SUMMARY UPDATE — Log markets in the Pacific Northwest remained relatively flat. In the U.S. South, pricing for all pine products rose during the quarter. Hardwood markets in the Northeast softened for most species due to a decrease in domestic and export lumber demand. Lumber and panel prices saw positive movement throughout the quarter. Mortgage rates remained relatively flat, while housing starts rebounded and saw the largest gain in the past nine months.

TIMBERLAND MARKETS — Several timberland transactions closed in the typically slow first quarter. The biggest news of the quarter was Manulife closing an internal transfer of 108,000 acres in Louisiana and Texas to a German fund manager for a reported price of $215.5 million, nearly $2,000/acre. The transaction was privately negotiated. PotlatchDeltic (PCH) announced its acquisition of 16,000 acres in Arkansas from a private seller for $31 million. PCH also announced it reached an agreement to sell 34,000 acres in Arkansas and Alabama to Forest Investment Associates for $58 million. The transaction is expected to close in the second quarter. In the Northeast, Eastwood Forests announced the acquisition of 92,000 acres in New York for an undisclosed price. Eastwood also purchased 20,500 acres of hardwood timberland in Virginia and West Virginia from Timberland Investment Resources for an undisclosed price. Several offerings received bids late in the quarter, while a handful of new offerings also hit the market. Investors will be closely monitoring these ongoing transactions to see if transaction values for 2024 can surpass the $2.2 billion mark from last year.

![]()

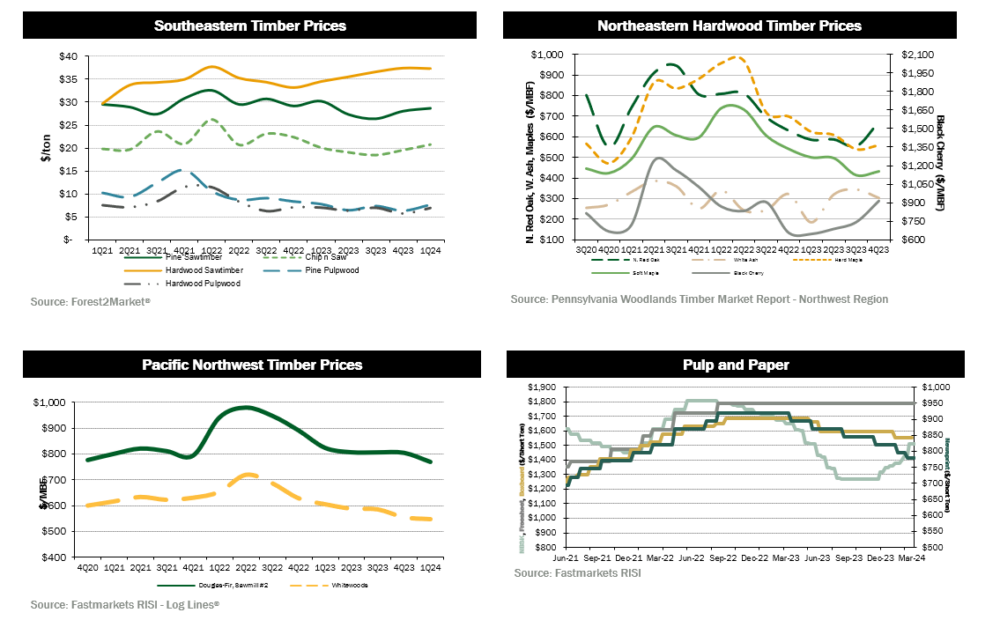

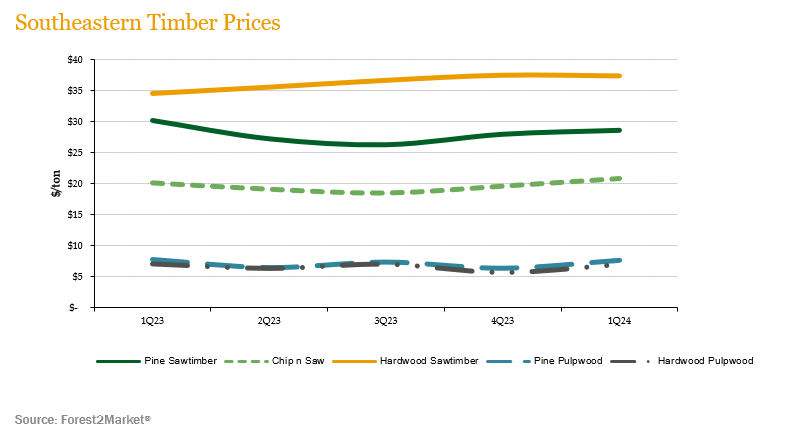

SOUTHEASTERN — Forest2Market reports that pricing for pine and hardwood sawtimber products in the U.S. South varied during the quarter depending on the product. Pine sawtimber rose 2.2% over the quarter but fell 5.1% year-over-year. Pine chip-n-saw prices rose 6.1% during the quarter and 3.4% year-over- year. Pine pulpwood prices saw an increase of 20.6% during the quarter but fell 1.7% year-over-year. Hardwood pulpwood rose 21.6% during the quarter but fell 1.2% below last year’s level. Hardwood sawtimber remained flat during the quarter and saw an 8.1% increase for the year.

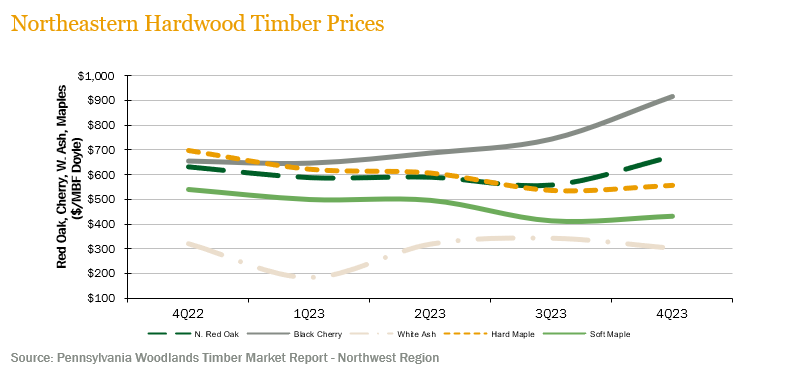

NORTHERN HARDWOODS — Demand varied across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices fell 11.9% during the fourth quarter (the most recent publicly reported pricing) and ended the quarter 5.8% below year-ago levels. Hard and soft maple rose in tandem at 3.8% and 4.5%, respectively for the quarter. Red oak had notable gains of 21.0% during the quarter and 6.7% year-over-year. Lastly, black cherry prices showed strong growth at 23.0% quarter-over-quarter and 39.5% year-over-year.

Hardwood markets continued to struggle, but there were a few positive movements compared to the previous quarter. High interest rates, muted new home construction and remodeling, and continued economic and political uncertainty continued to put a damper on hardwood demand in domestic markets. Exports of lumber and logs were steady but at reduced volumes. Increased demand for white oak continued. In the latter half of the quarter, sugar maple and red maple demand and pricing began to pick up as secondary manufacturers sought to replenish inventories. Black cherry demand saw no real signs of improvement domestically but exports to China showed promise. The continued wet winter weather kept sawmill log inventories in check.

In Wisconsin, hardwood markets, particularly sawlog markets, remained lackluster throughout the quarter. Demand for hard maple sawlogs was steady but at somewhat lower prices. Pricing for both hard maple and birch veneer logs was strong. Demand and pricing for ash sawlogs were good but only fair for birch sawlogs, and basswood sawlog demand left much to be desired. Despite lower hardwood flooring demand, boltwood performed fairly well throughout the quarter. Hardwood pulpwood markets continued to be weak, but most mills did not accumulate unmanageable inventories due to the mild wet weather experienced during the latter part of the quarter.

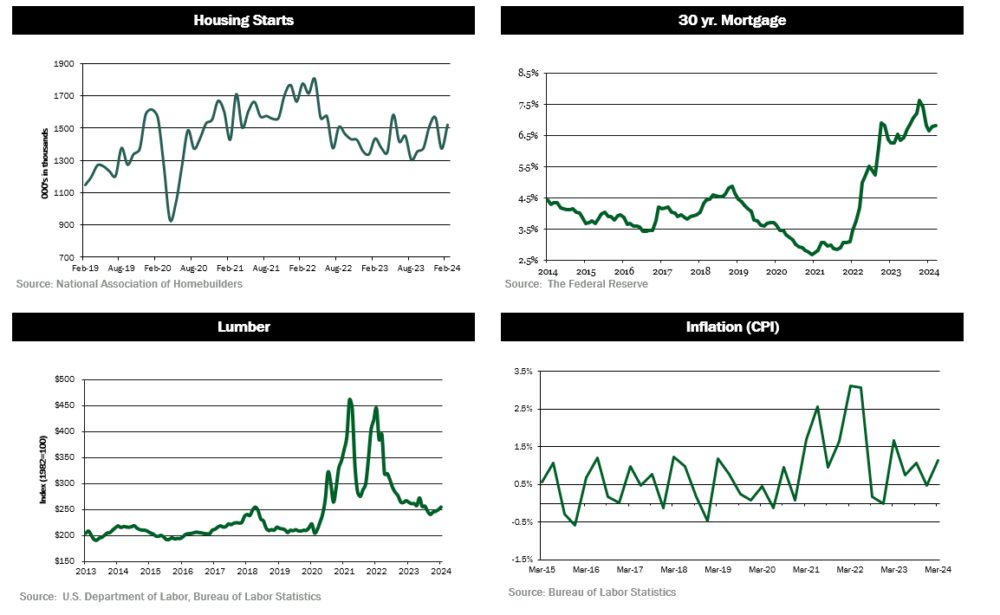

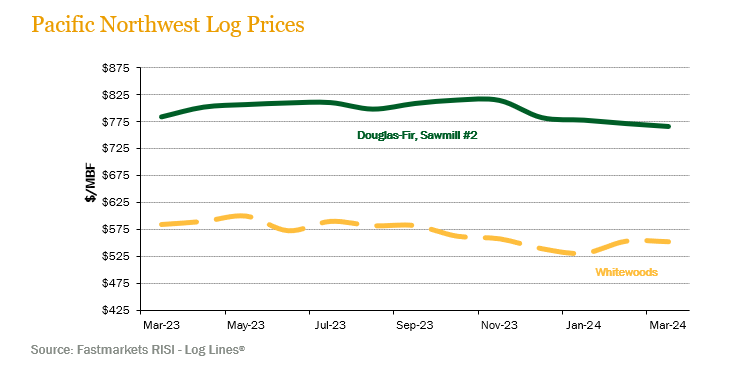

PACIFIC NORTHWEST — Pacific Northwest pricing continued to soften during the quarter. Log Lines® reported that average delivered prices for Douglas-fir #2 logs decreased 4.4% quarter-over-quarter and 6.6% year-over-year. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices fell 1.4% during the quarter and 9.7% year-over-year.

Log markets and demand remained relatively flat during the quarter. Prices were relatively flat and remain comparable to those seen last quarter. Domestic prices for Douglas-fir are holding around $775/MBF, with prices reaching over $850/MBF in select log markets. Export demand from China remains similar to previous quarters with pricing averaging around $600/MBF for Douglas-fir and about $500 for whitewoods. Exports to Japan have fallen but remain competitive at $875/MBF relative to domestic pricing. We are hopeful that pricing will increase during the second quarter as China shifts gears following lunar new year and increases purchasing from the Pacific Northwest.

![]()

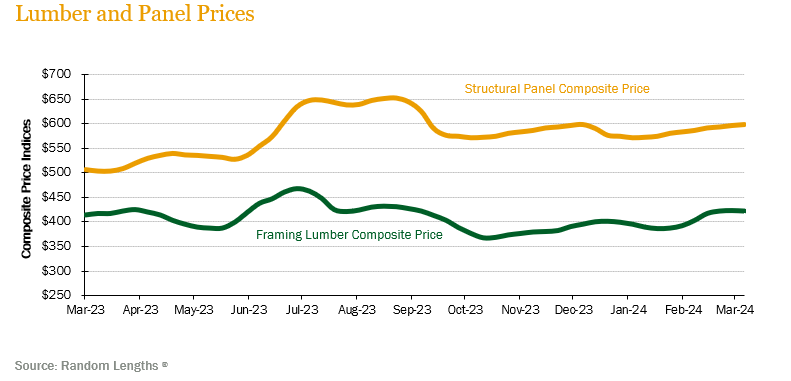

LUMBER AND PANELS — Lumber prices continued to climb during the quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter up 6.8% and 1.9% higher than year-ago levels. Panel prices fluctuated during the quarter but had significant gains year-over-year. Structural panel prices finished the quarter flat but rose 18.1% above March 2023 levels.

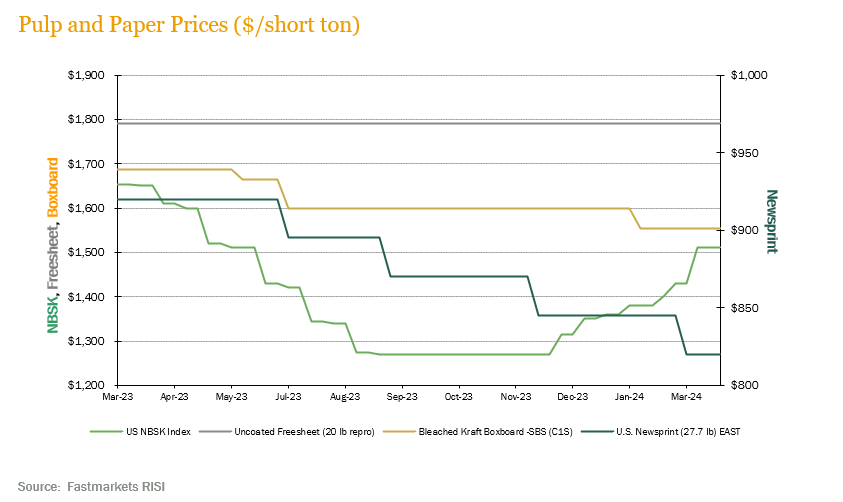

PULP AND PAPER — Demand for pulp and paper products generally softened during the quarter. The benchmark NBSK (northern bleached softwood kraft) pulp price index increased 14.8% and ended the quarter 8.7% below year-ago levels. U.S. Newsprint (27.7 lb.) prices fell 4.9% over the quarter and 15.2% year-over-year. Freesheet remained flat while boxboard prices fell 2.8% during the quarter and ended 7.9% below last year’s level.

![]()

TRANSACTIONS — In the South, the biggest news of the first quarter was Manulife closing an internal transfer of 108,000 acres in Louisiana and Texas to a German fund manager for a reported price of $215.5 million, or nearly $2,000/acre. The transaction was privately negotiated. Elsewhere in the South, Weyerhaeuser sold 9,900 acres in Mississippi to Salm Schulenburg for $31.6 million. PotlatchDeltic (PCH) announced its acquisition of 16,000 acres in Arkansas from a private seller for $31 million. PCH also announced it reached an agreement to sell 34,000 acres in Arkansas and Alabama to Forest Investment Associates for $58 million. The transaction is expected to close in the second quarter.

In the Northeast, Eastwood Forests announced the acquisition of 92,000 acres in New York for an undisclosed price. Eastwood also purchased 20,500 acres of hardwood timberland in Virginia and West Virginia from Timberland Investment Resources for an undisclosed price.

TRANSACTIONS IN PROGRESS — Several offerings accepted bids late in the first quarter, mainly in the South. A couple of sizeable new offerings in the Pacific Northwest also hit the market late in the first quarter. Investors are actively following these pending transactions, as many wait to see if transaction activity will top last year’s total of approximately $2.2 billion.

![]()

The Chinese construction crisis, now in its third year, continues to present a challenging outlook for Pacific log markets given lack-luster demand in China.

Sales of softwood logs in Australia started off the year with weak demand, recording 2.68 million m3 in January 2024 (latest data available), representing a 7.8% decline when compared to January 2023. Absolute softwood volume in January of 168,158 m3 is the lowest volume for the month since 2013. Total new housing starts for 2023 (latest data available) recorded 163,836 new homes, far from the target of 240,000 set by the Australian government to meet the housing shortage. High interest rates are the main headwind to low housing starts.

Log export markets from New Zealand have been challenging. Demand from China for New Zealand softwood log exports that was expected to return post-Chinese new year has not manifested and significantly impacted Pacific markets. Radiata pine log inventories are close to four million m3, which combined with sluggish demand, translates into weak log pricing for logs from New Zealand. Log prices at wharf gate dropped on average 7 to 10 NZD in March. India continues to be a potential outlet for logs but is very challenging destination and is unlikely to gain viable traction any time soon. Only domestic markets in NZ show signs of remaining relatively stable with industrial production and market demand level.

CHILE — Chile’s macroeconomic policies allowed pandemic-induced imbalances, such as high deficits and inflation to be controlled. Fiscal and monetary restrictions stabilized the economy but dampened growth in 2023. The country aims for faster, greener, and more inclusive growth, with reforms in productivity, technology, competition, and human capital development being crucial to achieving this goal. Real GDP increased by 0.2% in 2023 as domestic demand adjusted due to tightened macroeconomic policies post-pandemic. Labor market performance has not yet returned to pre-COVID-19 levels with the unemployment rate remaining high at 8.5%. Inflation has continued to decrease and is projected to reach 3.9% year-on-year in 2023, following determined implementation of restrictive monetary policy and decreased supply disruptions.

During January and February of this year (latest data available), volume growth was driven mainly by bleached eucalyptus pulp (up 76.4% vs. Jan/Feb 2023), and eucalyptus textile pulp (up 65% vs. Jan/Feb 2023), radiata pine boards export volumes also contributed strongly to Chilean forest products exports. Only radiata pine finger joint wood, mainly exported to U.S. construction markets, experienced a decrease of 16.7% vs. the same period last year.

Weakness in both Chinese and American markets, Chile’s two main export destinations, continue to be the main headwind in Chilean forest product market prices driving lower forest product prices. Prices for radiata pine MDF moldings and radiata pine blank boards were down 29.4% and 23.6% versus the same period last year, respectively.

BRAZIL — Brazil’s COPOM (Monetary Policy Committee) reduced the reference interest rate by 1.0% in total from 11.75% to 10.75%. With rolling 12-month inflation at 3.93%, within Brazil’s expected target inflation, additional rate cuts are expected for the remainder of the year. The BRL began the year with a 3.2% depreciation over the quarter from 4.841 reais per U.S. dollar at the beginning of the year to 4.996 reais per U.S. dollar by end of quarter.

Global pulp markets, a key export from Brazil’s forest products industry, began 2024 with stout pricing dynamics primarily driven by two factors: more pulp demand in European markets and unrelated disruptions to the global supply chain. For example, strikes in Finland and flooding in Indonesia affected the global supply outlook. These pulp market tailwinds are expected to continue through the first half of the year, and then cool down during mid-2024 when these disruptions should have passed as well as the expected additional pulp volumes from Brazil’s Cerrado project (Suzano) coming to market at some point during the end of 2024.

![]()

HOUSING — Construction of new U.S. homes rebounded 10.7% in February to an annual pace of 1.52 million units, the biggest gain in nine months. The NAHB index of homebuilder sentiment moved into positive territory in March for the first time since July 2023.

MORTGAGE RATES — Over the first quarter, rates on the traditional 30-year mortgage rose and remained in a band between approximately 6.6% and 7%, ending the quarter around 6.75%.

JOBS — The US economy added 303,000 jobs in March, far above economist expectations for 205,000 job gains.

CONSUMER CONFIDENCE — The University of Michigan’s Consumer Sentiment Index rose to 79.4, the highest since July 2021, thanks in part to expectations of a decline in inflation.

INFLATION — Year-over-year inflation measured 2.5% in February, based on the headline personal consumption expenditure metric tracked closely by the Fed, up slightly from January’s figure.

TRADE DEFICIT — The U.S. trade deficit widened for a second straight month in February as an increase in exports to a record high was offset by surging imports, suggesting trade could be a drag on economic growth in the first quarter.

INTEREST RATES — Yields on the 10-year treasury climbed over the first quarter, rising from a level of just under 4% to closer to 4.2%. In early April, yields spiked again, to 4.4%, reflecting concern about how long before the Fed will cut rates in the face of stubborn levels of inflation readings.

OIL PRICES — Oil prices rose over the first quarter, hitting a level of $85 by the beginning of Q2, reflecting geopolitical risks, particularly in the Middle East.

U.S. DOLLAR — The U.S. dollar strengthened over the first quarter, with the U.S. dollar index hitting a level of 105 as of April 1, up from 101 as of the start of the quarter. The increase seems primarily attributable to continued sentiment that the Fed will delay rate cuts in the face of stubborn inflation readings.

Disclaimer: Certain information contained in these materials has been obtained from third-party sources. While such information is believed to be reliable for the purposes used herein, FIA makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. This does not constitute an offering of any investment or an inducement to participate in any investment or investment advice. Past performance does not guarantee future performance. FIA is a Registered Investment Adviser with the Securities and Exchange Commission in the United States.

![]()