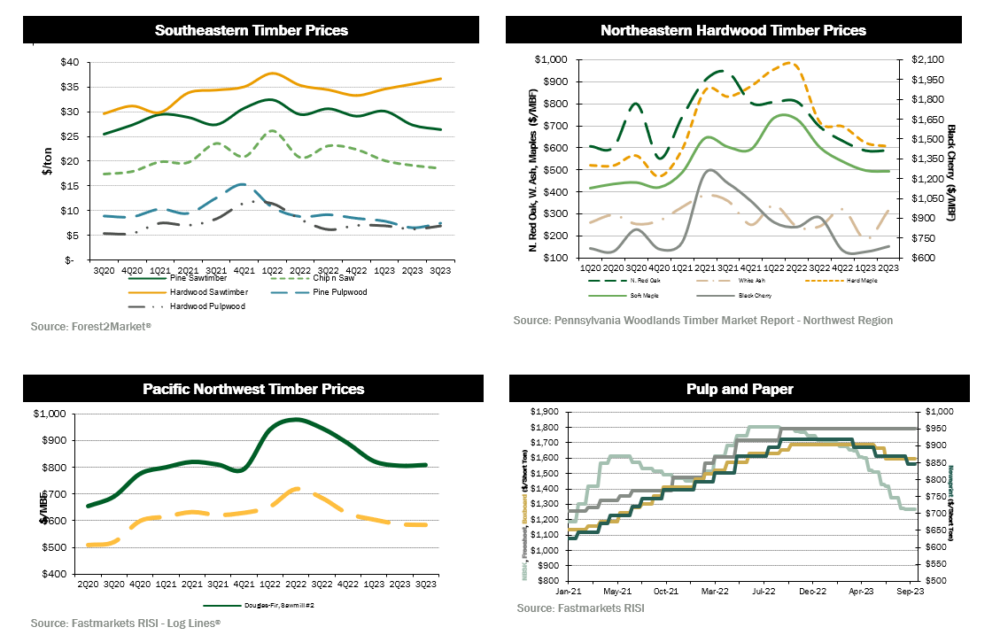

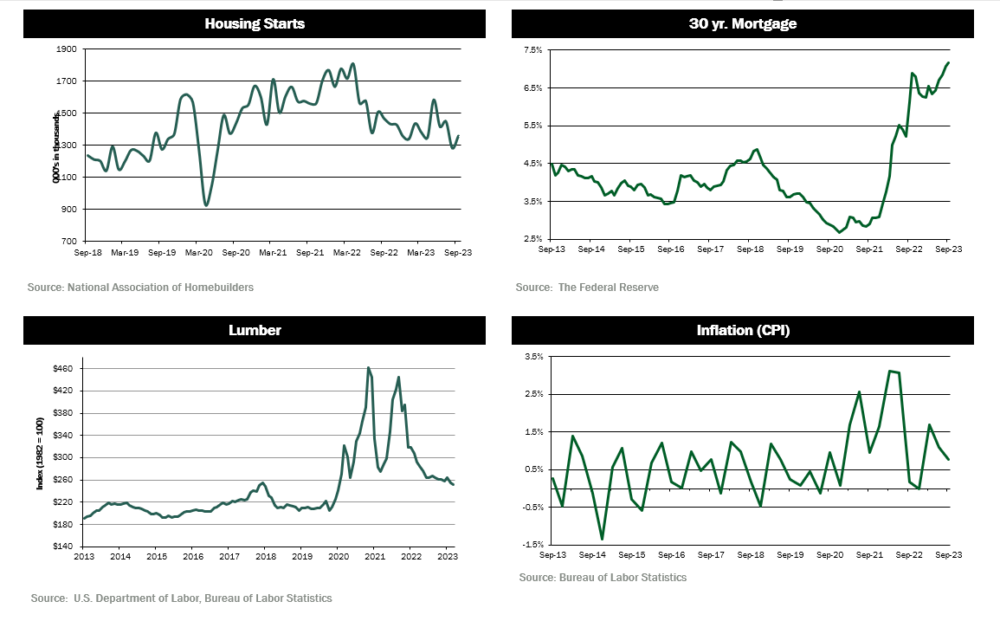

SUMMARY UPDATE — Log markets in the Pacific Northwest remained relatively flat. In the U.S. South, demand for pine sawtimber and chip-n-saw fell while pulpwood increased substantially. Hardwood markets in the Northeast softened for most species due to a decrease in domestic and export lumber demand. Lumber prices rose and fell throughout the quarter while panel prices gained and maintained traction. Mortgage rates climbed throughout the quarter, ending above 7% for a 30-year, fixed rate. Housing starts fell as rates increased throughout the quarter.

TIMBERLAND MARKETS — The third quarter saw a flurry of timberland transactions. Manulife completed its purchase of 70,200 acres in Arkansas, Florida, Louisiana, and Virginia from Conservation Resources for a reported total of $123.7 million. As part of the same offering from Conservation Resources, the Conservation Fund purchased 23,000 acres in Alabama for nearly $60 million. Weyerhaeuser purchased 22,000 acres in Mississippi from Forest Investment Associates (FIA) for $60 million. FIA also purchased 12,400 acres in Arkansas from Weyerhaeuser for an undisclosed price. The Rohatyn Group closed its acquisition of 27,500 acres in Alabama from Claw for $48.8 million. While deal volume has been down in 2023 compared to last year, transaction prices remain strong. Investors continue to wait for news on several sales processes, and more offerings are taking bids in the fourth quarter.

![]()

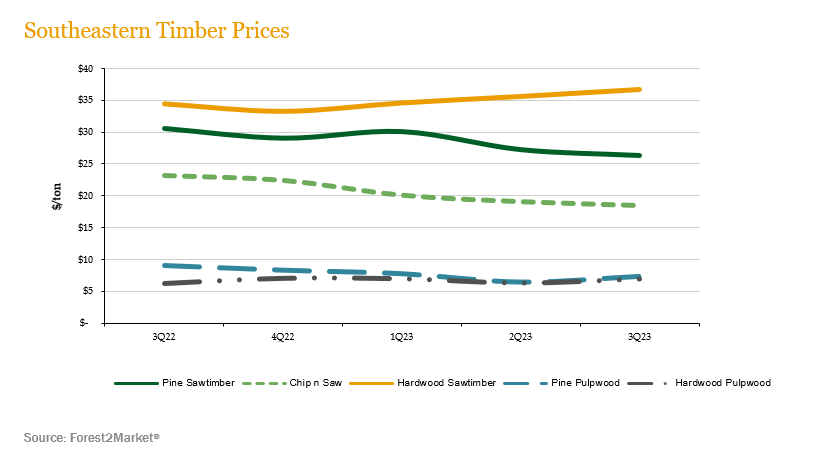

SOUTHEASTERN — Forest2Market reports that pricing for pine and hardwood sawtimber products in the U.S. South varied during the quarter depending on the product. Pine sawtimber fell 3.4% over the quarter and 14.1% year-over-year. Pine chip-n-saw prices fell 3.1% during the quarter and 19.9% for the year. Pine pulpwood prices saw a substantial increase of 14.1% during the quarter but fell 19.0% year-over-year. Hardwood pulpwood rose about 10.2% during the quarter and finished 11.7% above last year’s level. Hardwood sawtimber experienced a modest increase of 3.1% during the quarter and 6.5% for the year.

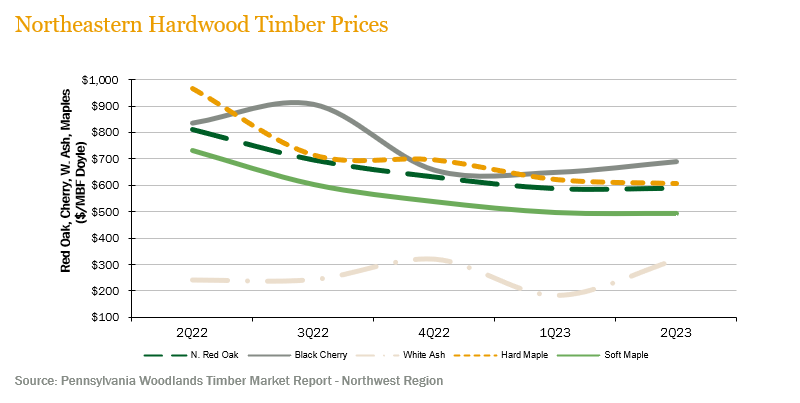

NORTHERN HARDWOODS — Demand varied across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices bounced back 72.5% during the first quarter (the most recent publicly reported pricing) and ended the quarter 31.5% above year-ago levels. Soft maple and red oak prices remained relatively flat, ending 32.2% and 27.4% below last year’s levels. Hard maple fell 2.5% during the quarter and 37.3% year-over-year. In addition, black cherry prices increased 6.3% quarter-over-quarter and fell 17.5% year-over-year.

Hardwood markets continued to decline throughout the quarter. Unfortunately, the decline hit both the domestic and export markets simultaneously. Demand for hardwood lumber and logs fell off rather sharply after a moderately strong first half of the year. As a result, sawmills adjusted their production rates downward, showed noticeably less interest in procuring additional stumpage, and adjusted pricing to better reflect the decrease in demand. Stumpage prices on red oak, red maple, sugar maple, and most other species declined, while white oak remained stronger. Black cherry prices stayed depressed as exports to China remained lackluster. Hardwood pulpwood markets experienced continued weakness.

Hardwood markets in Wisconsin remained depressed during the quarter. Sawmills adjusted log inventories, purchases, and pricing to better reflect the current lack of demand for hardwood lumber. Veneer log demand and pricing was stable. Boltwood demand was also down with lower pricing caused by the current decreased demand for hardwood flooring. Similar to the Pennsylvania and New York markets, pulpwood markets in Wisconsin continued to be weak.

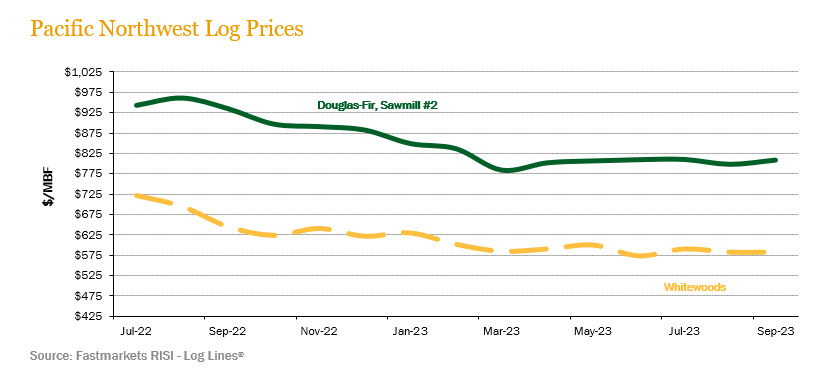

PACIFIC NORTHWEST — Pacific Northwest pricing remained relatively flat during the quarter. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs remained flat quarter-over-quarter and fell 14.5% year-over-year. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices remained flat during the quarter as well but fell 14.9% year-over-year.

Log markets remained relatively flat over the quarter. As seen throughout most of the year, log inventories remained high at most domestic sawmills, and prices dropped slightly but remain comparable to those seen last quarter. Domestic prices for Douglas-fir are holding around $800/MBF, with prices reaching over $850/MBF in select log markets. Export demand from China remains similar to the first quarter with pricing averaging around $680/MBF for Douglas-fir and about $575 for whitewoods. Exports to Japan have fallen but remain competitive at $880/MBF relative to domestic pricing. Barring a rapid or major decline in lumber prices, it is possble that the market has established a new baseline for log pricing.

![]()

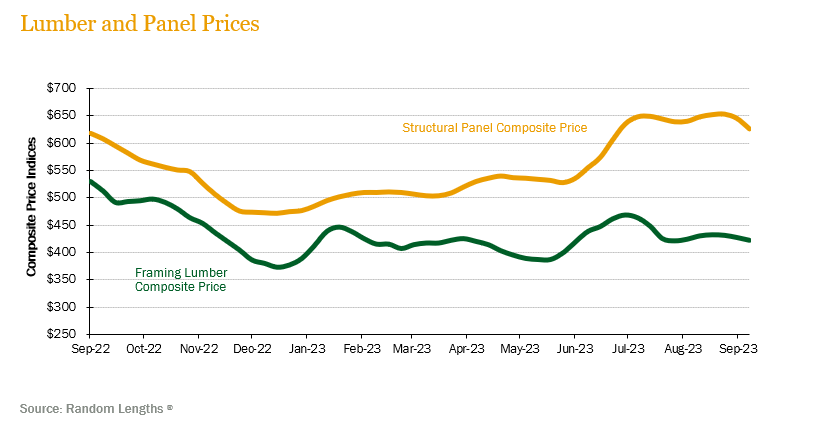

LUMBER AND PANELS — Lumber prices gained traction in July but fell as the quarter progressed. The Random Lengths® Framing Lumber Composite Price ended the second quarter down 3.7% and 20.2% below year-ago levels. Panel prices also gained traction but remained elevated to finish the quarter. Structural panel prices increased 12.8%, remaining 1.3% above September 2022 levels.

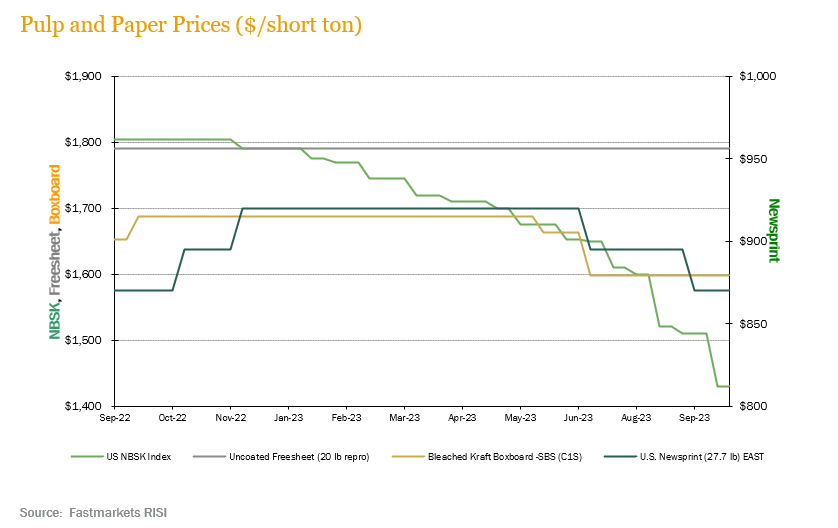

PULP AND PAPER — Demand for paper and paper products generally softened. The benchmark NBSK (northern bleached softwood kraft) pulp price index decreased 11.2% and ended the quarter 29.1% below year-ago levels. U.S. Newsprint (27.7 lb.) prices fell 2.9% over the quarter and 8.2% year-over-year. Freesheet prices also remained flat during the quarter. Boxboard prices fell 4.0%, ending 3.3% above last year’s level.

![]()

TRANSACTIONS — In the South, the biggest news of the third quarter was Manulife’s purchase of 70,200 acres in Arkansas, Florida, Louisiana, and Virginia from Conservation Resources for a reported total of $123.7 million. The transaction included over 30,000 acres in Florida that was under an existing conservation easement. As part of the same offering from Conservation Resources, the Conservation Fund purchased 23,000 acres in Alabama for nearly $60 million. Weyerhaeuser purchased 22,000 acres in Mississippi from Forest Investment Associates (FIA) for $60 million. FIA also purchased 12,400 acres in Arkansas from Weyerhaeuser for an undisclosed price. The Rohatyn Group closed its acquisition of 27,500 acres in Alabama from Claw for $48.8 million.

In the Pacific Northwest, New Forests announced the acquisition of 19,000 acres in northern California from BTG Pactual for an undisclosed price.

TRANSACTIONS IN PROGRESS — Several offerings took bids near the end of the third quarter, and are expected to close before year end. There are also a handful of new offerings that hit the market prior to the end of September. Most of the pending or upcoming deal flow is in the Pacific Northwest, which has been largely quiet so far this year. Overall, deal activity in 2023 is lagging well behind the pace of last year when transaction totals eclipsed $5 billion.

![]()

In Australia, the economy is expected to continue to grow at a more moderate pace during 2023 and 2024 when compared to 2022. Although annual inflation is expected to decline to 5.7% inflation during 2023, down from 6.9% annual inflation in 2022, it is still higher than the central bank’s target. This, combined with higher interest rates as the bank strives to control inflation, has had a dampening effect on Australia’s housing market which peaked in 2021 with 141,000 housing starts versus an expected 110,000 housing starts this year. Woodchip exports from Australia for both hardwood and softwoods are expected to end the year down by 8% and 21% respectively versus the same period last year.

In New Zealand, the forest industry continues to face headwinds with inflation that is still hovering around 6%, the highest level seen in decades, as well as weak log markets in China, the primary destination for NZ logs. On a positive note, in July NZ signed a free trade agreement with the European Union which will help further diversify the destination of NZ exports away from depending so much on Asian markets. Although it still needs to be ratified by both EU and NZ parliaments, it is expected to save hundreds of millions of dollars per year in tariffs.

CHILE — Consistent with global trends, inflation in Chile has continued decreasing significantly, reaching a level of 5.1% annual inflation in September, the lowest inflation rate since October 2021. The downward trend is expected to continue towards the Central Bank’s target inflation rate of 3.0% which could be reached as soon as mid-2024. On the FX front, the Chilean peso has experienced significant depreciation since June 2023. This in general is driven by both changes in interest rate differentials and increased risk aversion associated with various global events such as weakness in China, fiscal prospects in the U.S., and global uncertainty. Regarding monetary policy, at their August meeting, Chile’s Central Bank paused its interest rate reduction process and maintained its policy interest rate at a range of 11.25% to 10.25%.

Chile’s main political issue in 2023 continues to be the drafting process for the new Constitution. To date, progress has been made on the proposals, which are conservative and right-wing leaning in nature. Yet, the process has by no means been free of controversy as well as the population not showing great interest in it.

Forest products markets in Chile show a significant dispersion in the decline of shipments, according to the most recent report from INFOR. This is mainly driven due to the weak performance in the global economy (expected to grow by only 2.1% according to the latest projections from the World Bank). However, the main damage to forest product exports comes from the sharp decline in demand in the U.S. market, where construction activity has been depressed since mid-2022 and shows no clear path to recovery. The main market destinations for Chile’s forest products continue to be China and the U.S. with shares of 34% and 19% respectively; but both continuing to show weakness driven by their respective construction sectors.

BRAZIL — During the quarter, Brazil’s COPOM (Monetary Policy Committee) met twice and reduced Brazil’s reference interest rate by 0.5% in each meeting to a range of 13.75% to 12.75%. Current inflation levels suggest that new reductions should be expected to end the year in the range of 11.75%. Inflation over the last 12 months of the year was recorded at 4.61% with year-to-date (January to August) inflation coming in at 3.23%. The market expects inflation for the full year of 2023 to be around 4.86%. The BRL depreciated during the third quarter by 3.9% from 4.8186 to 5.007 BRL per USD.

In the forest sector, global pulp markets, a key export from Brazil’s forest products sector, are showing positive signs. Global pulp shipments increased by almost 5% year-over-year in August to approximately 4.8 metric tons. This recovery in global pulp markets is in general being driven by more robust pulp demand from China, where shipments into the country soared by 42% year over year during the month of August. This strong demand from China was contrasted by weaker volumes into Europe where the market fell by 18% year over year. Hardwood pulp prices which are currently at approximately $555/ton in China are expected to continue rising as the quarter progresses. Exports of wood panels from Brazil continue to show weakness with a drop in exported volumes year-to-date of 42%.

![]()

HOUSING — Housing starts plunged in August and hit a seasonally adjusted annual rate of 1,283,000, an 11.3% decrease from July’s revised 1,447,000 rate and 14.8% below August 2022. The level reflects a three-year low.

MORTGAGE RATES — 30-year fixed mortgage rates have hit their highest level in over 20 years, reaching a level just shy of 8% as of mid-October.

JOBS — The October jobs report hit an unexpectedly high level of 336,000 jobs in September. The jobs market shows the highest share of working-age Americans in the workforce in 20 years and the longest stretch of unemployment below 4% in 50 years.

CONSUMER CONFIDENCE — The consumer confidence index fell to 103 in September from 108.7 in August. The index measures both Americans’ assessment of current economic conditions and their outlook for the next six months.

INFLATION — The Consumer Price Index for October came in at 307.5, an increase of 0.8% quarter-over-quarter and 3.6% year-over-year.

TRADE DEFICIT — The U.S. trade deficit contracted 9.9% to $58.3 billion in August, the lowest level since September 2020. This decline was more than what was expected due to a solid increase in exports.

INTEREST RATES — The yield on the benchmark 10-year Treasury surged to a high of 4.89% in early October, in response to the strong jobs market report early in the month.

OIL PRICES — As of mid-October, Brent Crude, the worldwide oil benchmark stood at a level around $88 a barrel, with prices spiking in immediate reaction to the violence in Israel and the potential for market disruptions.

U.S. DOLLAR — The U.S. dollar rallied over the third quarter in excess of 6% since printing a 99.49 low. The U.S. dollar index has been helped by weakness in both the Euro and the Japanese Yen.

![]()