A Balanced Approach

Our Investment Strategy

Achieving target returns depends on building and managing a portfolio of high-quality timber assets within timber markets that are well established, competitive and positioned for long-term stability. FIA uses a time-tested, three-part strategy to strive to deliver optimum investment performance.

Broad Diversification

FIA’s client portfolios are typically diversified by location, age class, tree species and markets. Recommended allocations target core end use markets and achieve those allocations through a global investment strategy. The balance between supply and demand for timber is localized leading to low timber price correlations across markets. Diversifying a portfolio across multiple timber markets substantially hedges timber price risk. In addition, the best and time proven way to hedge natural risks such as fire or storm events is to locate investments in multiple parts of the globe.

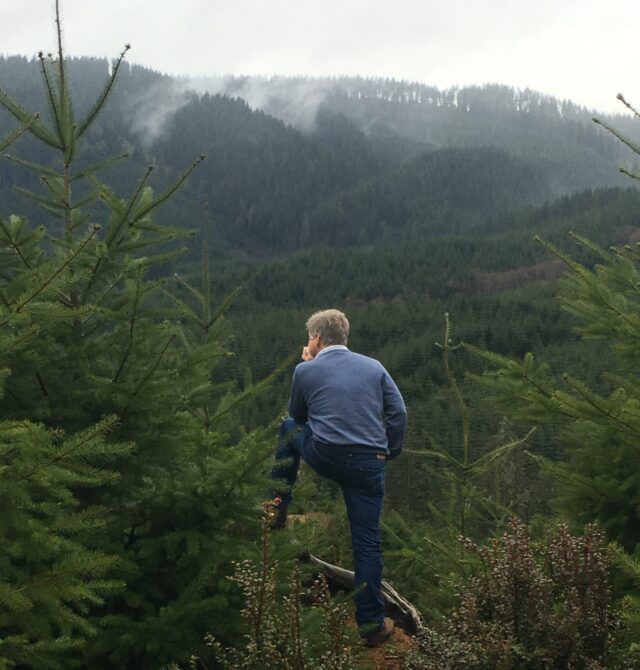

Active and Intensive Management

We strive to maximize biological growth and financial yield by practicing intensive forest management. As a result, we focus on high-quality and productive properties which are more responsive to intensive forest management and where we add the most value for clients. We also seek to identify alternative, non-timber values such as hunting, recreation, mitigation banking and conservation which help improve client returns. Decades of experience have also taught us that high quality and productive properties remain in greater demand and are more liquid even in turbulent markets.

Focus on Future Dispositions

Successful exit and disposition strategies are crucial to achieving target returns. Our disposition strategies begin at acquisition as portfolios are constructed and managed with a view to the final disposition of each property. Purchasing high quality timberland and improving the attractiveness of properties through active management maximizes the marketability and liquidity of client properties.