, U.S., with a total paperboard capacity of 420,000 tons per year.

![]()

HOUSING — U.S. housing starts fell to a seasonally adjusted annual rate of 1.277 million units in May, a decrease of 5.5% for the quarter and 19.3% year-over-year.

MORTGAGE RATES — The U.S. national average for 30-year mortgages as of the end of the second quarter was 6.82%.

JOBS — The U.S. June payroll report showed the creation of 206,000 jobs, more than the 190,000 expected by economists. The unemployment rate rose to 4.1%, up from 4% in the month prior and the highest reading in almost three years.

CONSUMER CONFIDENCE — The Conference Board’s U.S. consumer confidence index dipped to 100.4 in June.

INFLATION — The core Personal Consumption Expenditures Price Index, which excludes volatile energy and food prices, increased in May by 2.6% from a year prior, slowing from April’s 2.8% pace.

TRADE DEFICIT — The U.S. trade gap for May grew to the widest level since late 2022, to $75.1 billion, from a revised $74.5 billion in April.

INTEREST RATES — Yields on the U.S. three-month T-Bill and the 10-year treasury ended the quarter at levels of 5.4% and 4.4%, respectively.

OIL PRICES — West Texas crude ended the quarter at a price of around $83 a barrel, having traded in a range over the quarter of $73 and $86 dollars.

U.S. DOLLAR — The US Dollar Index closed the second quarter at a level around 106.

Disclaimer: Certain information contained in these materials has been obtained from third-party sources. While such information is believed to be reliable for the purposes used herein, FIA makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. This does not constitute an offering of any investment or an inducement to participate in any investment or investment advice. Past performance does not guarantee future performance. FIA is a Registered Investment Adviser with the Securities and Exchange Commission in the United States.

![]()